2025 World Oil Outlook 2050

Length: • 7 hrs 51 mins

Annotated by Paul Cox

Organization of the Petroleum Exporting Countries

2025 World Oil Outlook 2050

World Oil Outlook 2050 2025

Organization of the Petroleum Exporting Countries

Digital access to the WOO: an interactive user experience 24/7

OPEC's World Oil Outlook (WOO) aims to highlight and deepen understanding of the oil industry's potential future challenges and opportunities. It is also a channel to encourage dialogue, cooperation and transparency between OPEC and other stakeholders within the industry.

As part of OPEC's ongoing efforts to improve user experience of the WOO and provide data transparency, two digital interfaces are made available: the OPEC WOO App and the interactive version of the WOO.

The OPEC WOO App provides increased access to the publication's vital analysis and energyrelated data. It is ideal for energy professionals, oil industry stakeholders, policymakers, market analysts, academics and the media. The App's search engine enables users to easily find information, and its bookmarking function allows them to store and review their favourite articles. Its versatility also allows users to compare graphs and tables interactively, thereby maximizing information extraction and empowering users to undertake their own analysis.

The interactive version of the WOO also provides the possibility to download specific data and information, thereby enhancing user experience.

Download

OPEC publications app

Access the interactive version

OPEC is a permanent, intergovernmental organization, headquartered in Vienna, Austria. The Organization comprises 12 Members: Algeria, Republic of the Congo, Equatorial Guinea, Gabon, the Islamic Republic of Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, the United Arab Emirates and Venezuela.

© OPEC Secretariat, July 2025 Helferstorferstrasse 17 A-1010 Vienna, Austria www.opec.org

ISBN 978-3-9505790-0-0

The data, analysis and any other information (the "information") contained in the World Oil Outlook (the "WOO") is for informational purposes only and is neither intended as a substitute for advice from business, finance, investment consultant or other professional; nor is it meant to be a benchmark or input data to a benchmark of any kind. Whilst reasonable efforts have been made to ensure the accuracy of the information contained in the World Oil Outlook, the OPEC Secretariat makes no warranties or representations as to its accuracy, relevance or comprehensiveness, and assumes no liability or responsibility for any inaccuracy, error or omission, or for any loss or damage arising in connection with or attributable to any action or decision taken as a result of using or relying on the information in the World Oil Outlook. The views expressed in the World Oil Outlook are those of the OPEC Secretariat and do not necessarily reflect the views of its governing bodies or Member Countries. The designation of geographical entities in the World Oil Outlook, and the use and presentation of data and other materials, do not imply the expression of any opinion whatsoever on the part of OPEC and/or its Member Countries concerning the legal status of any country, territory or area, or of its authorities, or concerning the exploration, exploitation, refining, marketing and utilization of its petroleum or other energy resources.

Full reproduction, copying or transmission of the World Oil Outlook is not permitted in any form or by any means by third parties without the OPEC Secretariat's written permission, however, the information contained therein may be used and/or reproduced for educational and other non-commercial purposes without the OPEC Secretariat's prior written permission, provided that it is fully acknowledged as the copyright holder. The World Oil Outlook may contain references to material(s) from third parties, whose copyright must be acknowledged by obtaining necessary authorization from the copyright owner(s). The OPEC Secretariat or its governing bodies shall not be liable or responsible for any unauthorized use of any third party material(s). All rights of the World Oil Outlook shall be reserved to the OPEC Secretariat, as applicable, including every exclusive economic right, in full or per excerpts, with special reference but without limitation, to the right to publish it by press and/or by any communications medium whatsoever; translate, include in a data base, make changes, transform and process for any kind of use, including radio, television or cinema adaptations, as well as a sound-video recording, audio-visual screenplays and electronic processing of any kind and nature whatsoever.

Download: All the data presented in this Outlook is available at www.opec.org.

Acknowledgements

Secretary General HE Haitham Al Ghais

Director, Research Division Ayed S. Al-Qahtani

Head, Energy Studies Department Abderrezak Benyoucef

Main contributors

Chapter 1: Key assumptions

Mohammad Alkazimi, Mohannad Al-Suwaidan, Joerg Spitzy, Jan Ban, Eleni Kaditi, Irene Etiobhio, Maciej Filipek, Daniel McKirdy

Chapter 2: Energy demand Haris Aliefendic, Jan Ban, Raed Al-Aameri, Mohammed Attaba

Chapter 3: Oil demand

Jan Ban, Mohammed Attaba, Raed Al-Aameri, Maciej Filipek, Daniel McKirdy

Chapter 4: Liquids supply Julius Walker, Jan Ban

Chapter 5: Refining outlook Mohammed Attaba, Haris Aliefendic, Maciej Filipek

Chapter 6: Oil movements Haris Aliefendic, Mohammed Attaba

Chapter 7: Energy scenarios Jan Ban, Julius Walker

Chapter 8: Focus on Brazil Julius Walker, Haris Aliefendic, Jan Ban

The OPEC Secretariat is grateful for the kind contribution from The Brazilian Petroleum and Gas Institute (IBP) in Chapter 8.

Other contributors

Behrooz Baikalizadeh, Huda Almwasawy, Mhammed Mouraia, Yacine Sariahmed, Sulaiman Saad, Ali Dehghan, Aziz Yahyai, Pantelis Christodoulides, Klaus Stoeger, Mohammad Sattar, Mihni Mihnev, Justinas Pelenis

Editorial, Design & Production Team

Richard Murphy, James Griffin, Carola Bayer, Andrea Birnbach, Soojung Jung, Daniel McKirdy, Xenia Dixon, Sonja Soliman, Liva Novikova

OPEC's Economic Commission Board (as of June 2025)

Samir Madani, Antimo Asumu Obama Asangono, Fernand Epigat, Afshin Javan, Mohammed Adnan Ibrahim Al-Najjar, Abdullah Al Sabah, Asaad Khalifa, Maryamu Idris, Mohamed Kurdi, Salem Hareb Al Mehairi, Ronny Rafael Romero Rodriguez

Contents

| FOREWORD | 1 | |

|---|---|---|

| EXECUTIVE SUMMARY | 5 | |

| INTRODUCTION | 17 | |

| CHAPTER 1 KEY ASSUMPTIONS 1.1 1.2 Economic growth 1.3 Energy policies 1.4 | Population and demographics Technology and innovation | 21 22 28 40 50 |

| CHAPTER 2 ENERGY DEMAND 2.1 2.2 2.3 2.4 2.5 2.6 | Major trends in energy demand Energy demand by major regions Energy demand by fuel Energy demand by sector Electricity demand and generation Energy intensity and consumption per capita | 59 60 65 73 92 96 101 |

| CHAPTER 3 OIL DEMAND 3.1 3.2 3.3 | Oil demand outlook by region Oil demand outlook by sector Oil demand outlook by product | 107 109 131 156 |

| CHAPTER 4 LIQUIDS SUPPLY 4.1 4.2 4.3 4.4 4.5 DoC liquids 4.6 | Global liquids supply outlook Drivers of medium-term and long-term liquids supply Breakdown of liquids supply outlook by main regions Breakdown of liquids supply by type Upstream investment requirements | 161 162 164 164 174 179 180 |

| CHAPTER 5 REFINING OUTLOOK 5.1 5.2 5.3 5.4 Refinery closures 5.5 Secondary capacity 5.6 5.7 5.8 | Existing refinery capacity Distillation capacity outlook Refining sector market balance Refined products supply and demand balances Investment requirements Downstream industry implications | 183 184 191 198 210 213 222 224 225 |

| CHAPTER 6 OIL MOVEMENTS | 229 | |

|---|---|---|

| 6.1 | Logistics developments | 230 |

| 6.2 | Crude oil, condensate and refined product movements | 232 |

| CHAPTER 7 ENERGY SCENARIOS | 251 | |

| 7.1 | Energy demand and mix | 253 |

| 7.2 | Oil demand | 261 |

| 7.3 | Dialogue, open-minded analysis and transparency help to map out our common energy future | 265 |

| CHAPTER 8 FOCUS ON BRAZIL | 267 | |

| 8.1 | Specifics of Brazil | 268 |

| 8.2 | Primary energy demand | 270 |

| 8.3 | Oil demand | 272 |

| 8.4 | Liquids supply | 275 |

| 8.5 | Refining sector | 277 |

| 8.6 | Renewables and other energy sources: Brazil's energy policies, climate change and sustainable development | 280 |

| 8.7 | G20, BRICS and COP30 – Brazil's role in energy and climate policy diplomacy | 290 |

| Annex A | Abbreviations | 295 |

| Annex B | Regional definitions for energy and oil demand | 299 |

| Annex C | Regional definitions for oil refining and trade | 303 |

| Annex D | Major data sources | 307 |

List of boxes

| Box 8.1 | The Equatorial Margin: A New Frontier for Brazil's Offshore Exploration | 276 |

|---|---|---|

| Box 8.2 | Offshore Wind Energy in Brazil: Potential, Investments, and Regulatory Advances | 283 |

| Box 8.3 | The Future Fuel Law | 286 |

| Box 8.4 | Energy Transition Accelerate Programme (PATEN) | 289 |

List of tables

| Table 1.1 | World population by region | 23 |

|---|---|---|

| Table 1.2 | Working population by region | 25 |

| Table 1.3 | Urban population by region | 27 |

| Table 1.4 | Net migration by region | 28 |

| Table 1.5 | Medium-term annual GDP growth rate (in real terms, 2021 PPP) | 31 |

| Table 1.6 | Long-term annual GDP growth rate (in real terms) | 36 |

| Table 2.1 | World primary energy demand by fuel, 2024–2050 | 61 |

| Table 2.2 | Total primary energy demand by region, 2024–2050 | 63 |

| Table 2.3 | OECD primary energy demand by fuel type, 2024–2050 | 67 |

| Table 2.4 | Non-OECD primary energy demand by fuel type, 2024–2050 | 69 |

| Table 2.5 | China primary energy demand by fuel type, 2024–2050 | 70 |

| Table 2.6 | India primary energy demand by fuel type, 2024–2050 | 72 |

| Table 2.7 | Oil demand by region, 2024–2050 | 74 |

| Table 2.8 | Coal demand by region, 2024–2050 | 77 |

| Table 2.9 | Natural gas demand by region, 2024–2050 | 79 |

| Table 2.10 | Nuclear energy demand by region, 2024–2050 | 83 |

| Table 2.11 | Hydropower energy demand by region, 2024–2050 | 86 |

| Table 2.12 | Biomass energy demand by region, 2024–2050 | 88 |

| Table 2.13 | 'Other renewables' energy demand by region, 2024–2050 | 90 |

| Table 2.14 | Global electricity generation by fuel, 2024–2050 | 99 |

| Table 3.1 | Medium-term oil demand by region | 111 |

| Table 3.2 | Long-term oil demand by region | 113 |

| Table 3.3 | Global oil demand by sector, 2024–2050 | 132 |

| Table 3.4 | Number of passenger cars by region, 2024–2050 | 137 |

| Table 3.5 | Number of commercial vehicles by region, 2024–2050 | 138 |

| Table 3.6 | Number of electric vehicles by region, 2024–2050 | 139 |

| Table 3.7 | Oil demand in the road transportation sector by region, 2024–2050 | 142 |

| Table 3.8 | Oil demand in the aviation sector by region, 2024–2050 | 144 |

| Table 3.9 | Oil demand in the petrochemical sector by region, 2024–2050 | 147 |

| Table 3.10 | Oil demand in the residential/commercial/agricultural sector by region, 2024–2050 | 150 |

| Table 3.11 | Oil demand in the marine bunkers sector by region, 2024–2050 | 152 |

| Table 3.12 | Oil demand in the 'other industry' sector by region, 2024–2050 | 153 |

| Table 3.13 | Oil demand in the rail and domestic waterways sector by region, 2024–2050 | 154 |

| Table 3.14 | Oil demand in the electricity generation sector by region, 2024–2050 | 155 |

| Table 3.15 | Global oil demand by product, 2024–2050 | 156 |

| Table 4.1 | Long-term global liquids supply outlook | 163 |

| Table 4.2 | US total liquids production outlook | 166 |

| Table 4.3 | Non-DoC liquids supply outlook by type | 175 |

| Table 4.4 | Non-DoC tight oil outlook | 175 |

| Table 4.5 | Long-term non-DoC biofuels and other liquids production outlook | 179 |

|---|---|---|

| Table 5.1 | Global base refining capacity as of January 2025 | 187 |

| Table 5.2 | Distillation capacity additions from existing projects by region, 2025–2030 | 192 |

| Table 5.3 | Refinery distillation capacity additions by period | 195 |

| Table 5.4 | Crude unit throughputs and utilization rates, 2024–2050 | 208 |

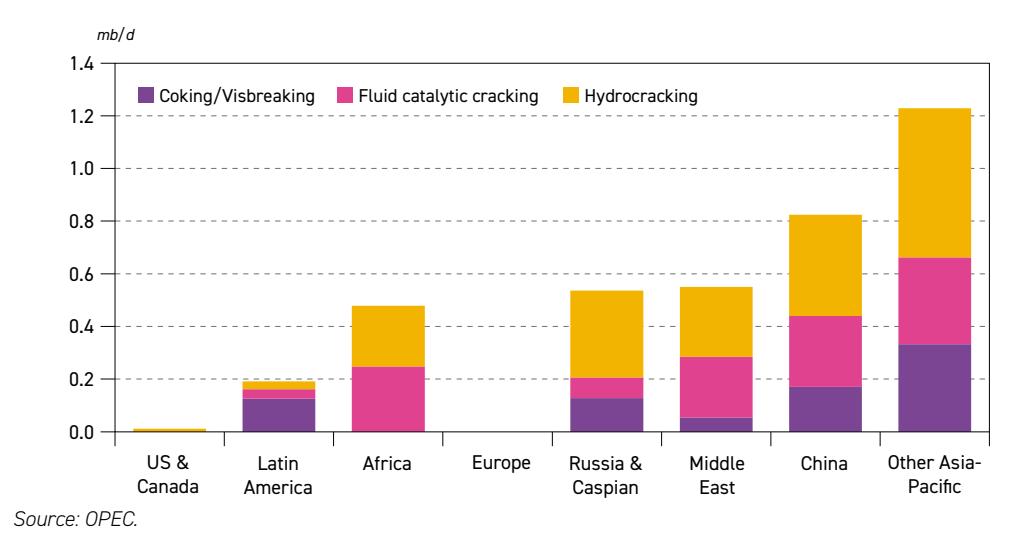

| Table 5.5 | Secondary capacity additions from existing projects, 2025–2030 | 214 |

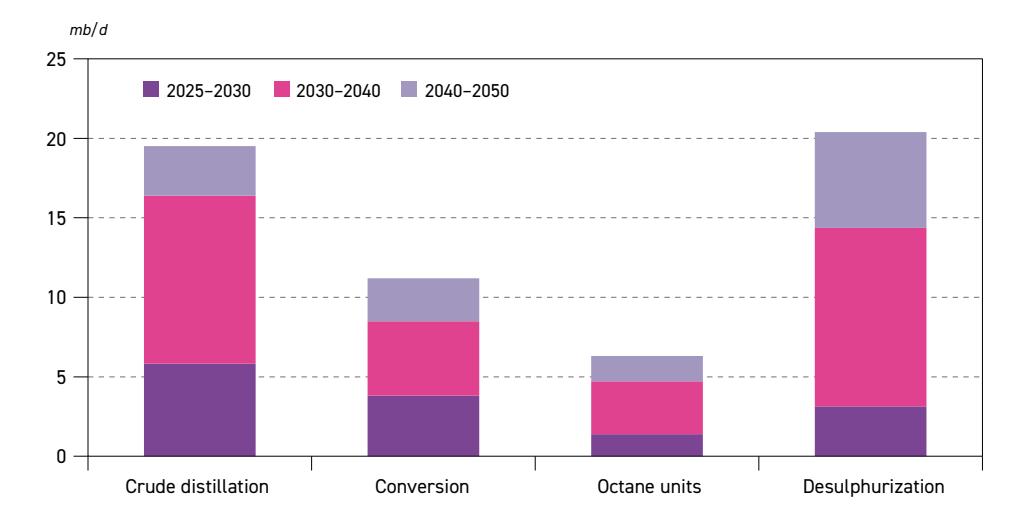

| Table 5.6 | Global capacity requirements by process, 2025–2050 | 217 |

| Table 5.7 | Global cumulative potential for incremental product output, 2025–2030 | 223 |

| Table 8.1 | Primary energy demand, Brazil | 271 |

| Table 8.2 | Fuels of the future | 286 |

List of figures

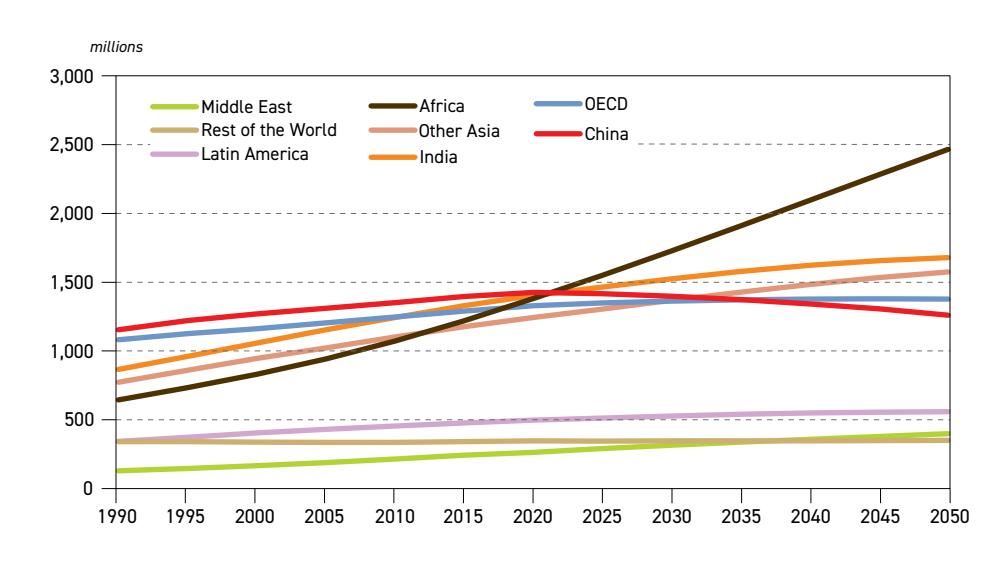

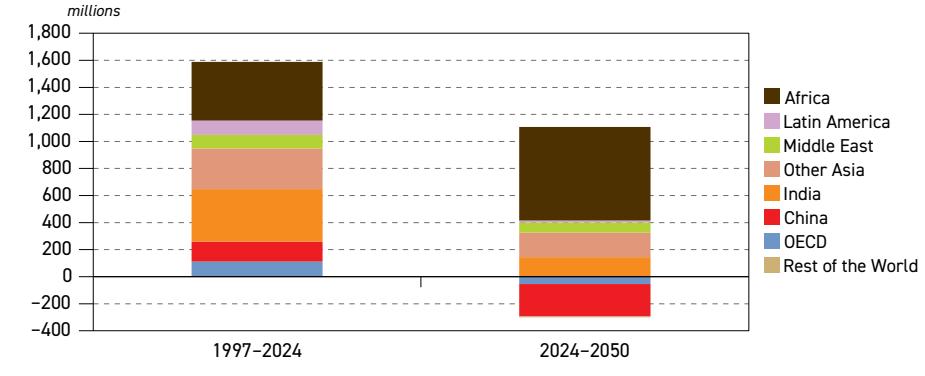

| Figure 1.1 | World population growth, 1997–2024 versus 2024–2050 | 23 |

| Figure 1.2 | World population by region, 1990–2050 | 24 |

| Figure 1.3 | Working age population growth, 1997–2024 versus 2024–2050 | 26 |

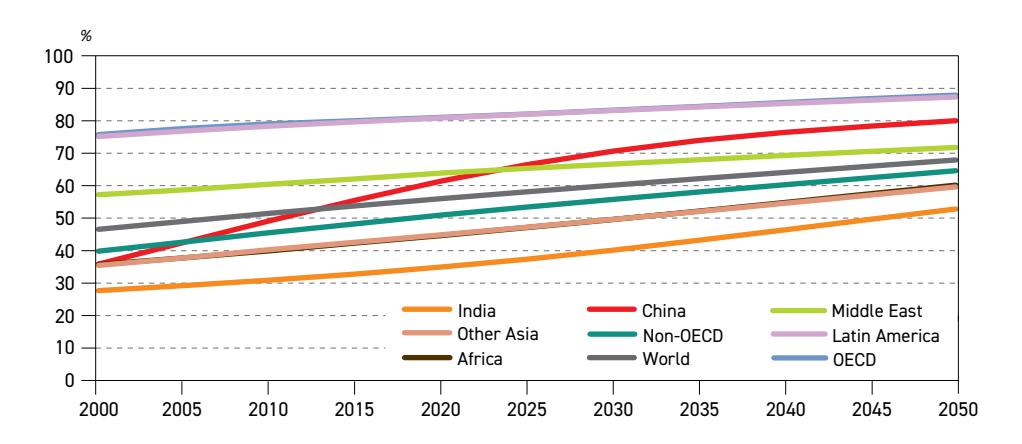

| Figure 1.4 | Urbanization rate by region, 2000–2050 | 26 |

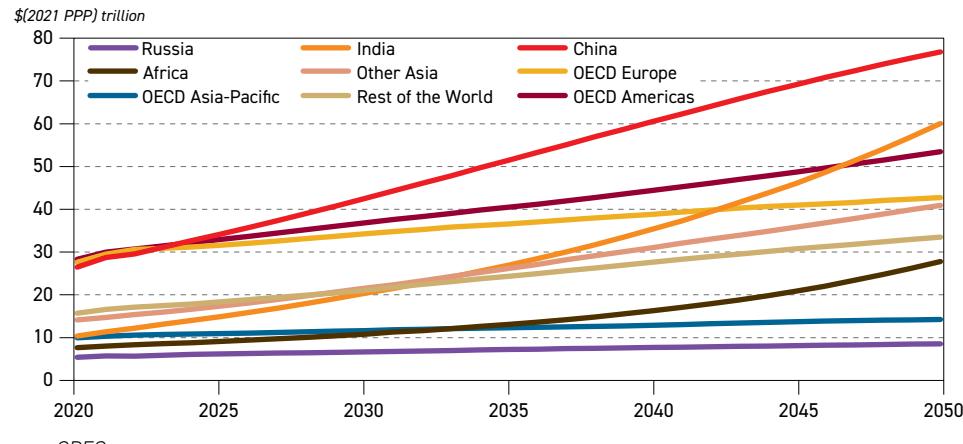

| Figure 1.5 | GDP of major economies, 2020–2050 | 36 |

| Figure 1.6 | Distribution of the global GDP, 2024 and 2050 | 39 |

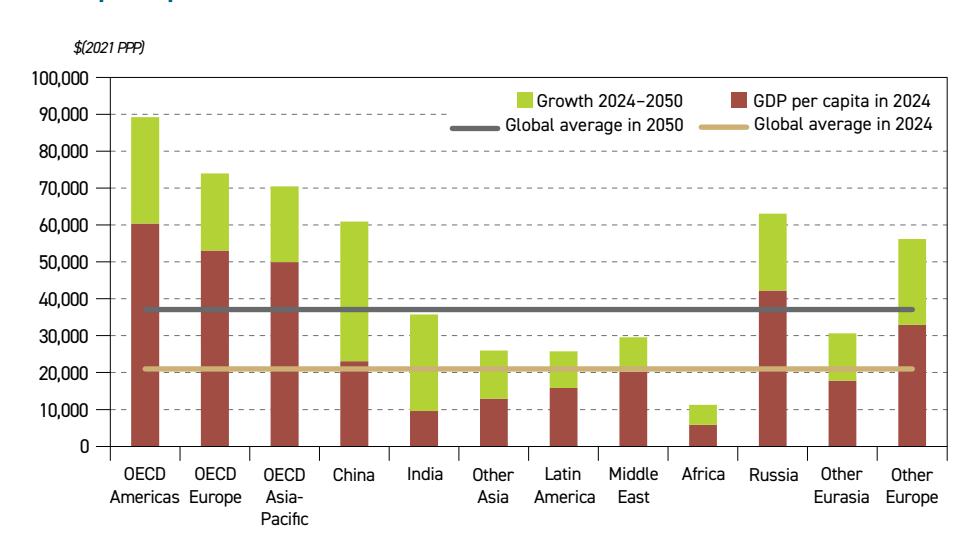

| Figure 1.7 | Real GDP per capita in 2024 and 2050 | 39 |

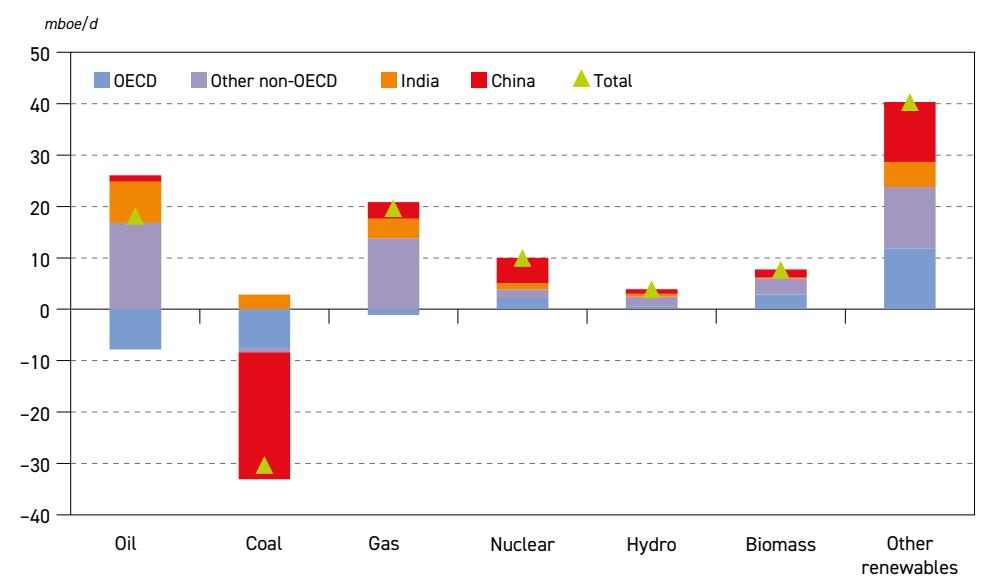

| Figure 2.1 | Growth in primary energy demand by fuel, 2024–2050 | 62 |

| Figure 2.2 | Growth in primary energy demand by region, 2024–2050 | 64 |

| Figure 2.3 | Energy mix and primary energy demand in selected regions, 2024–2050 | 65 |

| Figure 2.4 | Growth in primary energy demand by fuel type and region, 2024–2050 | 66 |

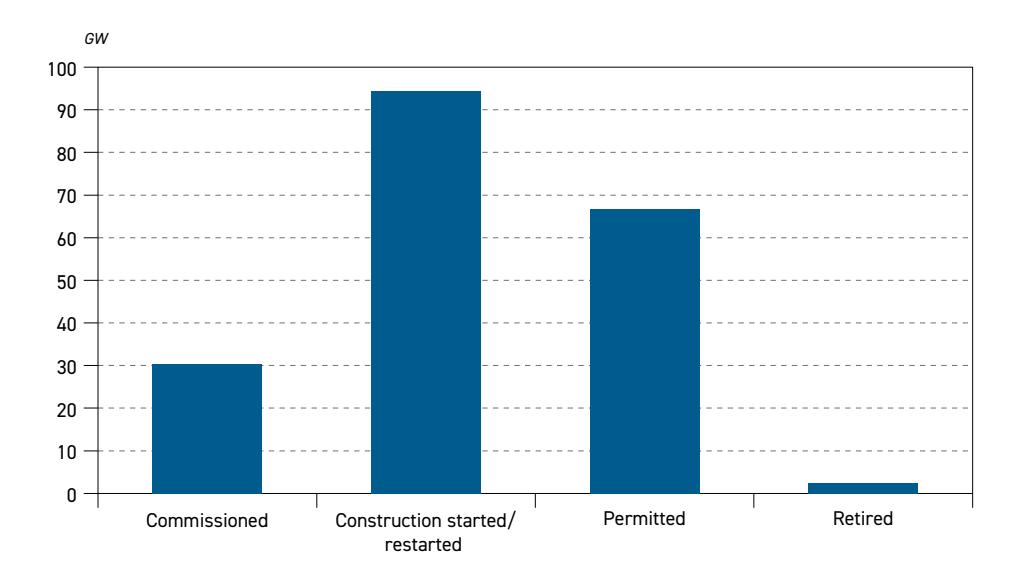

| Figure 2.5 | Coal-fired power generation capacity changes in China, 2024 | 75 |

| Figure 2.6 | Coal demand by major region, 2024–2050 | 77 |

| Figure 2.7 | Natural gas demand by major region, 2024–2050 | 79 |

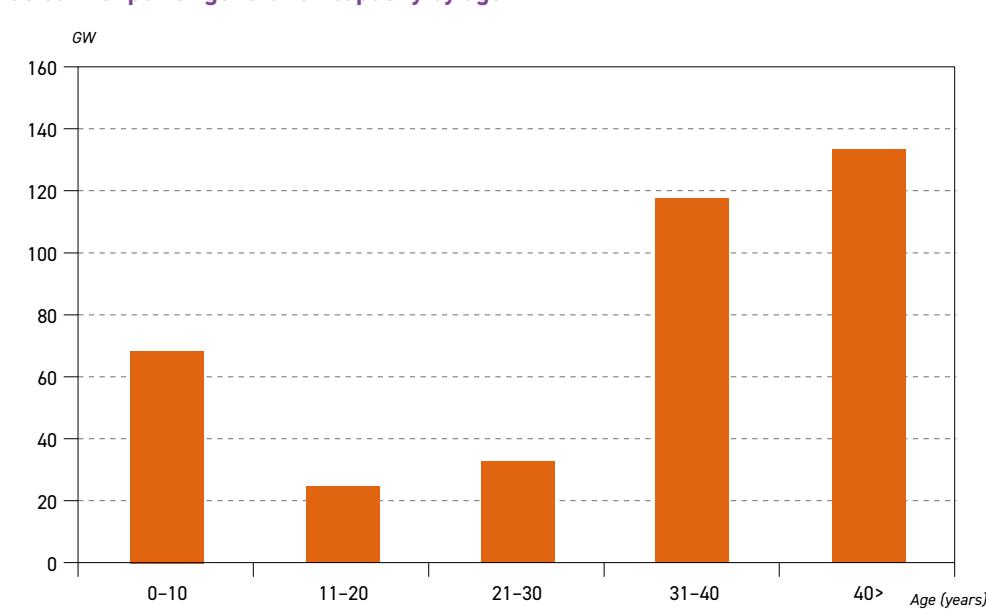

| Figure 2.8 | Nuclear generation by major region | 82 |

| Figure 2.9 | Nuclear net power generation capacity by age | 82 |

| Figure 2.10 | Nuclear energy demand by region, 2024–2050 | 84 |

| Figure 2.11 | Hydropower energy demand by region, 2024–2050 | 86 |

| Figure 2.12 | Biomass energy demand by region, 2024–2050 | 87 |

| Figure 2.13 | 'Other renewables' energy demand by region, 2024–2050 | 90 |

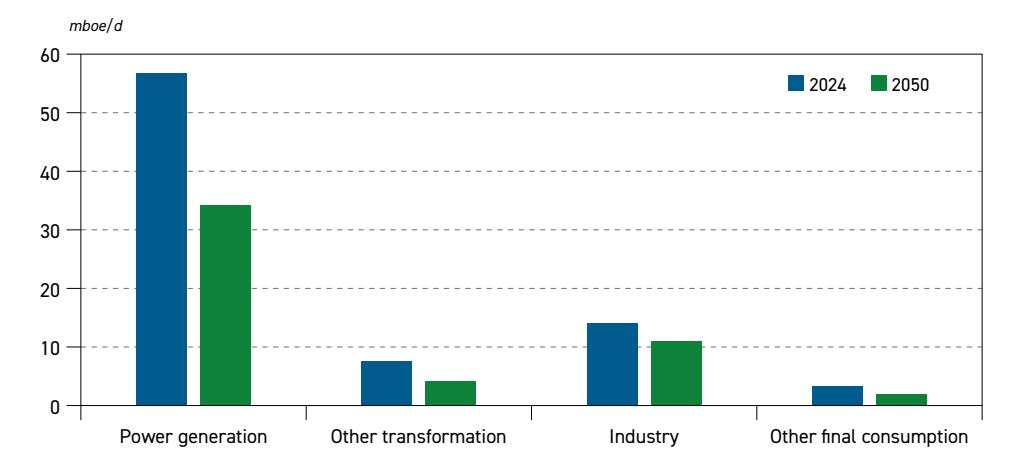

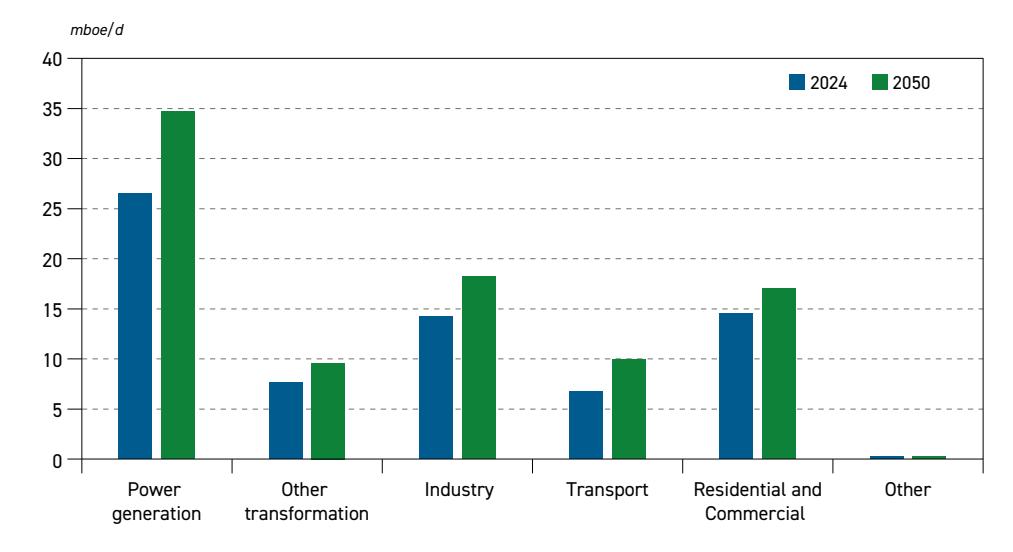

| Figure 2.14 | Global coal demand by sectors, 2024 and 2050 | 92 |

| Figure 2.15 | Global natural gas demand by sectors, 2024 and 2050 | 93 |

| Figure 2.16 | Global total final consumption of electricity by sector, 2024 and 2050 | 95 |

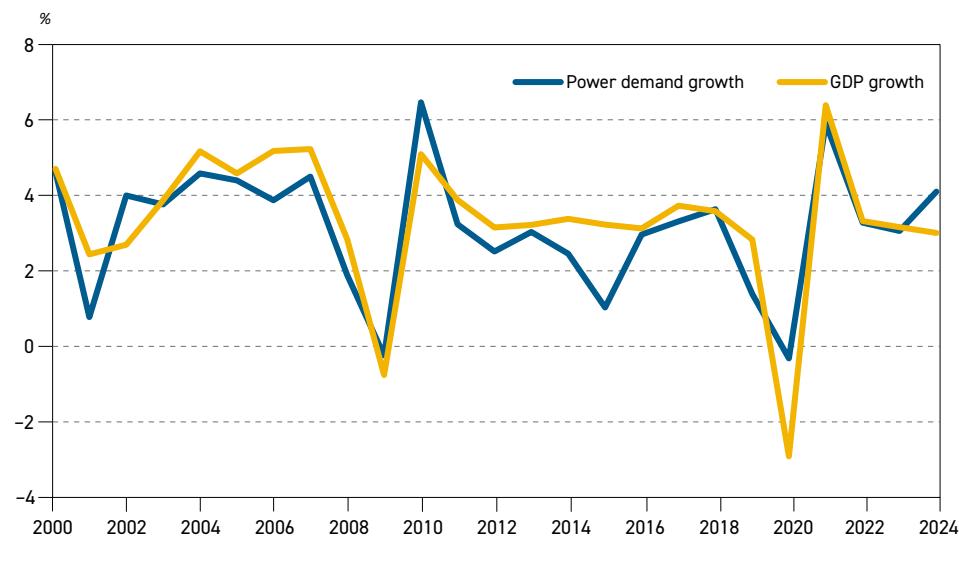

| Figure 2.17 | Global GDP and electricity demand growth, 2000–2024 | 96 |

| Figure 2.18 | Average annual growth rate of electricity demand, 2000–2024 | 97 |

| Figure 2.19 | Electricity demand by region, 2024–2050 | 98 |

| Figure 2.20 | Global electricity generation by fuel, 2024–2050 | 99 |

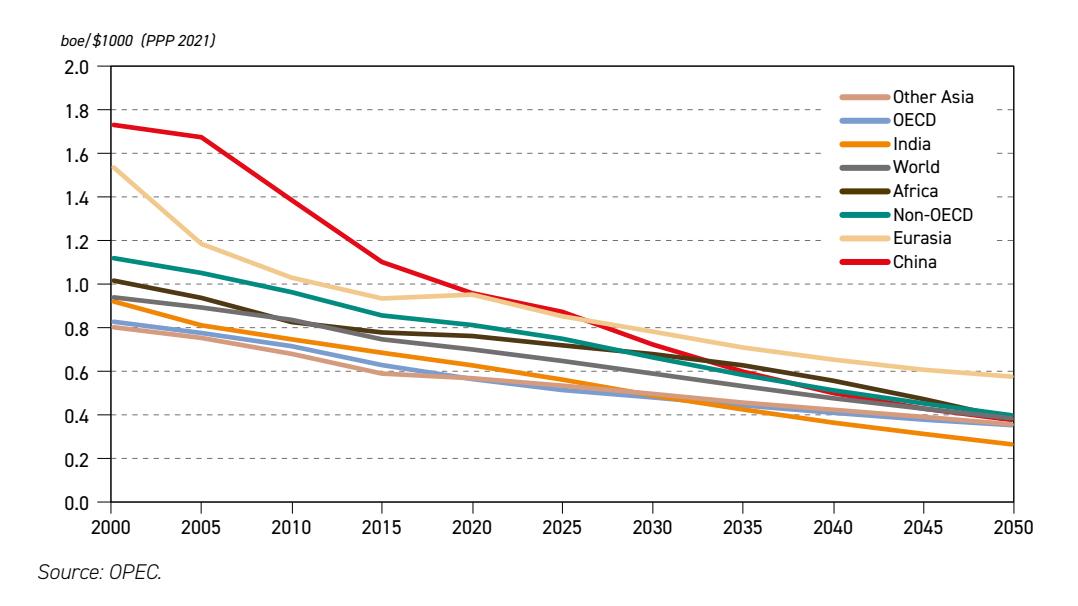

| Figure 2.21 | Evolution and projections of energy intensity in major regions, 2000–2050 | 102 |

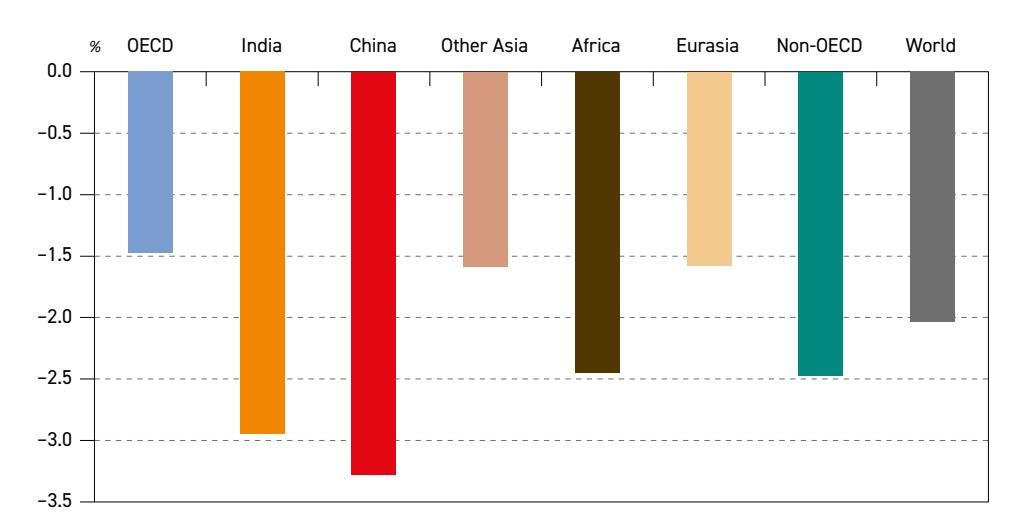

| Figure 2.22 | Average annual rate of improvement in energy intensity, 2024–2050 | 102 |

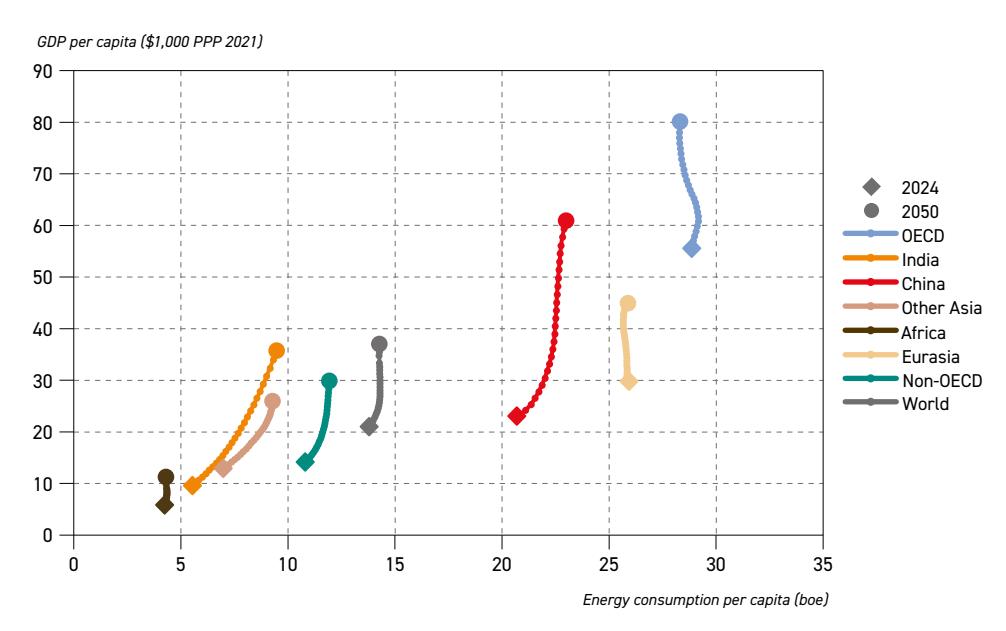

| Figure 2.23 | Per capita GDP and energy consumption, 2024–2050 | 104 |

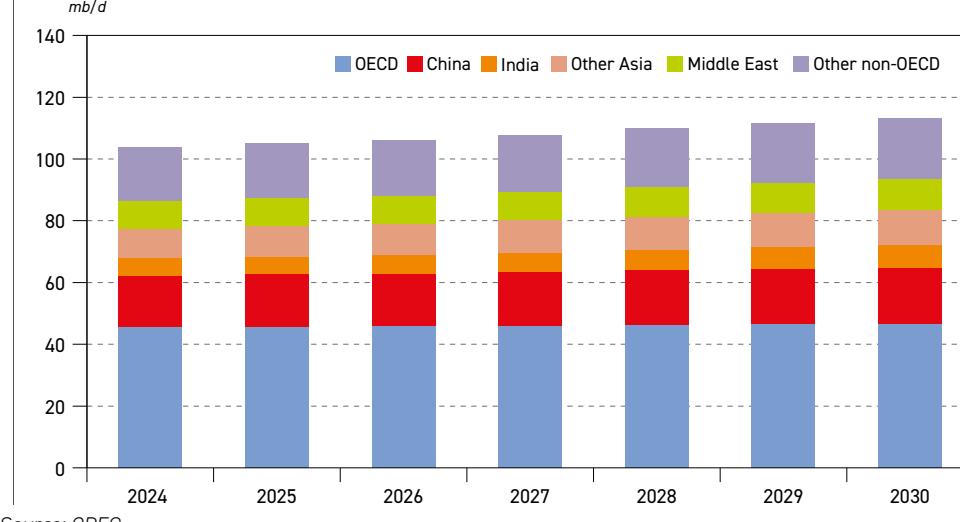

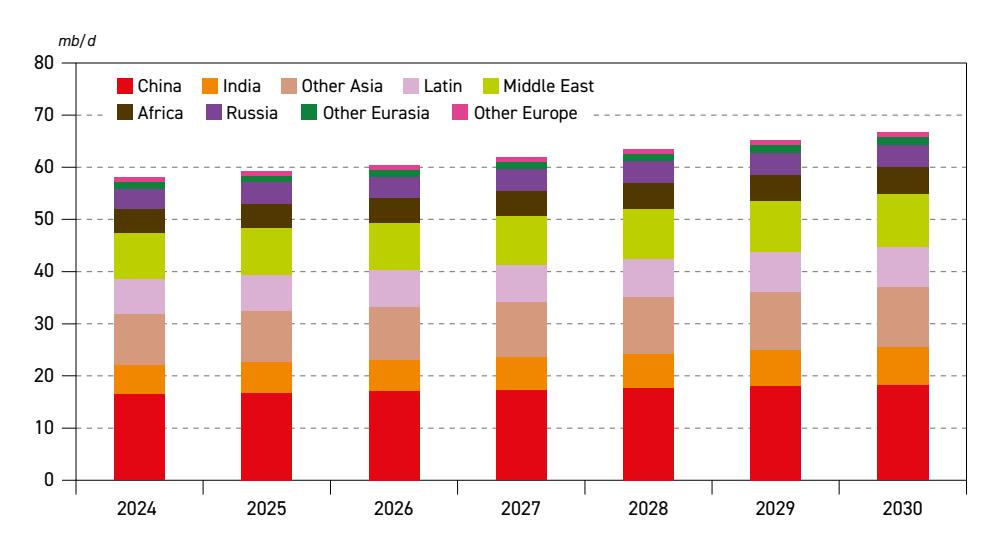

| Figure 3.1 | Meditum-term oil demand by region | 112 |

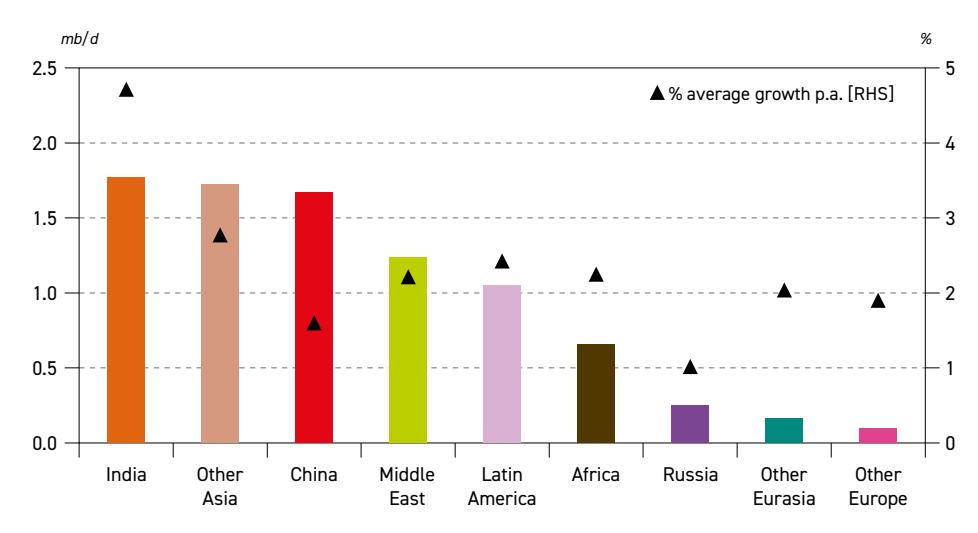

| Figure 3.2 | Incremental oil demand by region, 2024–2030 | 113 |

| Figure 3.3 | Average annual oil demand growth by region, 2024–2050 | 114 |

| Figure 3.4 | OECD oil demand by region, 2024–2050 | 115 |

| Figure 3.5 | OECD oil demand by sector, 2024–2050 | 116 |

|---|---|---|

| Figure 3.6 | OECD oil demand by product, 2024–2050 | 118 |

| Figure 3.7 | Non-OECD oil demand by region, 2024–2030 | 119 |

| Figure 3.8 | Non-OECD oil demand growth by region, 2024–2030 | 120 |

| Figure 3.9 | Non-OECD oil demand growth by region, 2030–2050 | 121 |

| Figure 3.10 | Non-OECD oil demand by sector, 2024–2050 | 122 |

| Figure 3.11 | Non-OECD oil demand by product, 2024–2050 | 123 |

| Figure 3.12 | Oil demand in India by sector, 2024–2050 | 124 |

| Figure 3.13 | Oil demand in India by product, 2024–2050 | 126 |

| Figure 3.14 | Oil demand in China by sector, 2024–2050 | 127 |

| Figure 3.15 | Oil demand in 'Other Asia' by sector, 2024–2050 | 129 |

| Figure 3.16 | Oil demand in the Middle East by sector, 2024–2050 | 130 |

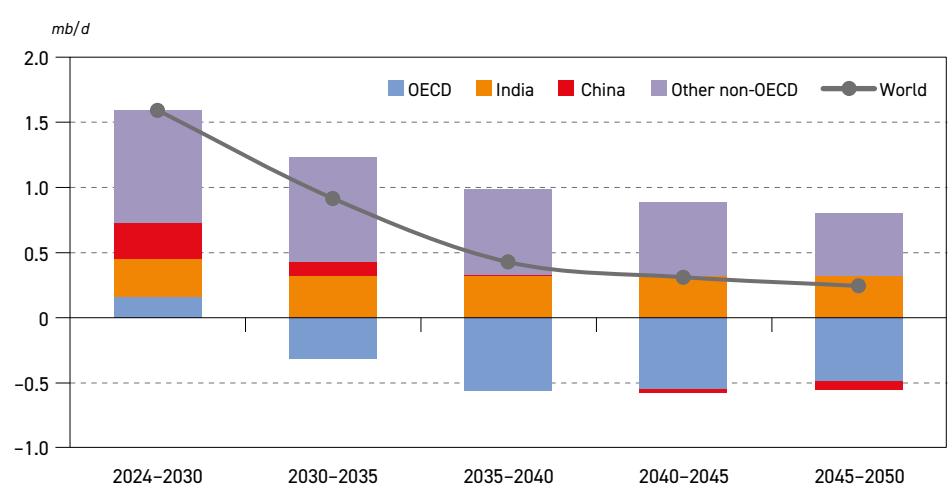

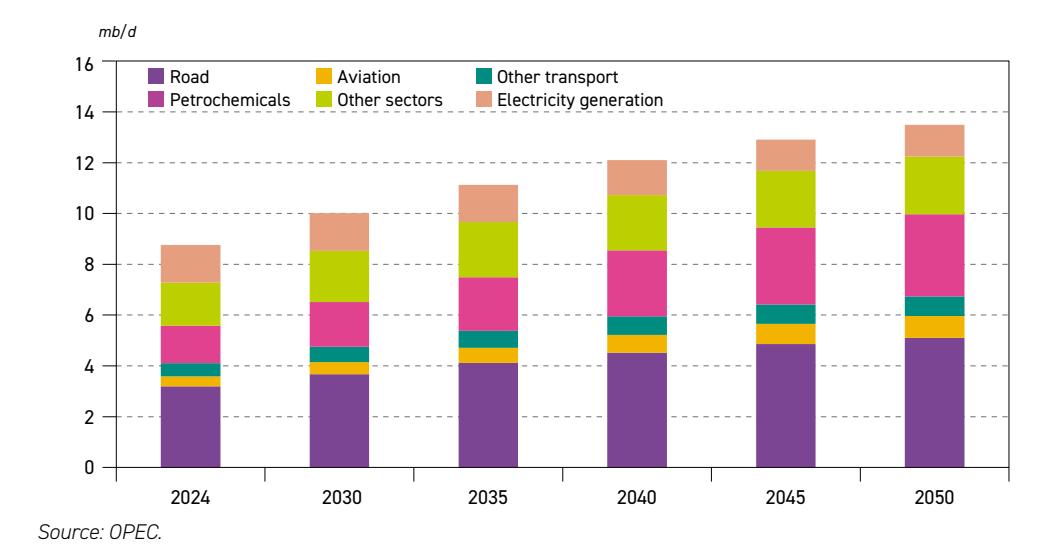

| Figure 3.17 | Global oil demand growth by sector, 2024–2050 | 132 |

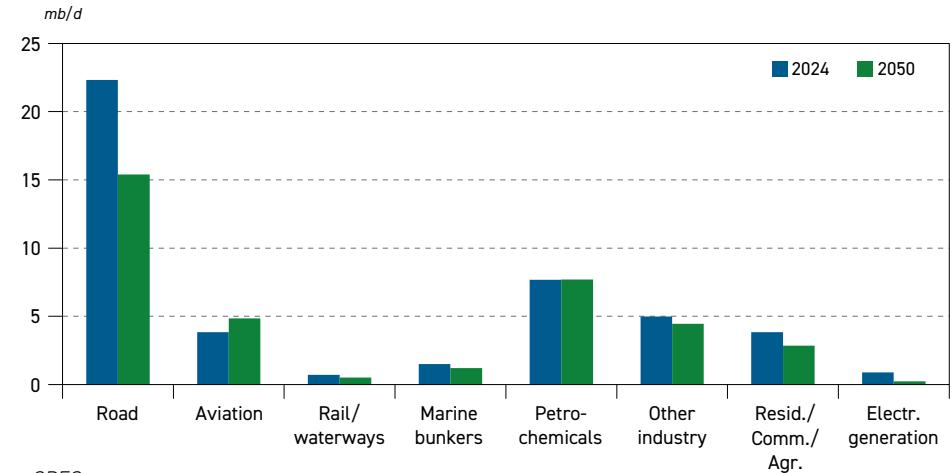

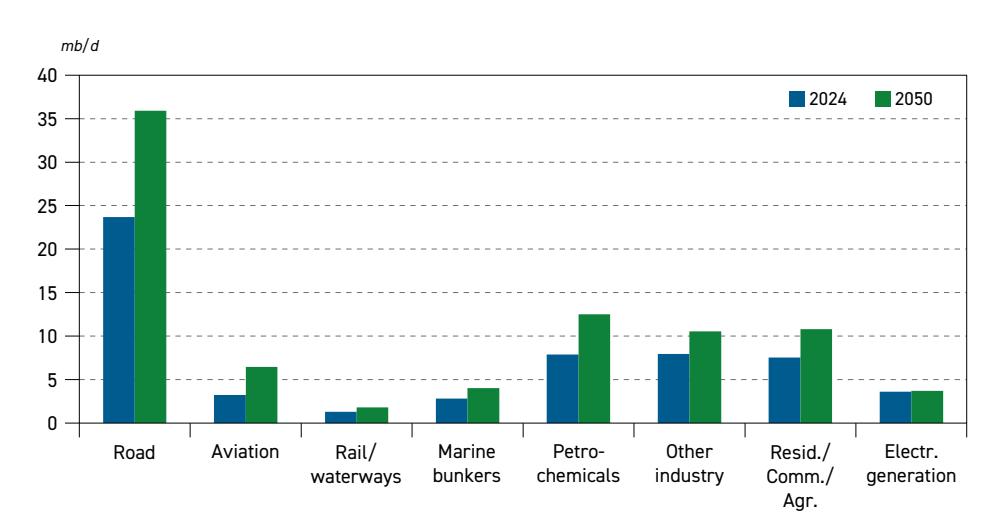

| Figure 3.18 | OECD oil demand by sector, 2024 and 2050 | 134 |

| Figure 3.19 | Non-OECD oil demand by sector, 2024 and 2050 | 134 |

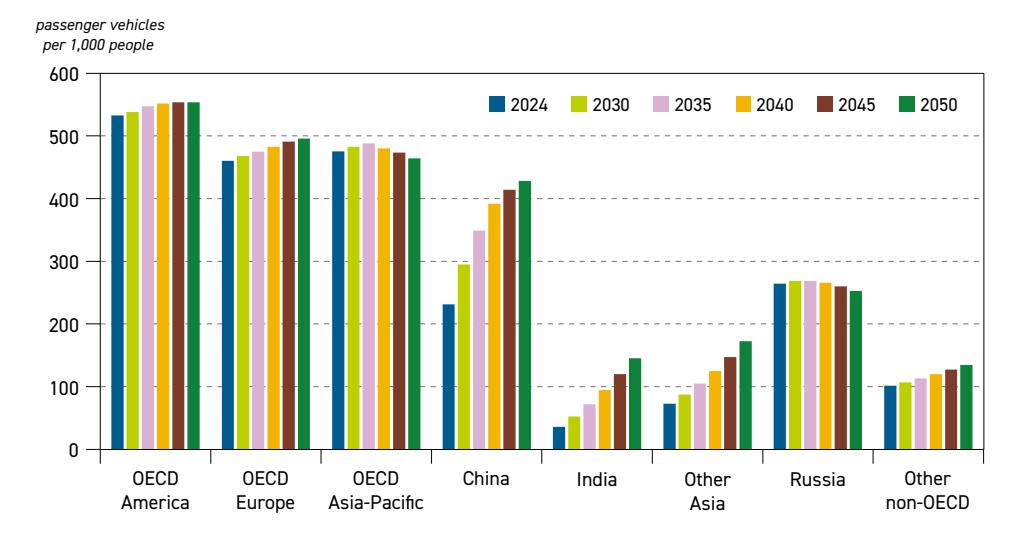

| Figure 3.20 | Passenger vehicle ownership by region | 137 |

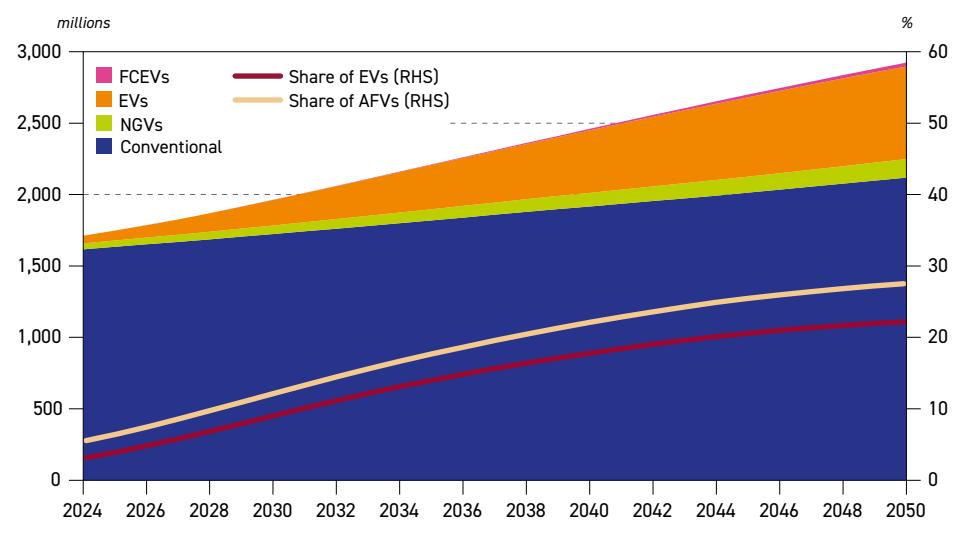

| Figure 3.21 | Global fleet composition, 2024–2050 | 140 |

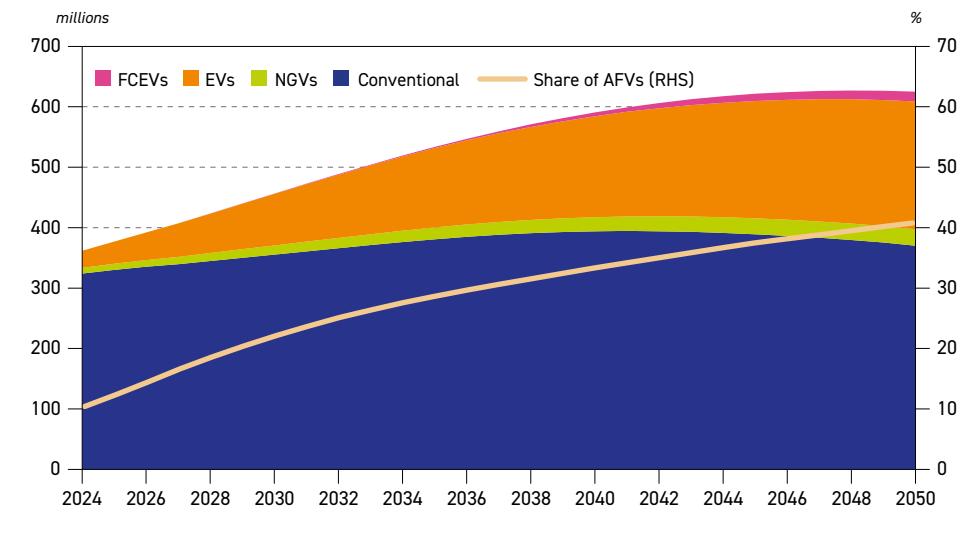

| Figure 3.22 | China fleet composition, 2024–2050 | 141 |

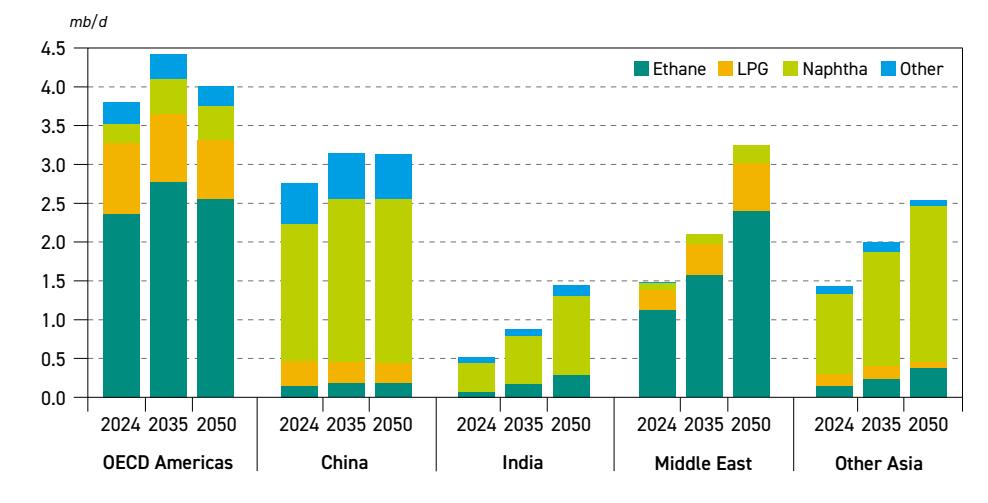

| Figure 3.23 | Regional demand in the petrochemical sector by product, 2024–2050 | 149 |

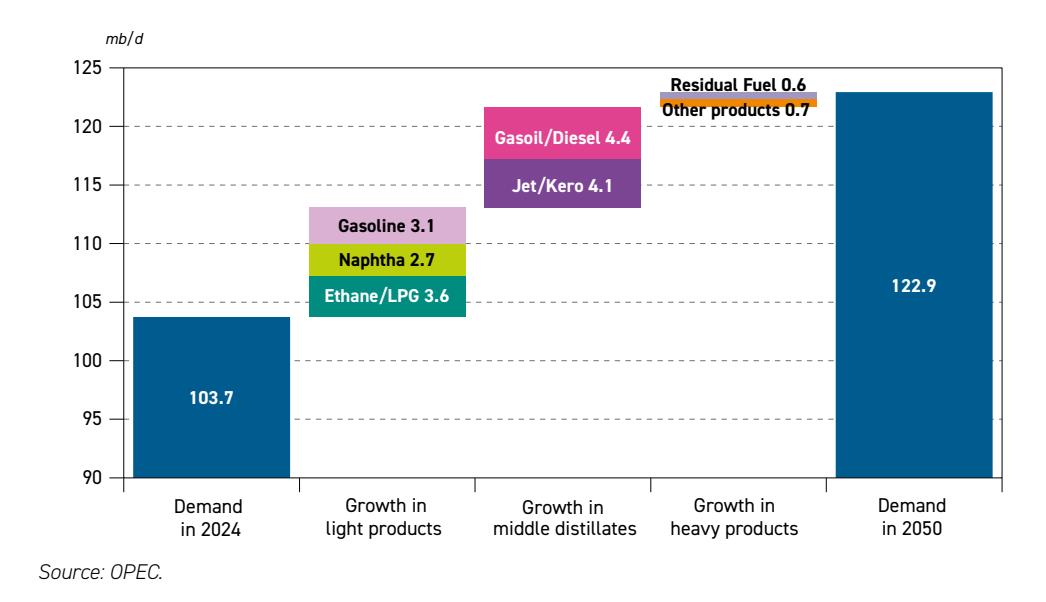

| Figure 3.24 | Demand growth by product category between 2024 and 2050 | 157 |

| Figure 3.25 | Growth in global oil demand by product | 158 |

| Figure 4.1 | Long-term non-DoC liquids supply outlook | 162 |

| Figure 4.2 | Composition of global liquids supply growth, 2024–2050 | 163 |

| Figure 4.3 | Major contributors to non-DoC total liquids growth, 2024–2030 | 164 |

| Figure 4.4 | Non-DoC liquids supply outlook by region | 165 |

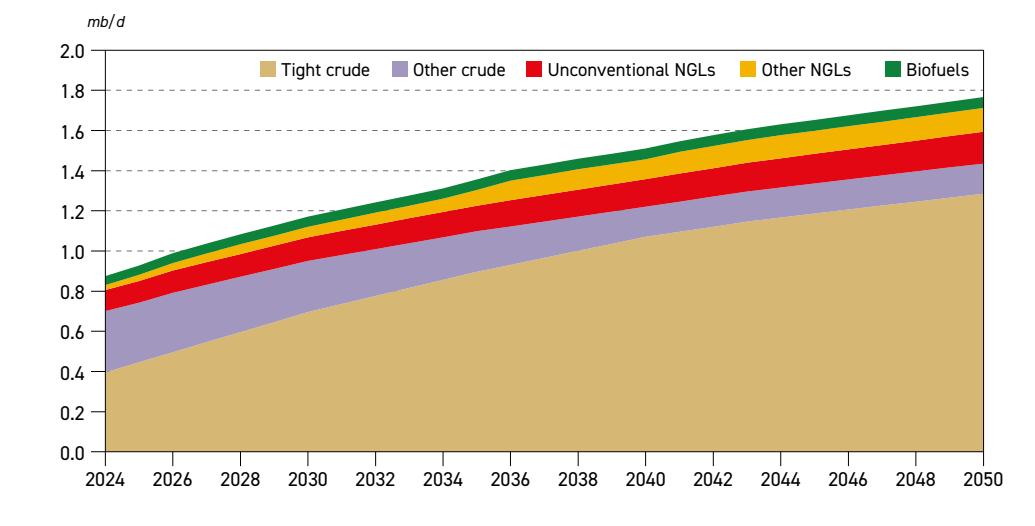

| Figure 4.5 | US total liquids production outlook by source | 166 |

| Figure 4.6 | Canada total liquids production outlook by source | 167 |

| Figure 4.7 | Norway total liquids production outlook by source | 169 |

| Figure 4.8 | UK total liquids production outlook by source | 170 |

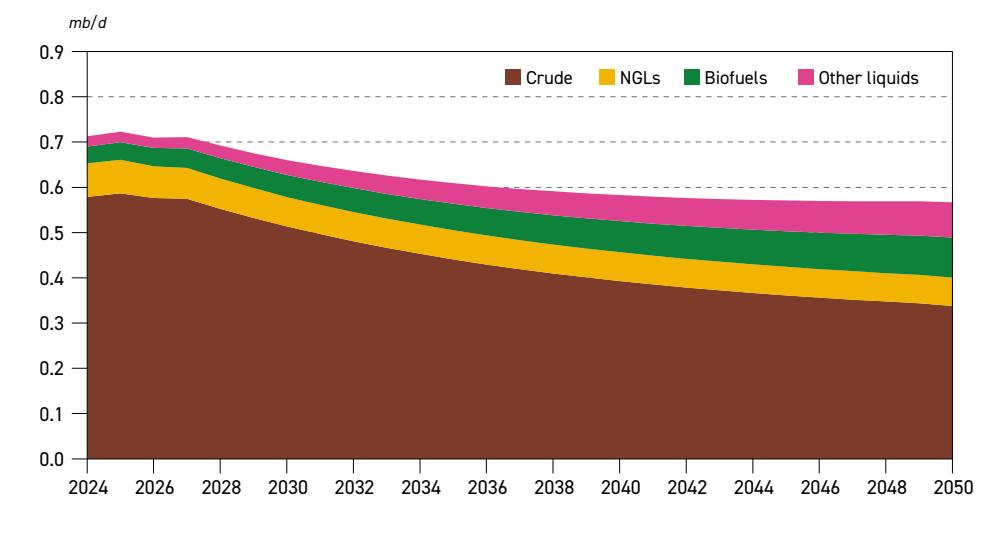

| Figure 4.9 | Argentina total liquids production outlook by source | 171 |

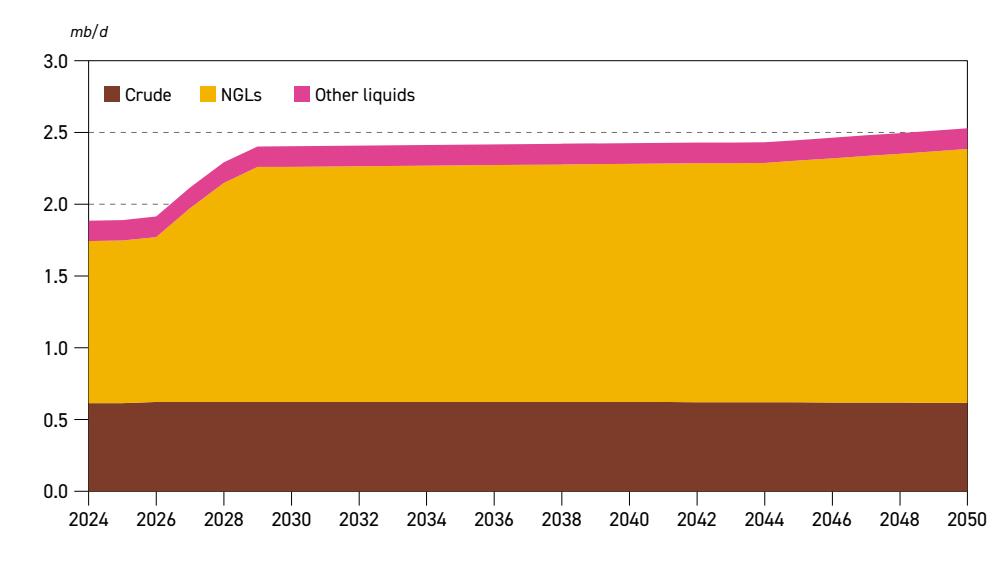

| Figure 4.10 | Qatar total liquids production outlook by source | 172 |

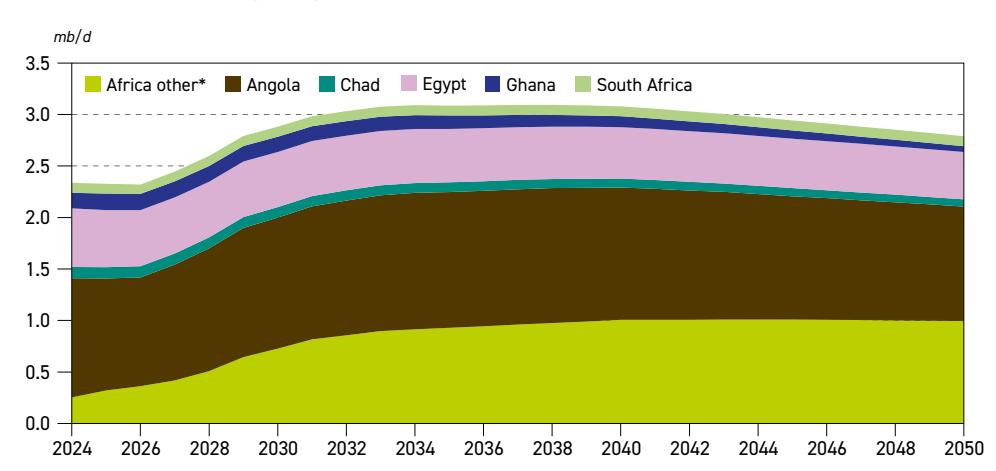

| Figure 4.11 | Non-DoC Africa total liquids production outlook by country | 172 |

| Figure 4.12 | India total liquids production outlook by source | 173 |

| Figure 4.13 | China total liquids production outlook by source | 174 |

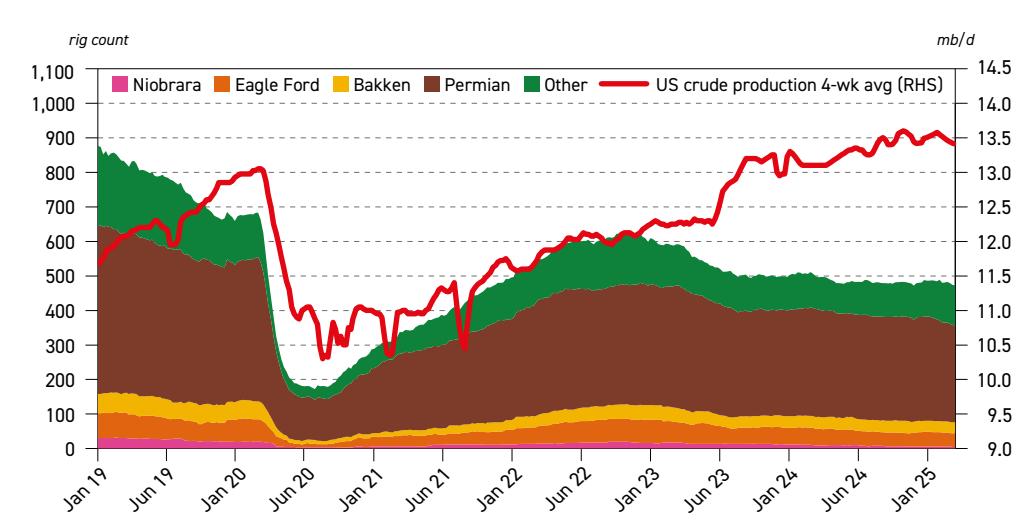

| Figure 4.14 | Composition of US tight oil production by play | 176 |

| Figure 4.15 | US oil rig count and crude production | 177 |

| Figure 4.16 | Non-DoC NGLs production outlook by country | 178 |

| Figure 4.17 | DoC total liquids supply | 179 |

| Figure 4.18 | Cumulative oil-related investment requirements by segment, 2025–2050 | 180 |

| Figure 4.19 | Annual upstream investment requirements, 2025–2050 | 180 |

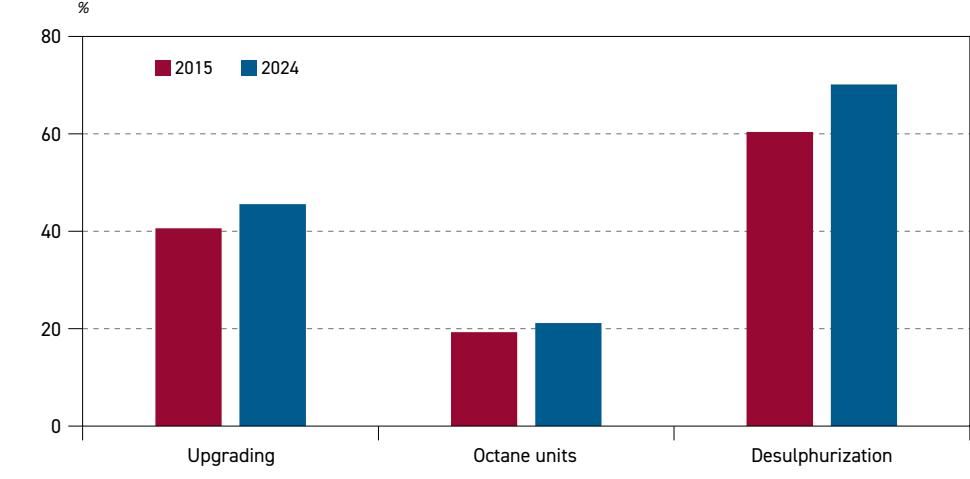

| Figure 5.1 | Secondary capacity relative to distillation capacity by major categories, | |

| 2015 and 2024 | 185 | |

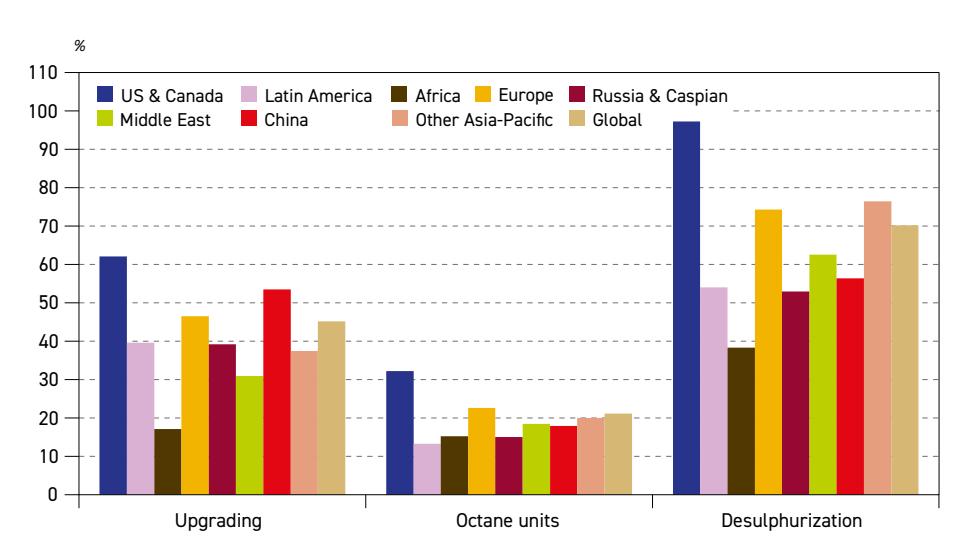

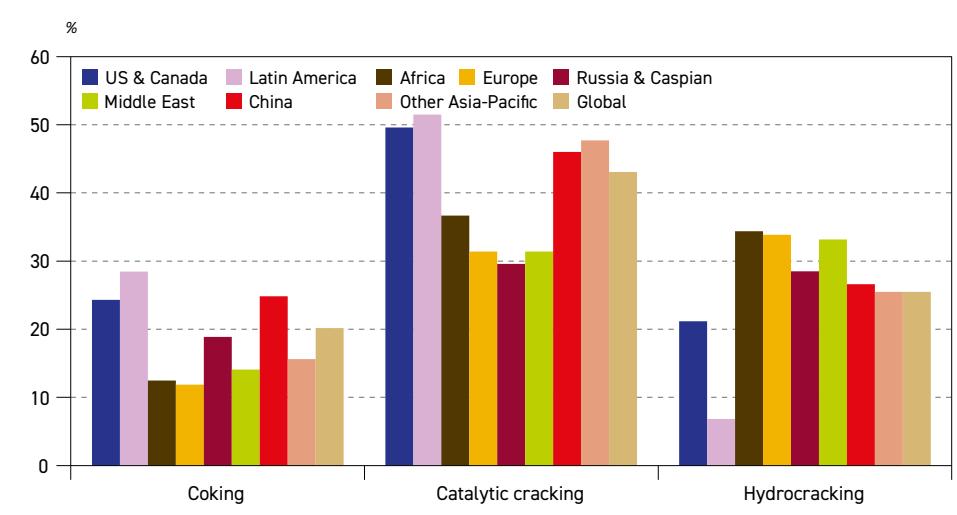

| Figure 5.2 | Secondary capacity relative to distillation capacity, January 2025 | 188 |

| Figure 5.3 | Upgrading capacity by technology relative to total upgrading capacity, | |

| January 2025 | 189 | |

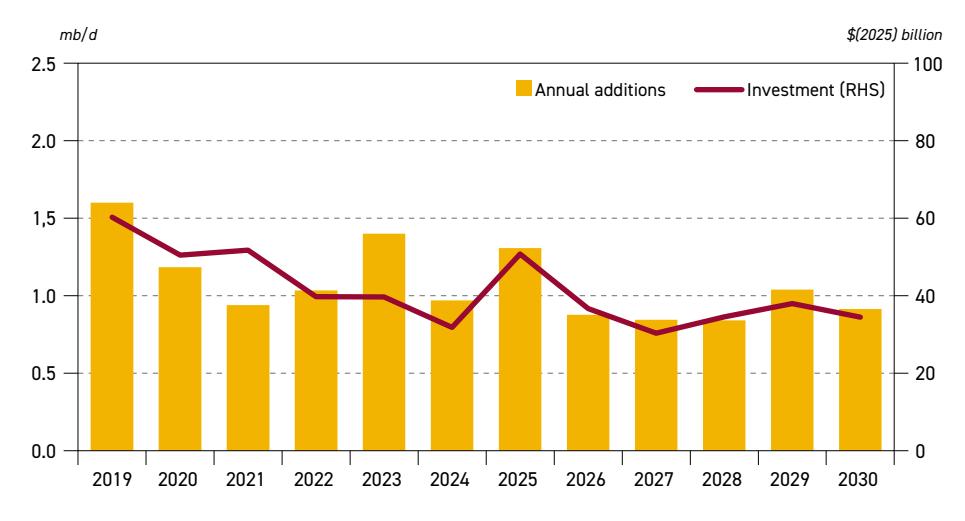

| Figure 5.4 | Annual distillation capacity additions and total project investment | 192 |

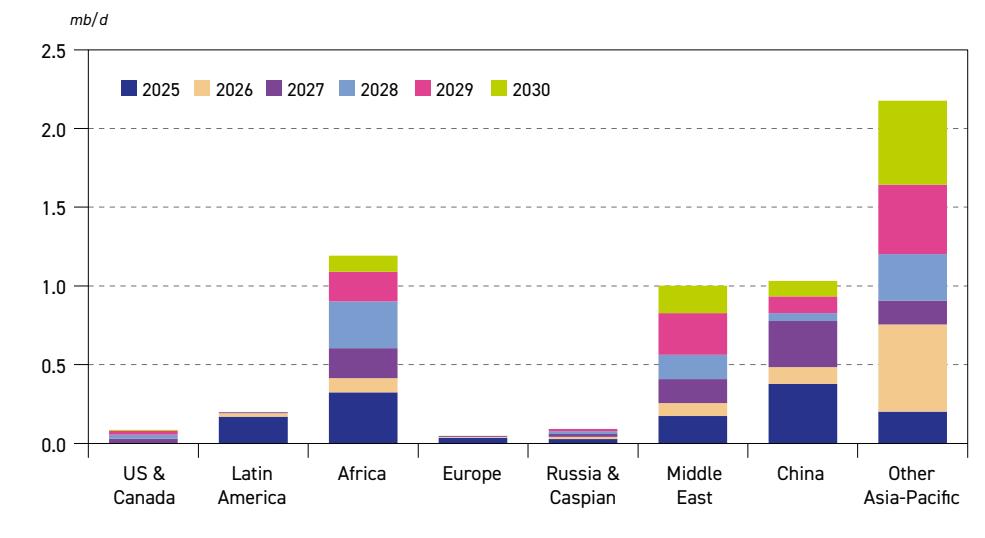

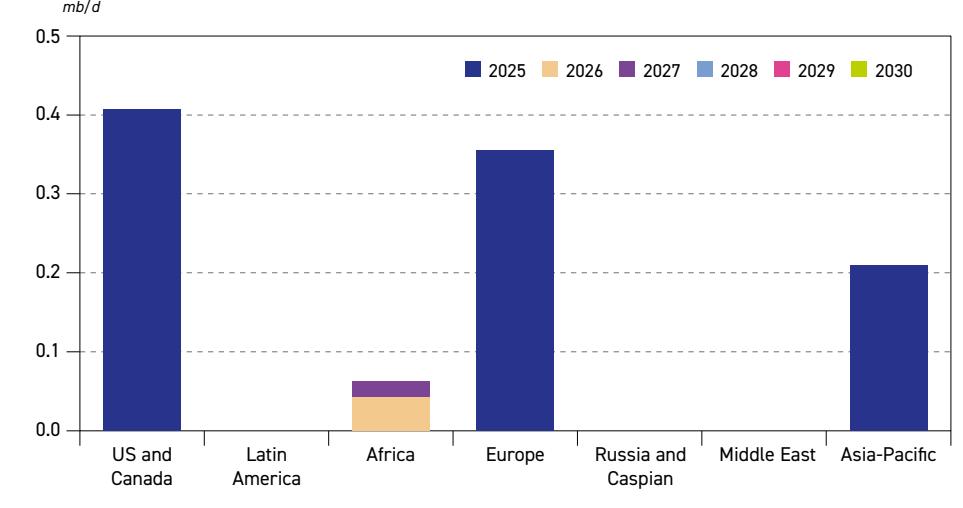

| Figure 5.5 | Distillation capacity additions from existing projects, 2025–2030 | 193 |

| Figure 5.6 | Distillation capacity additions per period and cumulative, 2025–2050 | 196 |

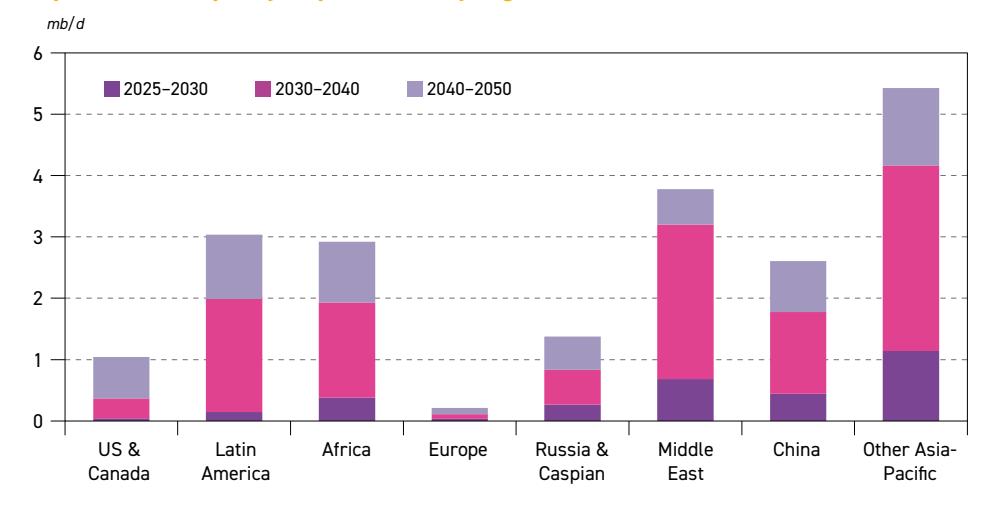

| Figure 5.7 | Crude distillation capacity additions by region, 2025–2050 | 197 |

| Figure 5.8 | Additional global cumulative refinery crude runs, potential and required | 199 |

| Figure 5.9 | Additional cumulative crude runs in US & Canada, potential and required | 200 |

|---|---|---|

| Figure 5.10 | Additional cumulative crude runs in Europe, potential and required | 201 |

| Figure 5.11 | Additional cumulative crude runs in China, potential and required | 201 |

| Figure 5.12 | Additional cumulative crude runs in Asia-Pacific (excl. China), potential and | |

| required | 202 | |

| Figure 5.13 | Additional cumulative crude runs in the Middle East, potential and required | 203 |

| Figure 5.14 | Additional cumulative crude runs in Russia & Caspian, potential and required | 203 |

| Figure 5.15 | Additional cumulative crude runs in Africa, potential and required | 204 |

| Figure 5.16 | Additional cumulative crude runs in Latin America, potential and required | 204 |

| Figure 5.17 | Net cumulative regional refining potential surplus/deficits versus requirements | 205 |

| Figure 5.18 | Historical and projected global refinery utilization, 2019–2030 | 206 |

| Figure 5.19 | Global oil demand, refining capacity and crude runs, 1980–2030 | 207 |

| Figure 5.20 | Projected net refinery closures by region | 211 |

| Figure 5.21 | Conversion projects by region, 2025–2030 | 215 |

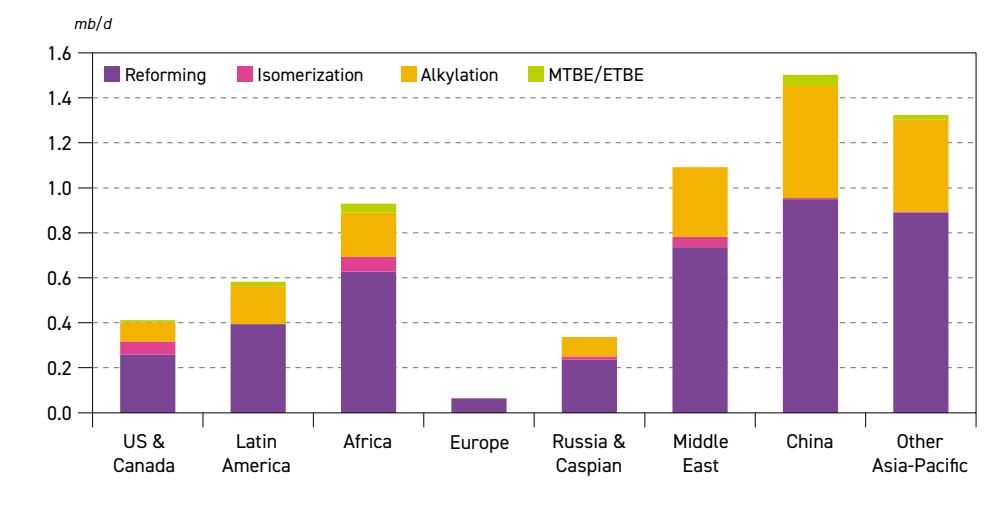

| Figure 5.22 | Global capacity requirements by process type, 2025–2050 | 218 |

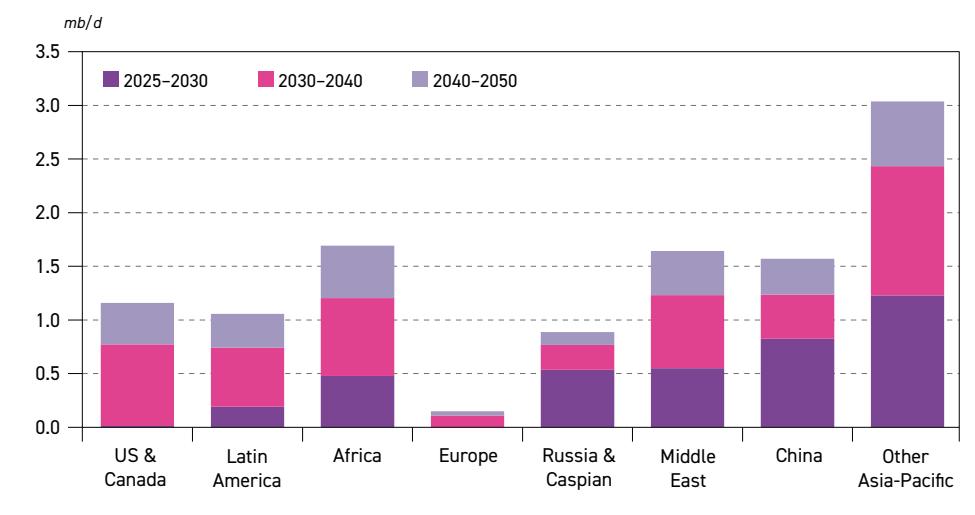

| Figure 5.23 | Conversion capacity requirements by region, 2025–2050 | 219 |

| Figure 5.24 | Desulphurization capacity requirements by region, 2025–2050 | 220 |

| Figure 5.25 | Desulphurization capacity requirements by product and region, 2025–2050 | 221 |

| Figure 5.26 | Octane capacity requirements by process and region, 2025–2050 | 222 |

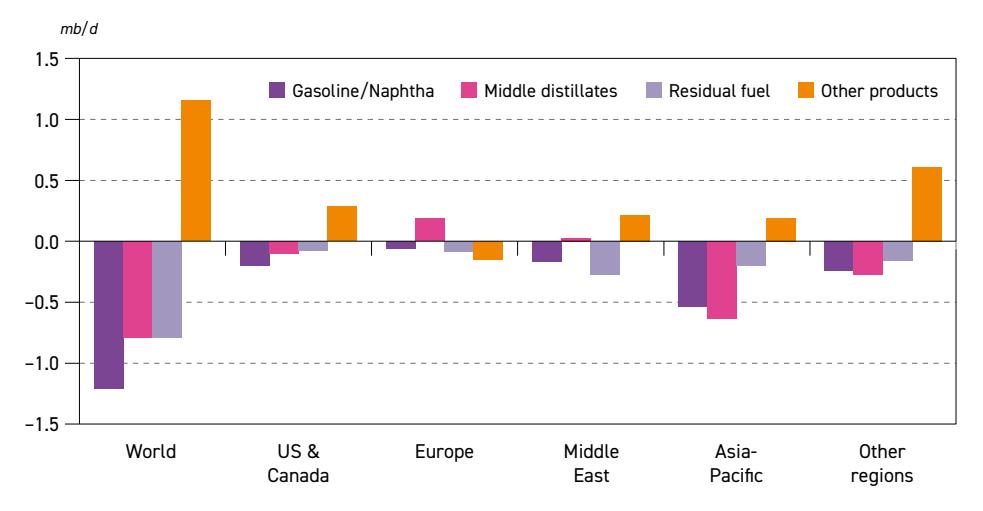

| Figure 5.27 | Expected cumulative surplus/deficit of incremental product output from existing | |

| refining projects, 2025–2030 | 223 | |

| Figure 5.28 | Refinery investments by region, 2025–2050 | 224 |

| Figure 6.1 | Interregional crude oil, condensate and products exports, 2024–2050 | 235 |

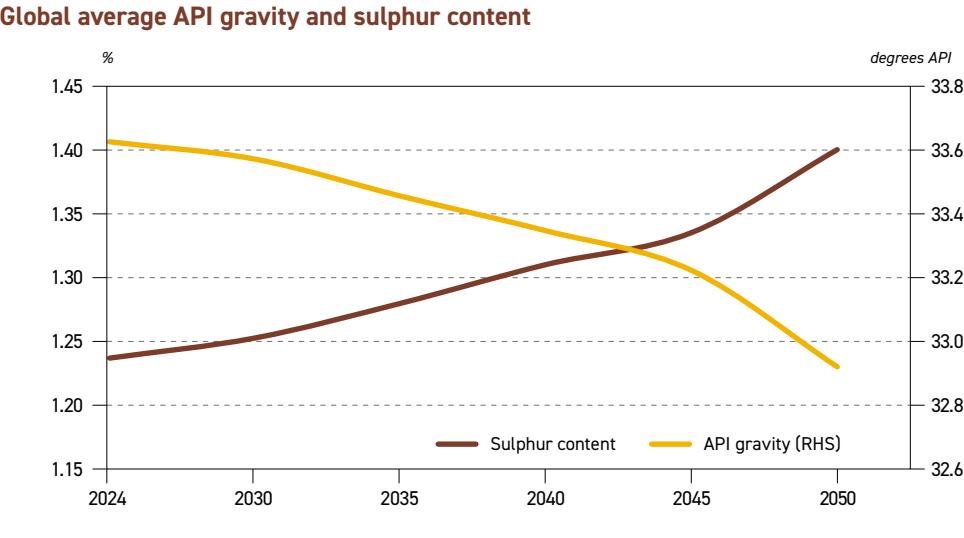

| Figure 6.2 | Global average API gravity and sulphur content | 236 |

| Figure 6.3 | Global crude and condensate exports by origin, 2024–2050 | 237 |

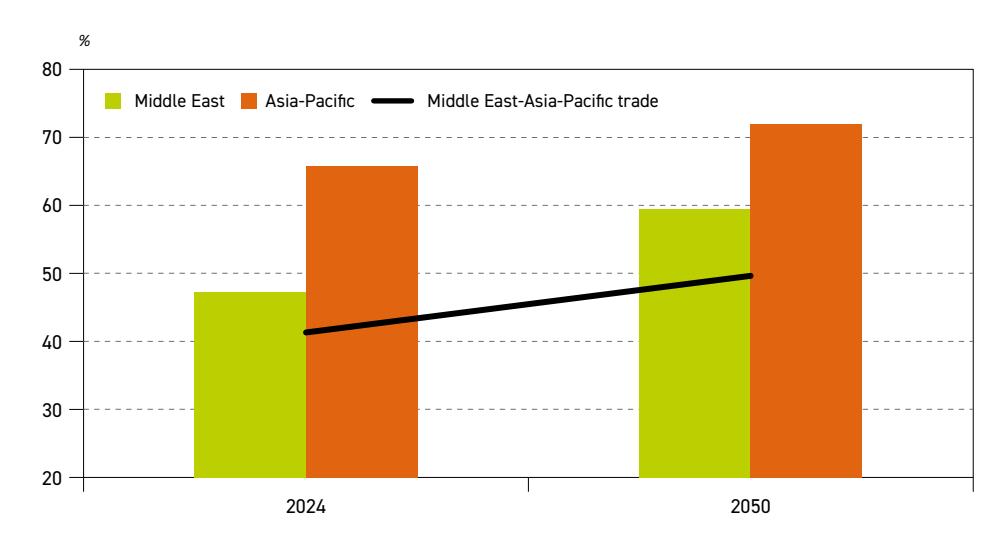

| Figure 6.4 | Middle East and Asia-Pacific share of global crude and condensate trade, | |

| 2024–2050 | 238 | |

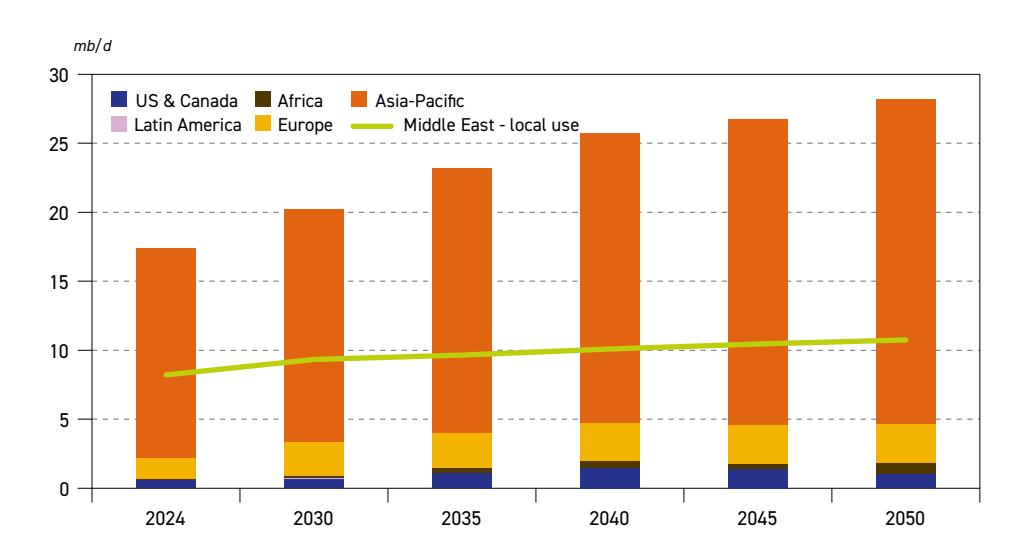

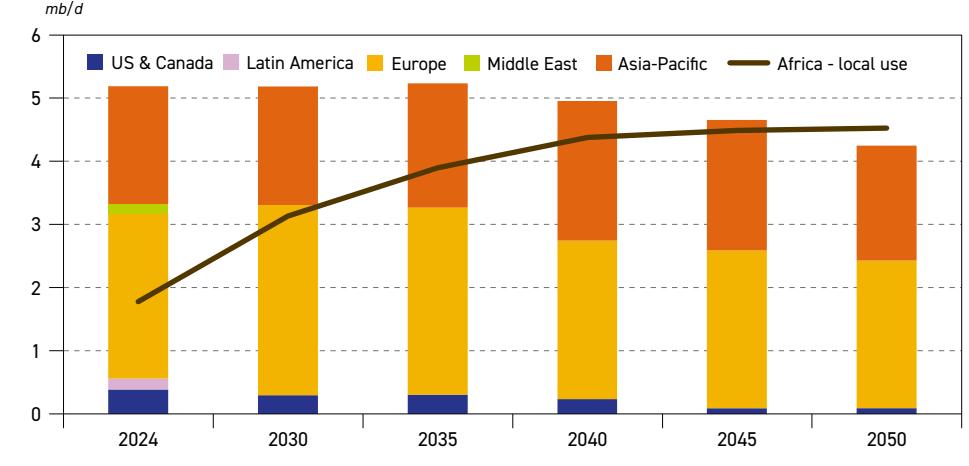

| Figure 6.5 | Crude and condensate exports from Middle East by major destination | |

| (and local use), 2024–2050 | 239 | |

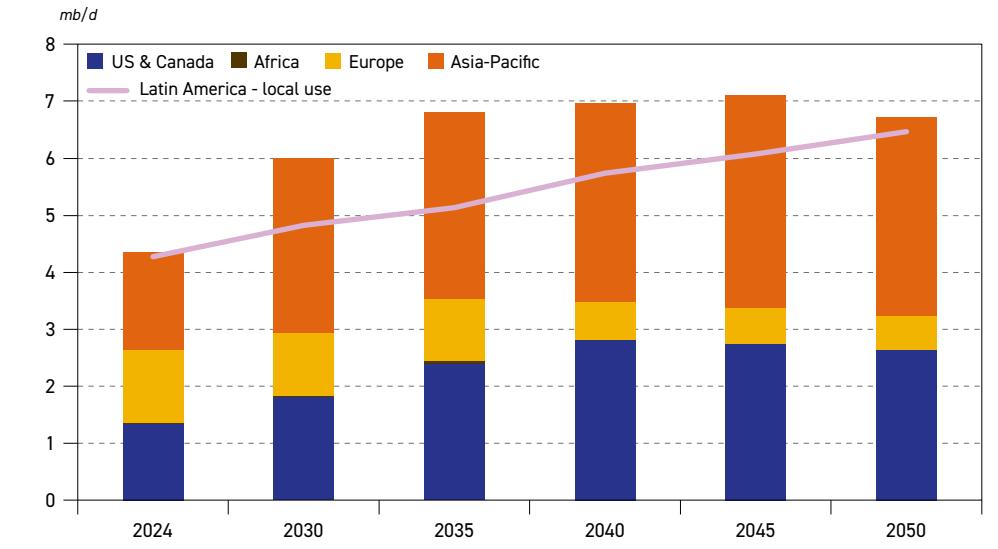

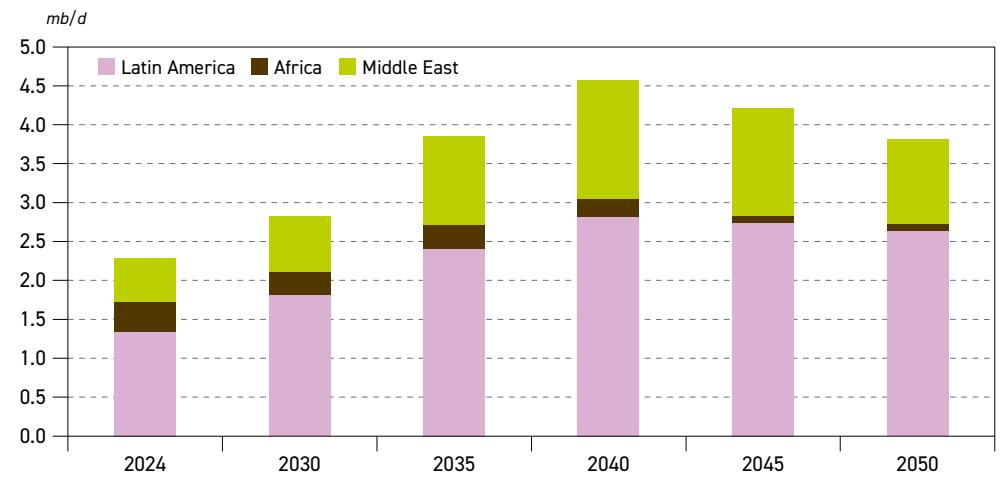

| Figure 6.6 | Crude and condensate exports from Latin America by major destination | |

| (and local use), 2024–2050 | 240 | |

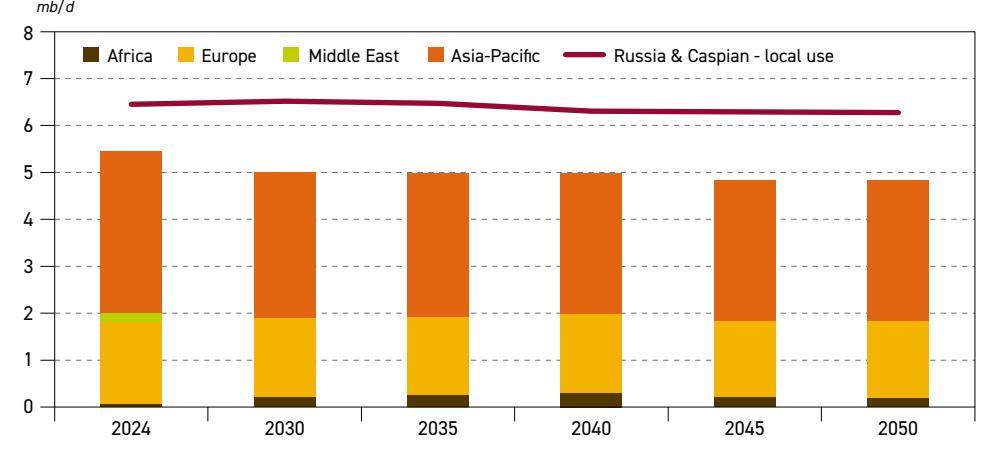

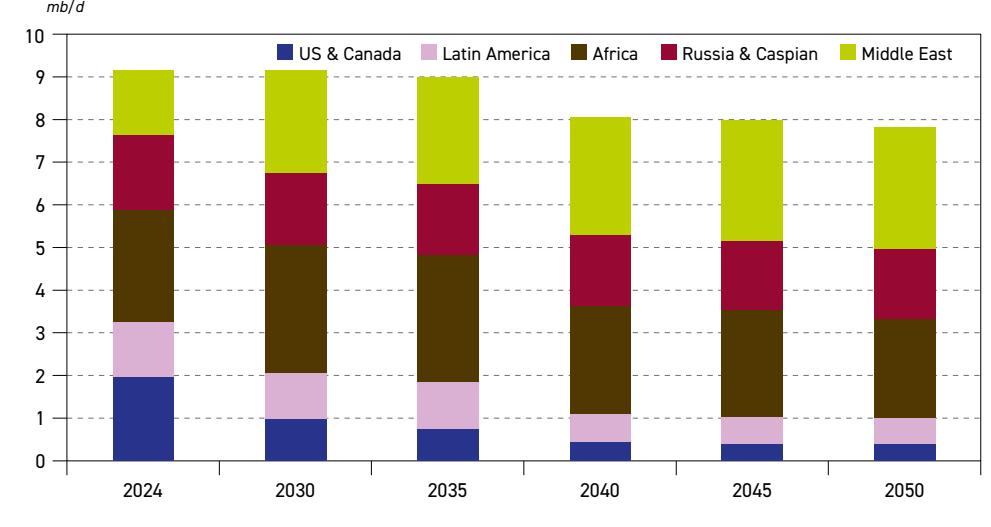

| Figure 6.7 | Crude and condensate exports from Russia & Caspian by major destination | |

| (and local use), 2024–2050 | 241 | |

| Figure 6.8 | Crude and condensate exports from Africa by major destination (and local use), | |

| 2024–2050 | 242 | |

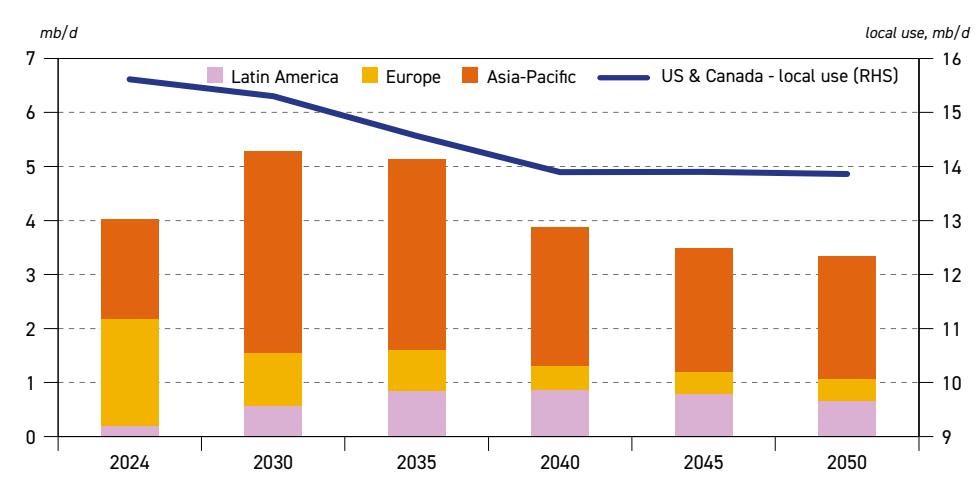

| Figure 6.9 | Crude and condensate exports from US & Canada by major destination | |

| (and local use), 2024–2050 | 243 | |

| Figure 6.10 | Crude and condensate imports to US & Canada by origin, 2024–2050 | 244 |

| Figure 6.11 | Crude and condensate imports to Europe by origin, 2024–2050 | 245 |

| Figure 6.12 | Crude and condensate imports to Asia-Pacific by origin, 2024–2050 | 246 |

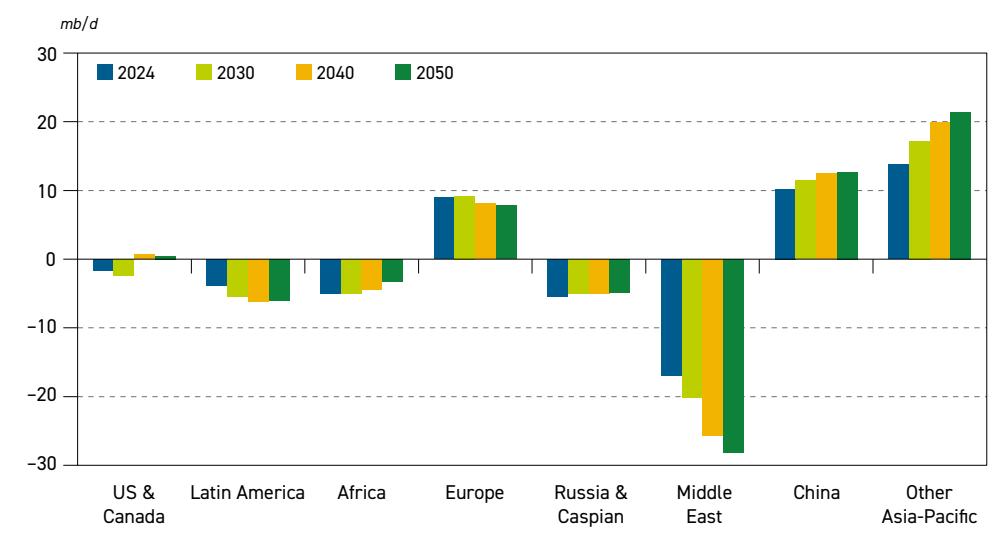

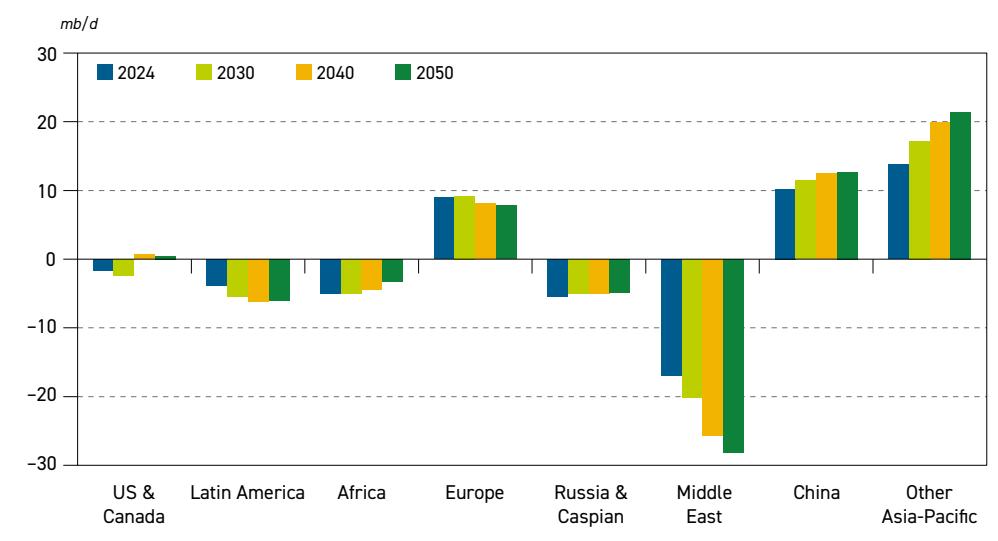

| Figure 6.13 | Regional net crude and condensate imports, 2024, 2030, 2040 and 2050 | 248 |

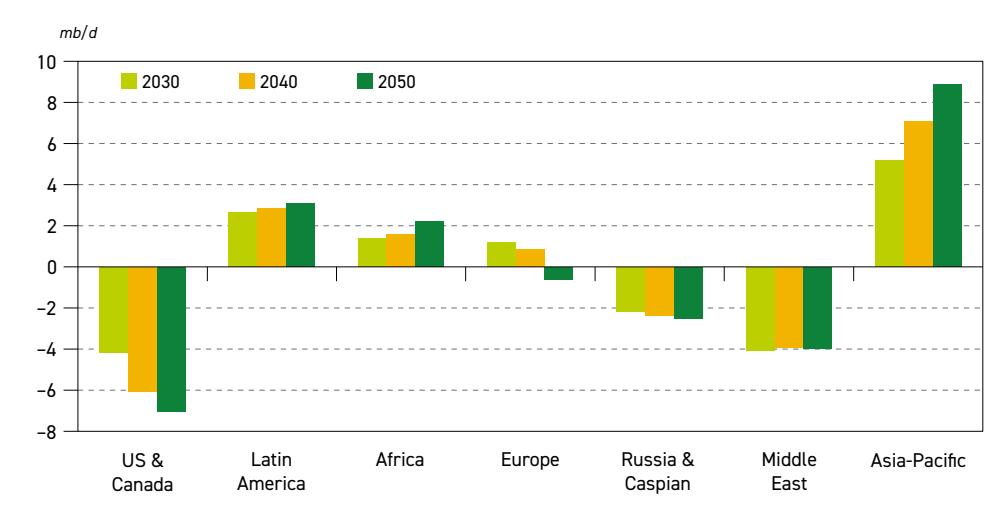

| Figure 6.14 | Regional net product imports, 2030, 2040 and 2050 | 249 |

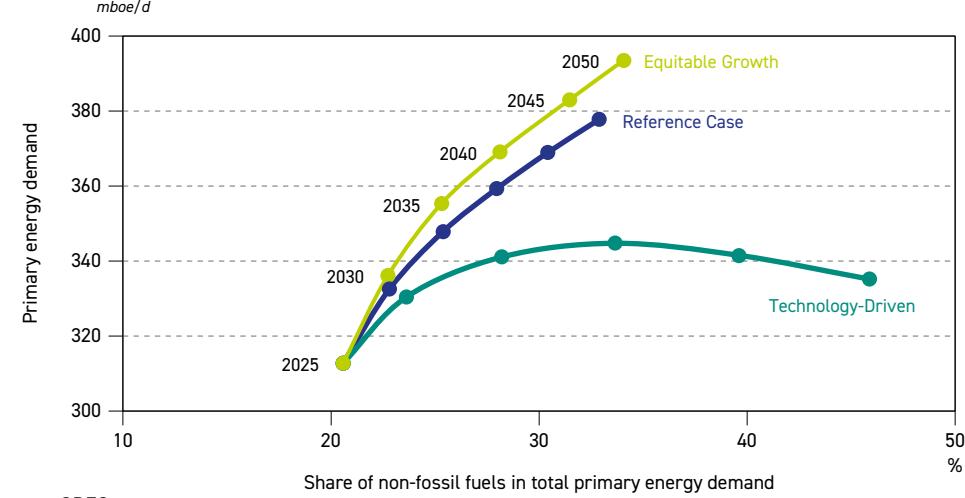

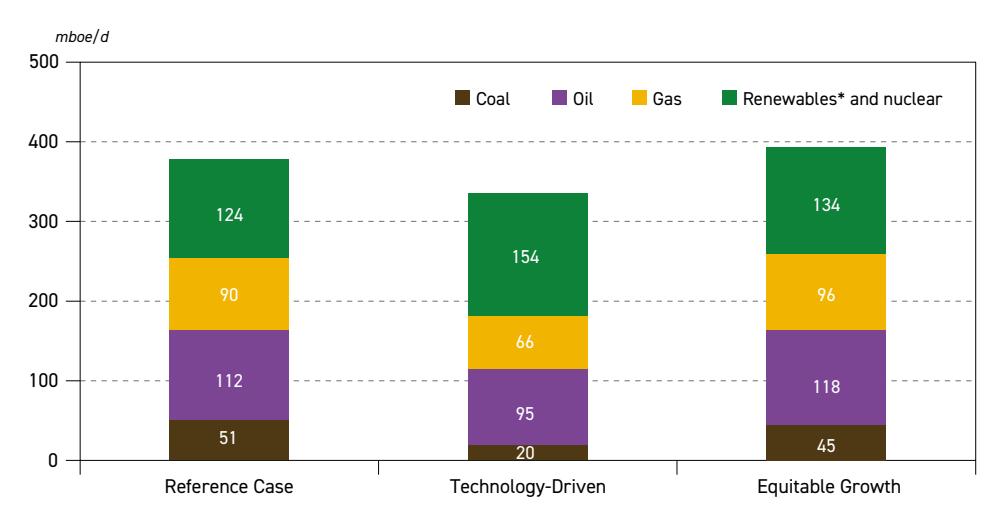

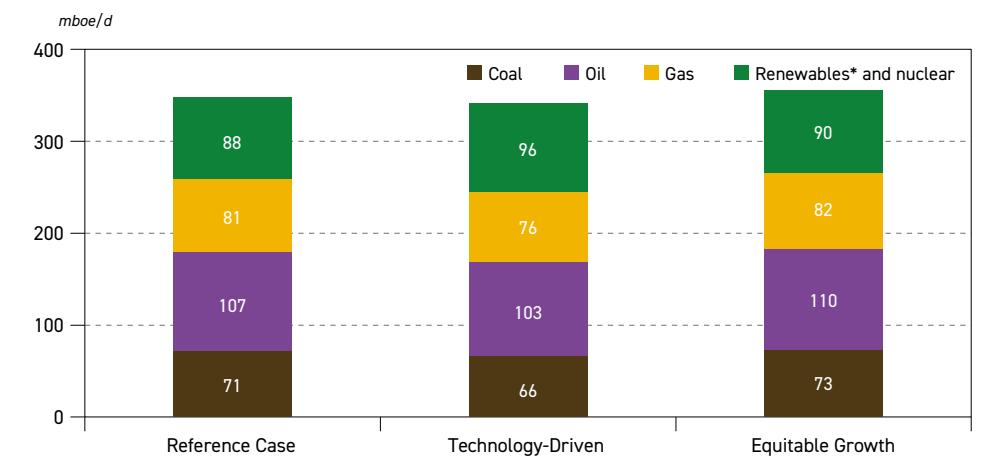

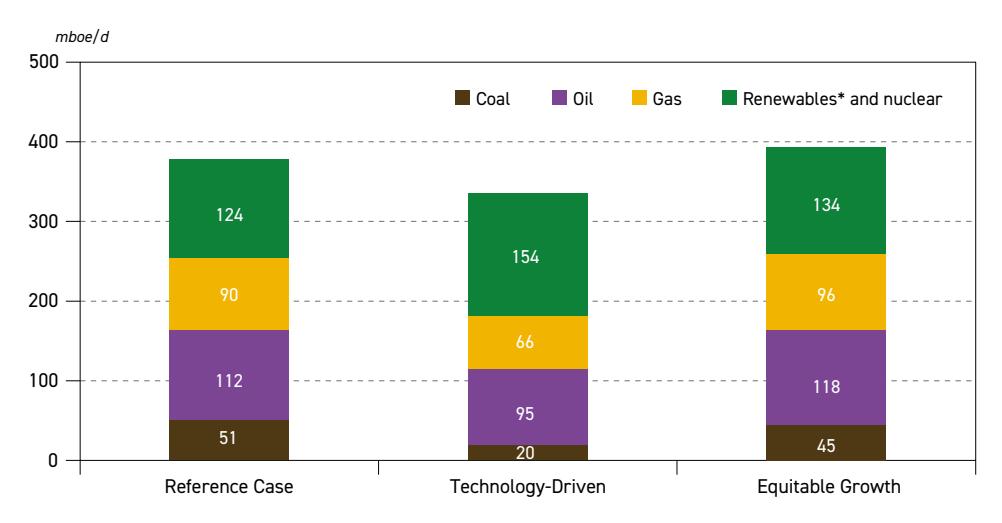

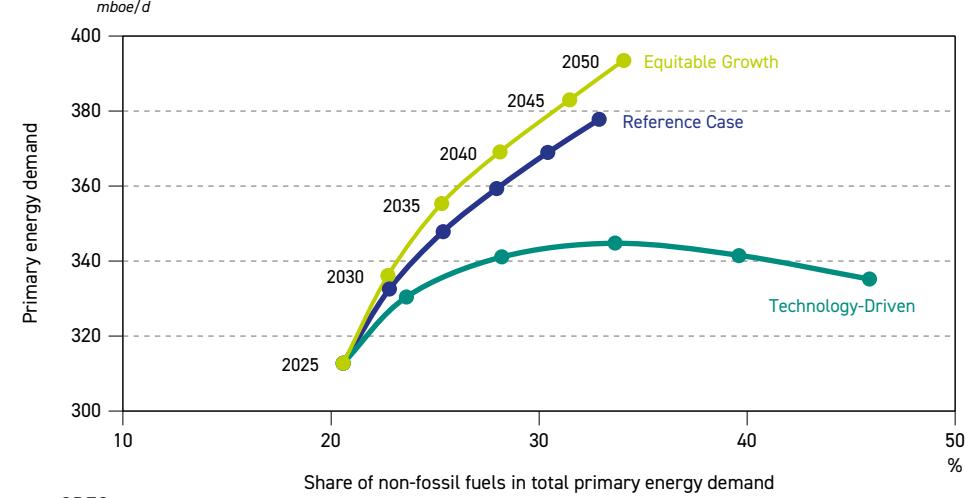

| Figure 7.1 | Global primary energy demand in the Reference Case and in alternative scenarios, 2024–2050 | 253 |

| Figure 7.2 | Global primary energy demand in the Reference Case and in alternative scenarios, | |

| 2035 | 255 | |

| Figure 7.3 | Global primary energy demand in the Reference Case and in alternative scenarios, | |

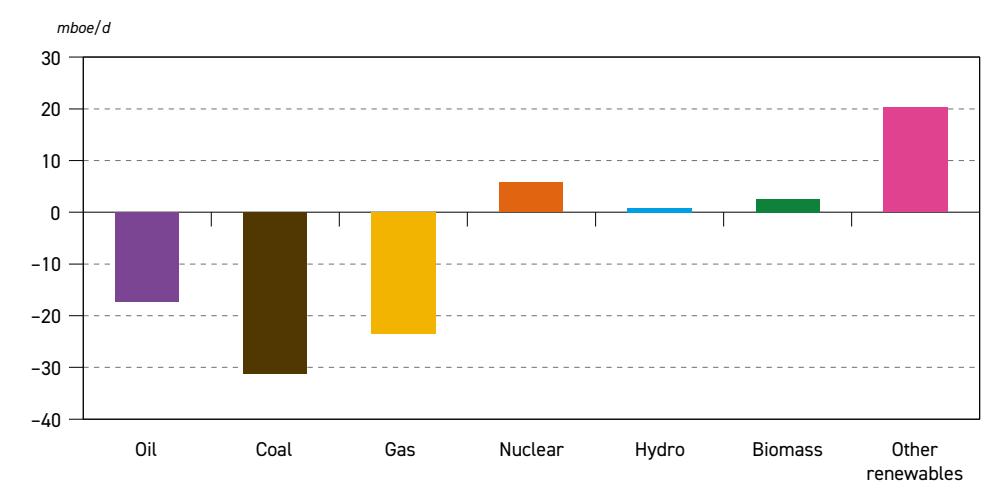

| 2050 | 255 | |

| Figure 7.4 | Change in primary energy demand between the Technology-Driven Scenario | |

| and Reference Case in 2050 | 256 |

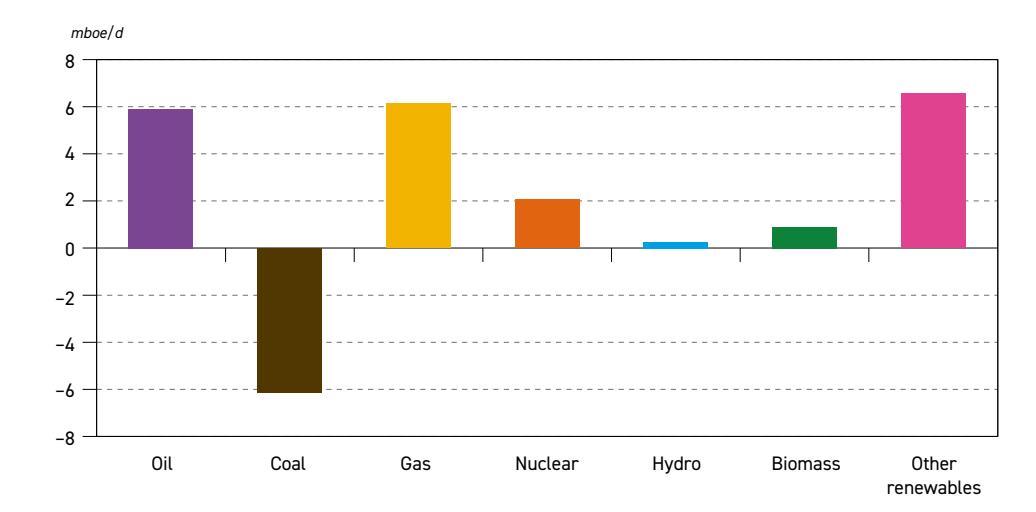

| Figure 7.5 | Change in primary energy demand between the Equitable Growth Scenario | |

|---|---|---|

| and Reference Case in 2050 | 258 | |

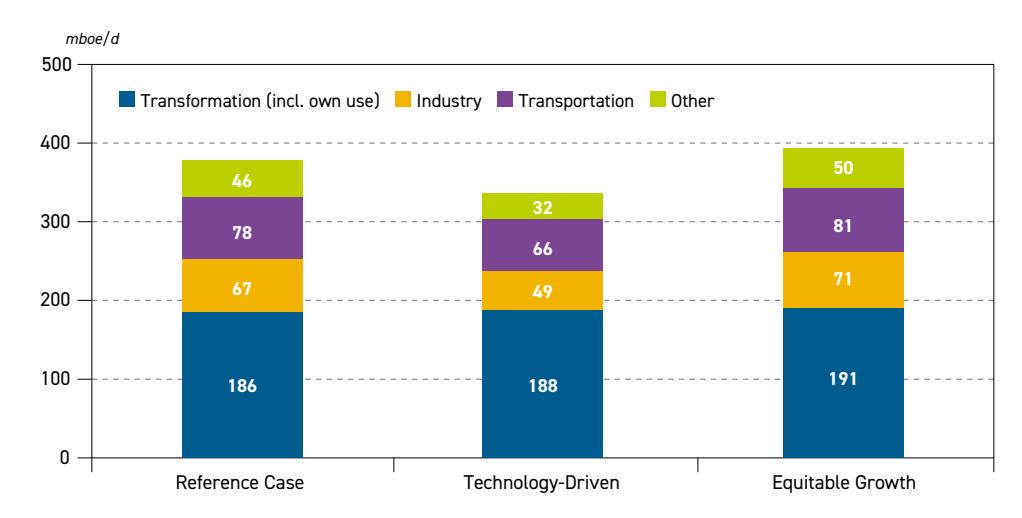

| Figure 7.6 | Global energy demand by sector in the Reference Case and alternative | |

| scenarios, 2050 | 259 | |

| Figure 7.7 | Global energy system in the Reference Case and alternative scenarios, 2025–2050 | 261 |

| Figure 7.8 | Global liquids demand in the Reference Case and alternative scenarios, | |

| 2024–2050 | 262 | |

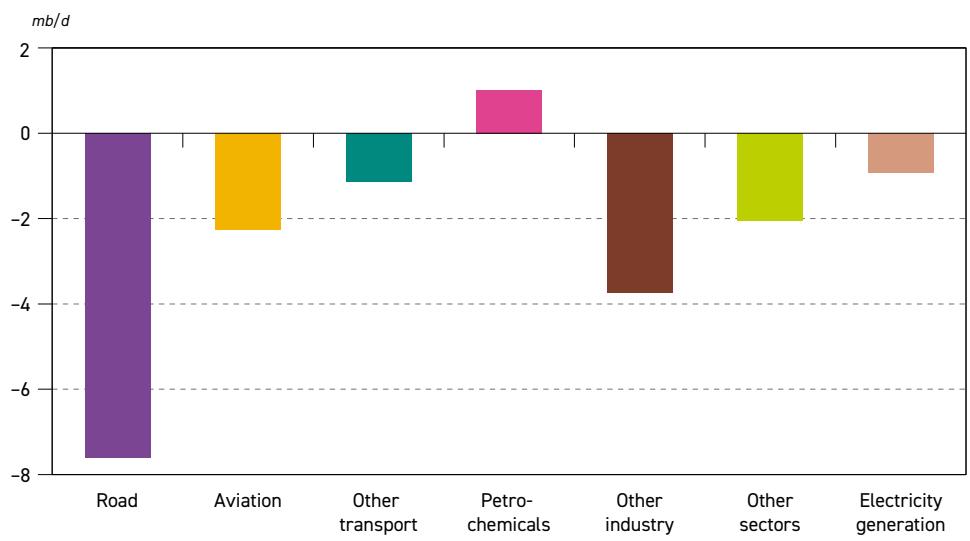

| Figure 7.9 | Difference in liquids demand between the Technology-Driven Scenario and | |

| Reference Case by sector in 2050 | 262 | |

| Figure 7.10 | Difference in liquids demand between the Equitable Growth Scenario and | |

| Reference Case by sector in 2050 | 263 | |

| Figure 7.11 | Liquids demand in the Reference Case and alternative scenarios, 2024–2050 | 264 |

| Figure 8.1 | Brazil GDP average annual growth rates, 1990–2050 | 269 |

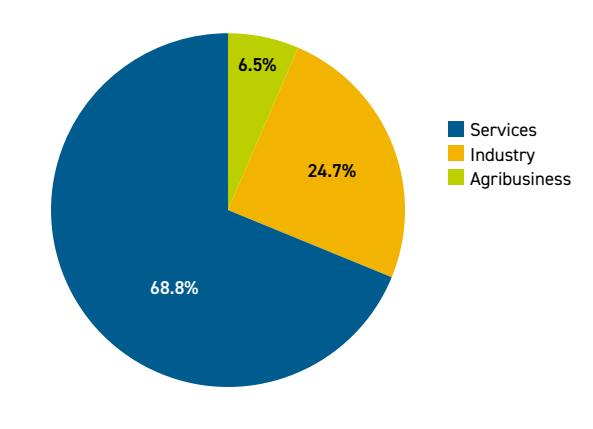

| Figure 8.2 | Composition of Brazil's GDP, 2024 | 269 |

| Figure 8.3 | Primary energy demand, Brazil | 271 |

| Figure 8.4 | Oil demand in Brazil by sector, 2024–2050 | 273 |

| Figure 8.5 | Oil demand in Brazil by product, 2024–2050 | 274 |

| Figure 8.6 | Brazil total liquids production outlook | 275 |

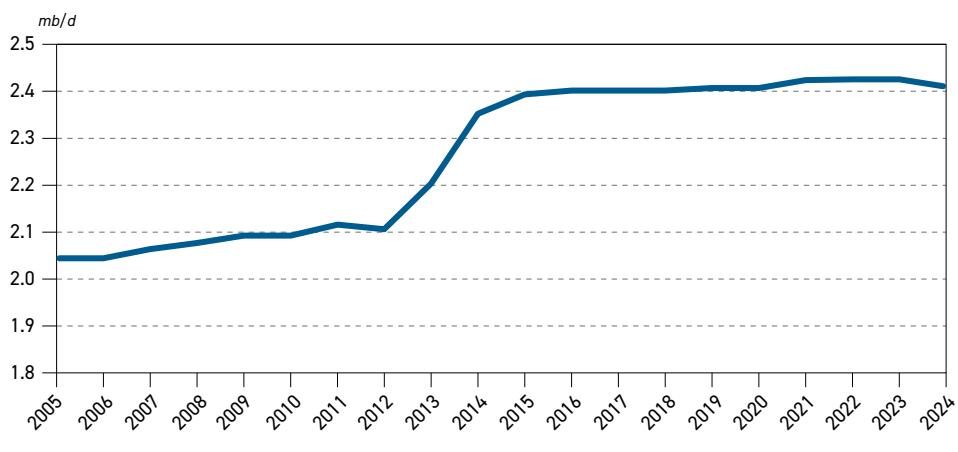

| Figure 8.7 | Brazil's refining capacity | 277 |

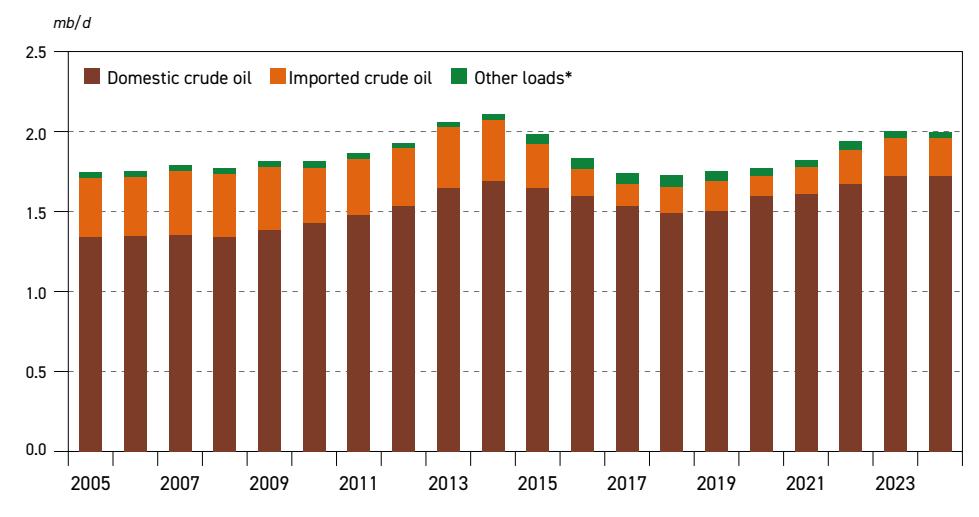

| Figure 8.8 | Brazil refinery throughput | 278 |

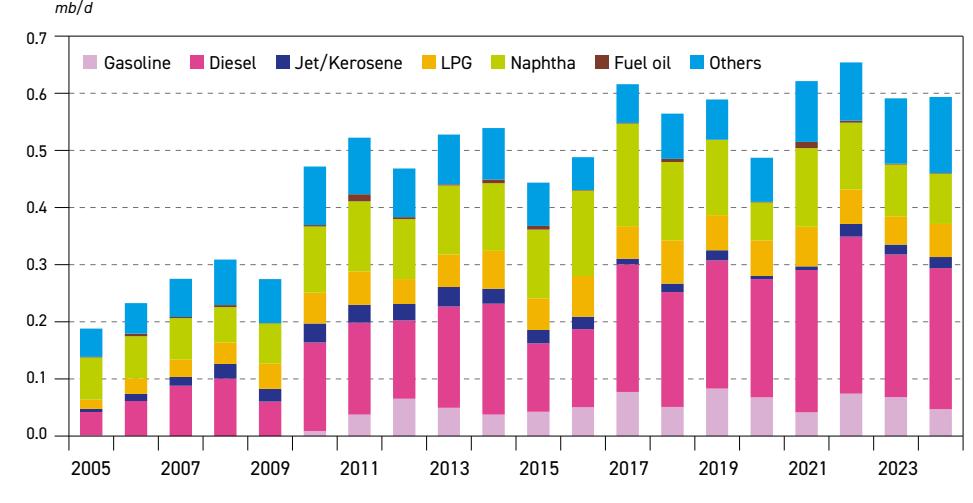

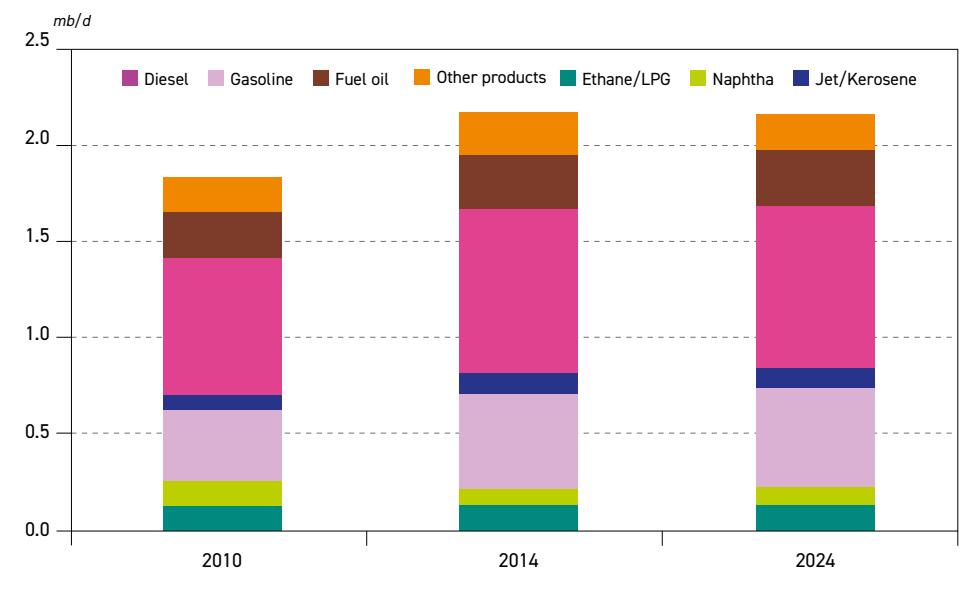

| Figure 8.9 | Production profile of refined products | 278 |

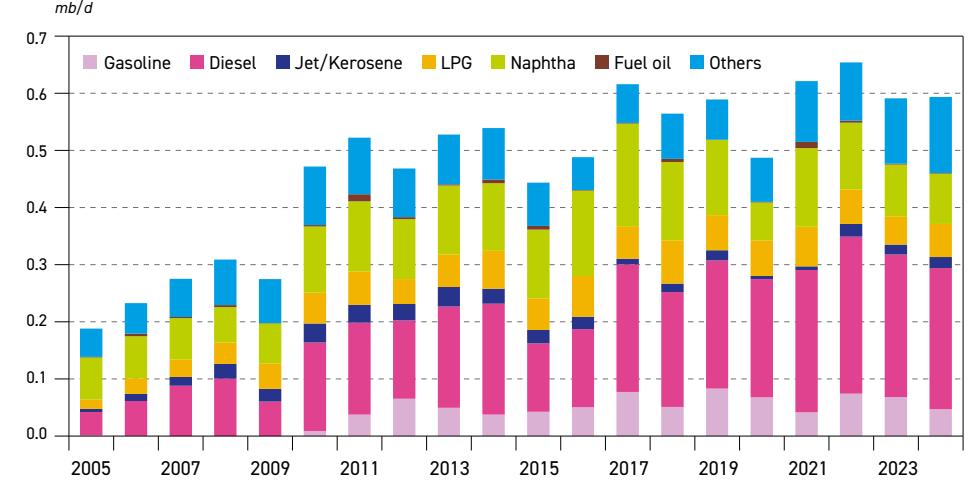

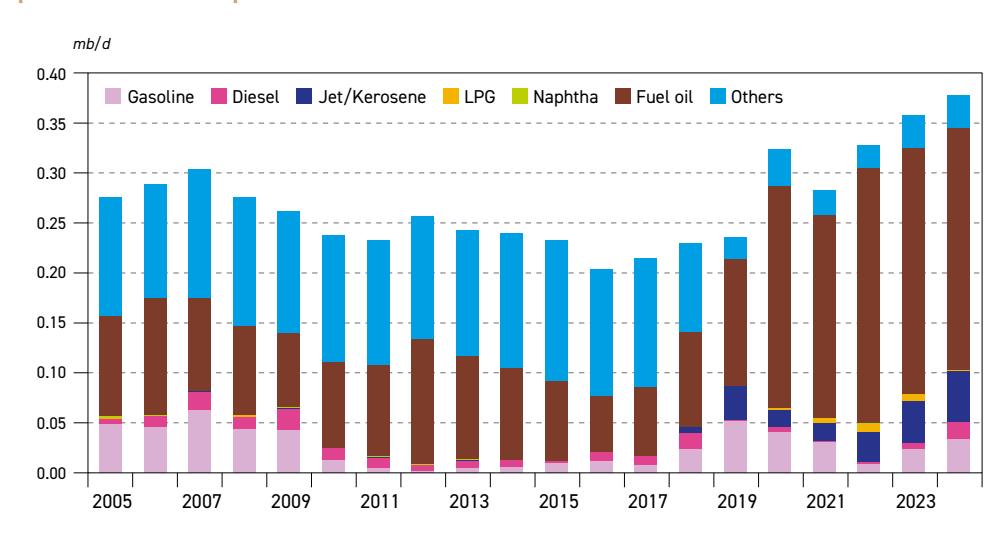

| Figure 8.10 | Imports of refined oil products | 279 |

| Figure 8.11 | Exports of refined oil products | 279 |

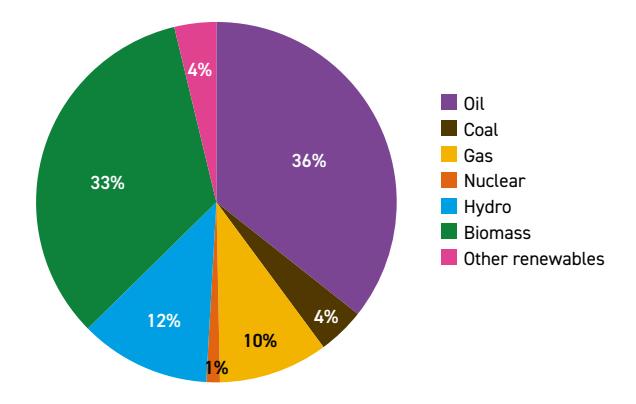

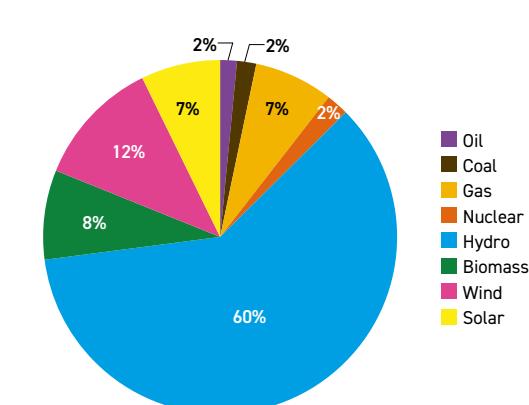

| Figure 8.12 | Share of primary energy demand in Brazil, 2024 | 281 |

| Figure 8.13 | Share of primary sources in Brazil's electricity generation, 2024 | 281 |

| Figure 8.14 | Offshore wind technical potential in Brazil | 283 |

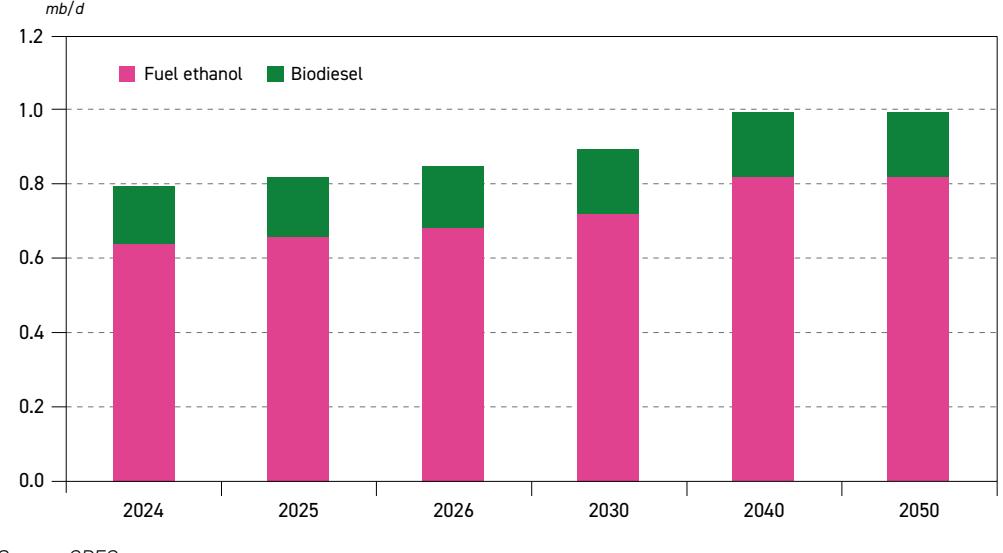

| Figure 8.15 | Brazilian biofuels production | 285 |

| Figure 8.16 | Accumulated reinjection of CO2 in Brazil | 287 |

Foreword

The 9th OPEC International Seminar at the Hofburg Palace in Vienna sees the launch of the World Oil Outlook (WOO) 2025. With over 1,000 participants attending, including ministers, CEOs, policymakers, academics, analysts and media from around the world, the launch provides a global platform to highlight the Organization's views on future energy pathways that are credible and driven by sound data and robust analysis.

This year's WOO reinforces a theme that OPEC has emphasized in recent years: the need for an 'all-encompassing' approach to future energy pathways and energy security, closely linked with efforts to reduce emissions and ensure sustainable development.

The WOO 2025 does not view any energy in isolation or dismiss anything. Instead, it takes a holistic view, encompassing the realities we see before us, as well as an appraisal of a host of uncertainties, economic, policy-driven and geopolitical, to build a picture centered around a number of key energy issues.

Firstly, the world will require more energy in the decades to come. In this year's WOO, global energy demand is set to expand by 23% to 2050, driven by expanding economic growth, rising populations, increasing urbanization, new energy-intensive industries like artificial intelligence, and the need to bring energy to the billions without it.

Here, we must remember that the future of energy means different things to different people. For those without energy access, it means the need for basic services like lighting, clean cooking options, and the possibility of owning a motorized vehicle or taking a flight. In this regard, it is important to note that it is the developing world – the non-OECD – which sees almost all energy demand growth over the outlook period.

Secondly, the history of energy is one of additions, not subtractions. Indeed, the reality today is that the world consumes more wood, oil, coal, gas, in fact, all energies, than ever before. Moreover, energies tend to complement each other – the rise of coal saw the world use more wood; the rise of oil saw the world use more coal; and renewables and electric vehicles require a host of oil products for their development and use.

In this regard, it is important to note that the combined percentage of oil, gas and coal in the energy mix was around 80% in 2024, only a little less than when OPEC was founded in 1960, despite energy consumption increasing more than five-fold over that time.

Positively, it has become increasingly clear to many policymakers in recent years that the narrative of swiftly phasing out oil and gas has been seen for what it is: unworkable, and a fantasy. Many initial net-zero policies promoted unrealistic timelines or had little regard for energy security, affordability or feasibility – this mindset is shifting.

Thirdly, oil and the petroleum products derived from it continue to provide immense benefits to billions. Without them, cars, buses and trucks would be stranded, airplanes would be grounded, the construction sector would all but grind to a halt, food production would be devastated, and many health-related products would be difficult to produce.

Oil underpins the global economy and is central to our daily lives. Out to 2050, we see oil demand continuing to expand and reaching 123 million barrels a day (mb/d). There is no peak oil demand on the horizon.

And fourthly, the WOO emphasizes the need to ramp up efforts across the board to reduce emissions, advance efficiencies and implement lower carbon solutions. In this regard, OPEC Member Countries, and the oil industry, in general, are already playing a proactive and constructive role by undertaking investments in areas such as carbon capture utilization and storage, direct air capture and the circular carbon economy.

What all this underscores is the need for major investments in all energies and technologies, coupled with the need to maintain a realistic understanding of the needs of all peoples. This is a message that OPEC has consistently delivered in recent years.

To put the key issue of investment in context, for the oil industry alone, we see global oil industry investment requirements of $18.2 trillion out to 2050. It is vital that these investments are made for consumers and producers everywhere, as well as for the effective functioning of the global economy at large.

Why? Because it is clear that the world needs all energies to deliver the energy security and energy availability that it desires, and all technologies to achieve the emissions reductions it requires. As such, the need to embrace a prudent approach to future energy pathways for nations and peoples around the world is also central to this year's WOO.

In looking ahead, the platform for building a sustainable energy future not only comes from stability in energy markets, which remains the core focus of OPEC and its partners in the Declaration of Cooperation, but also through all industry stakeholders working together. Collaboration is imperative, data transparency is vital and energy realities must be recognized and prioritized.

The WOO 2025 provides a basis for this, and I would like to take this opportunity to thank all those who have been involved in putting it together. We are proud of this publication and the key insights it offers into the challenges and opportunities shaping our shared energy future, and trust that it will serve as a useful tool for policymakers and experts everywhere.

Haitham Al Ghais Secretary General

Executive Summary

Current uncertainties surrounding the global economy and energy landscape are quite significant

The World Oil Outlook (WOO) 2025 again sets out OPEC's long-term views and projections on the evolving global energy future. However, the current uncertainties surrounding the global economy and energy landscape make this task challenging. Despite this, and bearing in mind the high degree of uncertainty, this Outlook looks to thoroughly review the key assumptions and outline a plausible and viable energy future for all. As such, it intends to provide an impartial, consistent and realistic understanding to all stakeholders.

Energy policies in a state of re-evaluation

Energy policies across major economies are undergoing a significant recalibration as nations navigate an array of complex challenges. While energy policy ambitions appear robust, a noticeable trend of policy pushback and intensified scrutiny is evident, primarily in the US and in a number of other developed countries. Decision-makers are increasingly challenged to address a variety of priorities, including energy security, energy affordability, reducing emissions, sustainability and industrial competitiveness. Furthermore, while many national changes can be relatively small, the cumulative effects on regional and global energy demand can be much more significant.

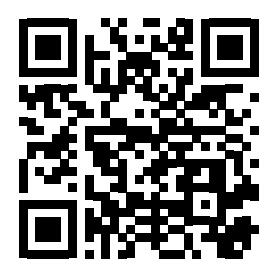

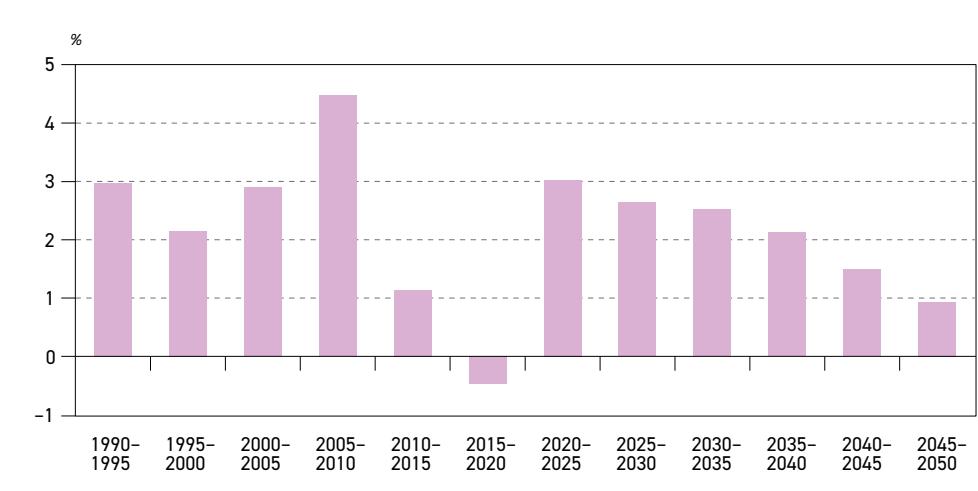

Demographic trends and economic growth drive long-term energy demand

The global population is expected to rise by 1.5 billion from its current level of 8.2 billion in 2024 to almost 9.7 billion by 2050, with the working age population set to increase by 800 million over the same time period to reach around 6.1 billion. The global urbanization rate is expected to increase from 58% to 68%, resulting in about 1.9 billion people moving to cities by 2050. Concurrently, the global economy is set to more than double in size, increasing from $171 trillion in 2024 to $358 trillion in 2050, while global average income is expected to rise from approximately $21,000 in 2024 to $37,100 (all 2021 PPP) by 2050. Non-OECD countries are set to play the key role, driving population expansion and seeing economic growth rates well above the global average.

Size of major economies and population trends, 2020–2050

Source: OPEC.

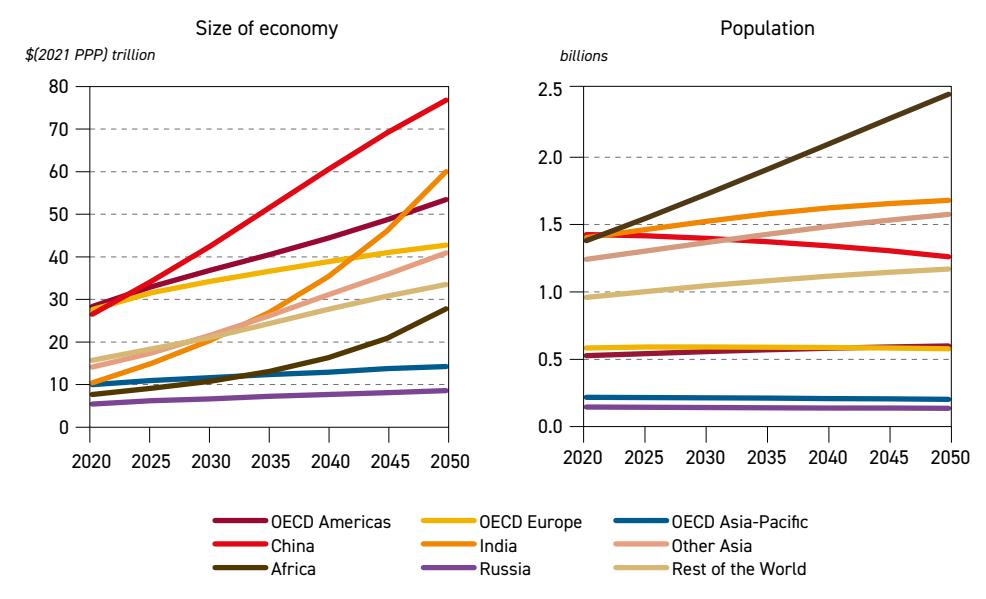

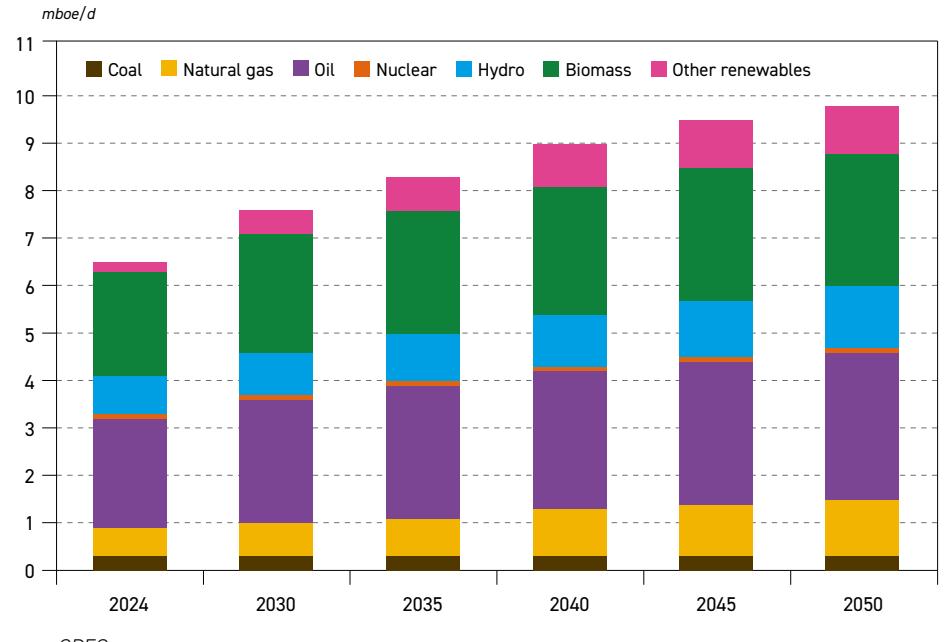

Global primary energy demand to increase by 23% to 2050

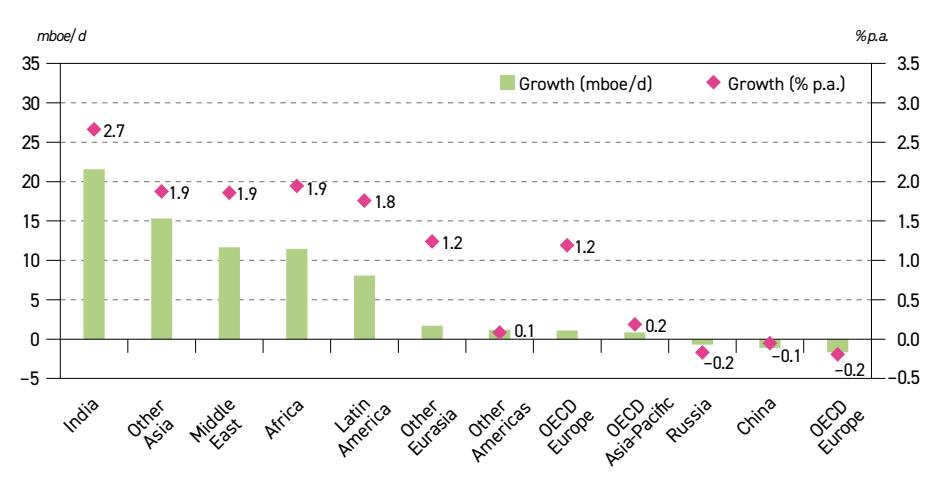

Global primary energy demand is set to rise from 308 million barrels of oil equivalent (mboe/d) in 2024 to 378 mboe/d in 2050. This is an increase of 23% over the outlook period, or 0.8% per annum (p.a.) on average. The growth will come almost entirely from developing regions, led by India, Other Asia, Africa and the Middle East. At the same time, energy demand in developed countries is expected to generally stay flat and/or decline.

Total primary energy demand by fuel and region, 2024 and 2050

Source: OPEC.

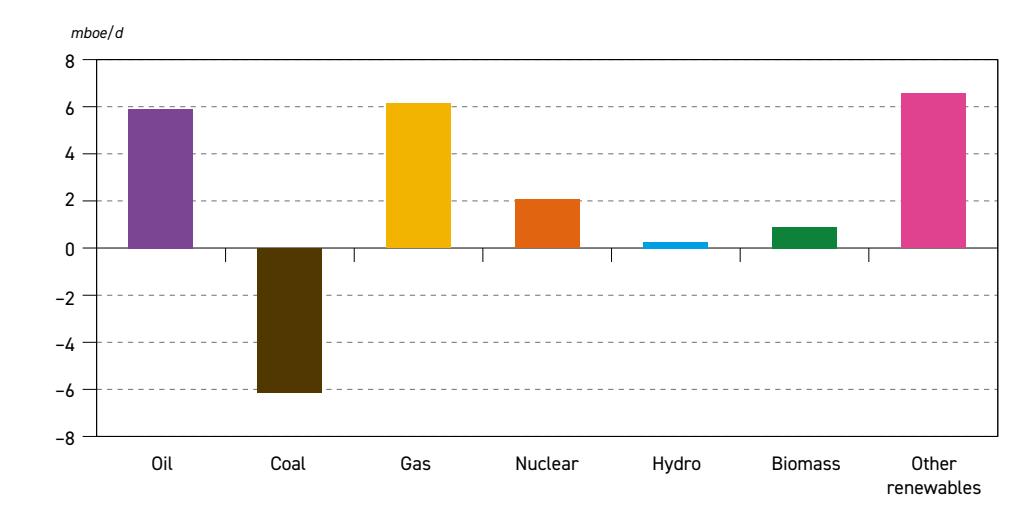

Demand for all fuels increases, with the exception of coal

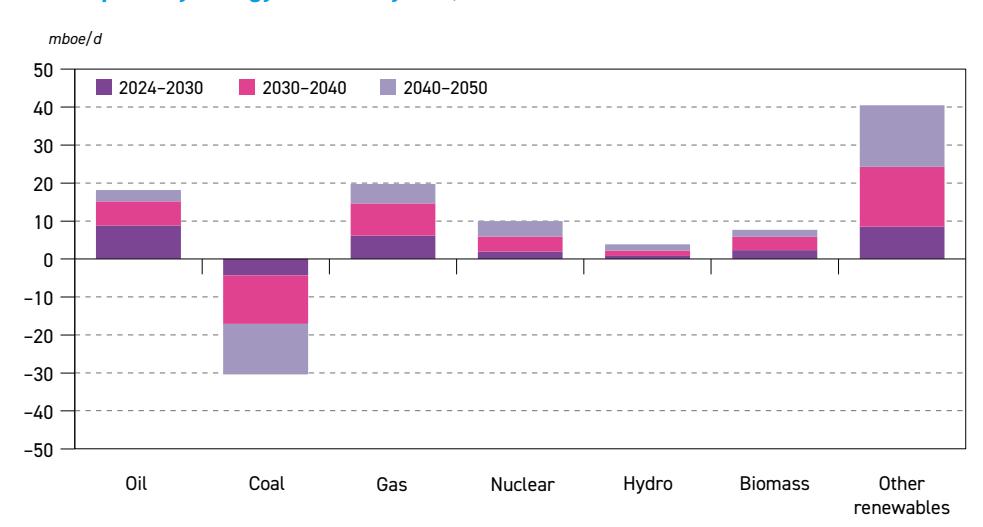

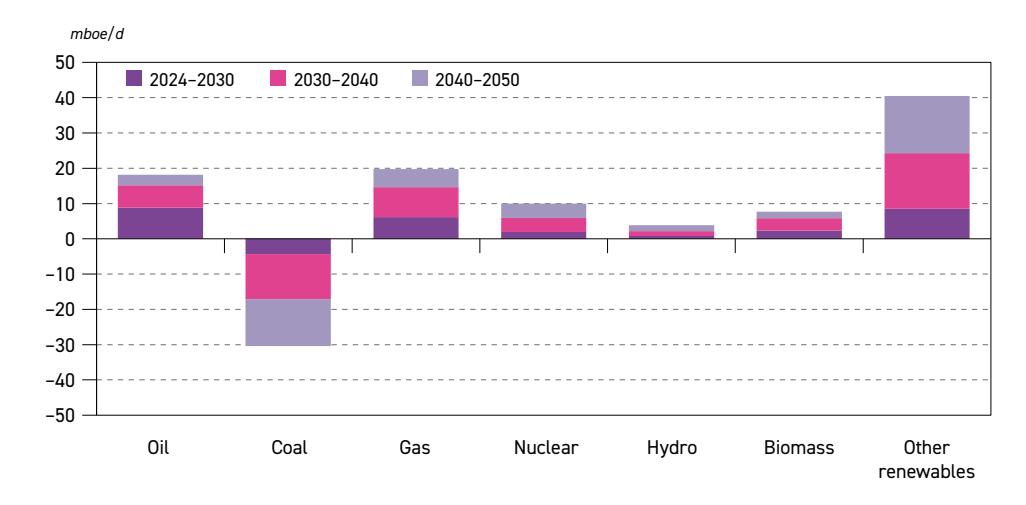

Demand for all primary fuels is set to increase to 2050, with the exception of coal. Driven by supportive polices and declining electricity generation costs, demand for other renewables (mostly wind and solar) is set to increase by 40.5 mboe/d over the outlook period. Demand for oil and gas is also expected to increase strongly, in line with the need for reliable and Figure 2.1

Growth in primary energy demand by fuel, 2024–2050

Source: OPEC.

affordable energy. Oil demand is expected to rise by 18.2 mboe/d, while natural gas rises by almost 20 mboe/d to 2050. After a long period of stagnation, nuclear energy is likely to see significant growth, rising by 10 mboe/d in the outlook period. Demand for coal is expected to drop by 30.4 mboe/d, due to unfavourable energy and climate policies and the penetration of other fuels.

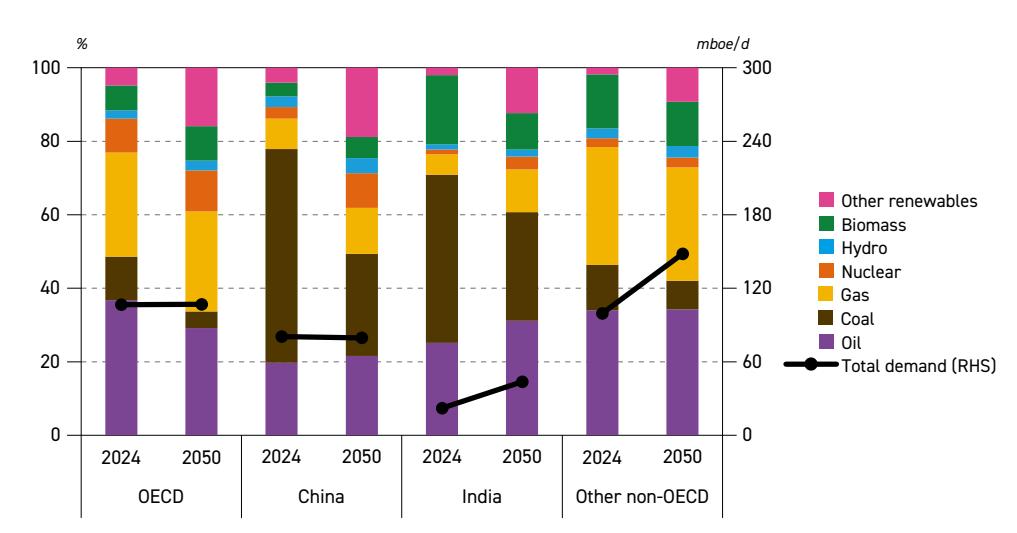

Oil retains the largest share in the energy mix; oil and gas combined remain above 50%, with other renewables at 13.5% in 2050

Despite a marginal decline in its share, oil is set to maintain the largest share in the energy mix in 2050, at just below 30%. The combined share of oil and gas is expected to stay above 50% between 2024 and 2050. At the same time, the share of other renewables in the energy mix increases to 13.5% in 2050, up by 10 percentage points (pp) from 2024.

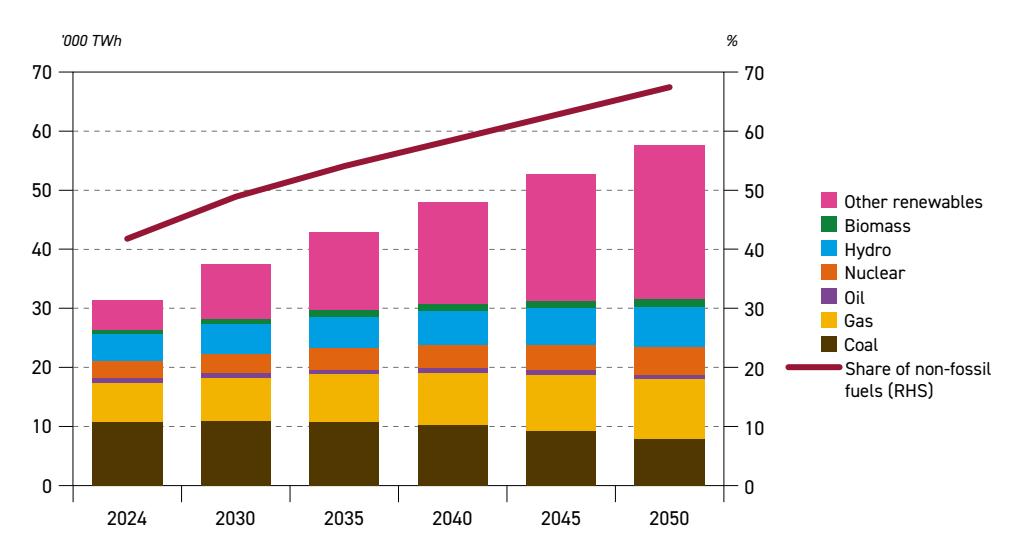

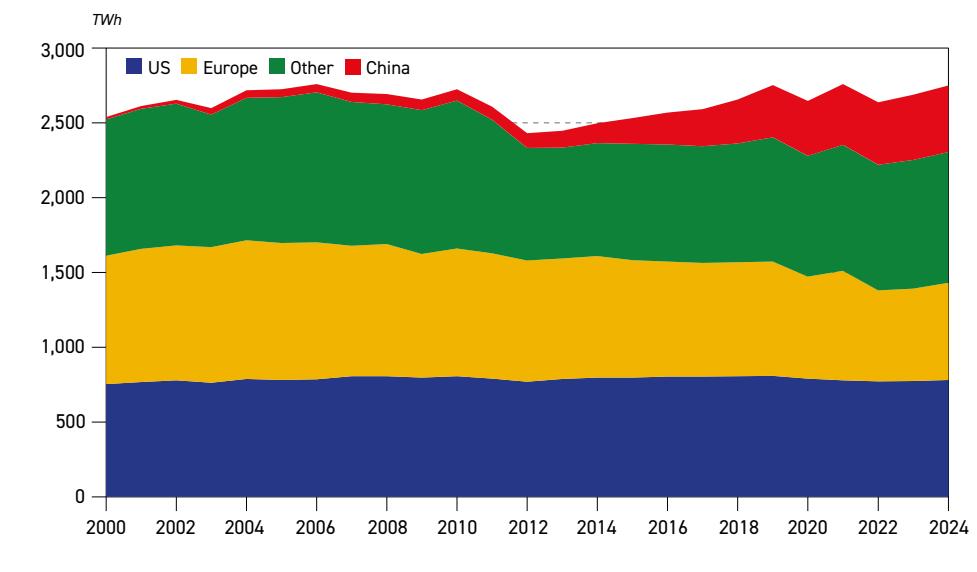

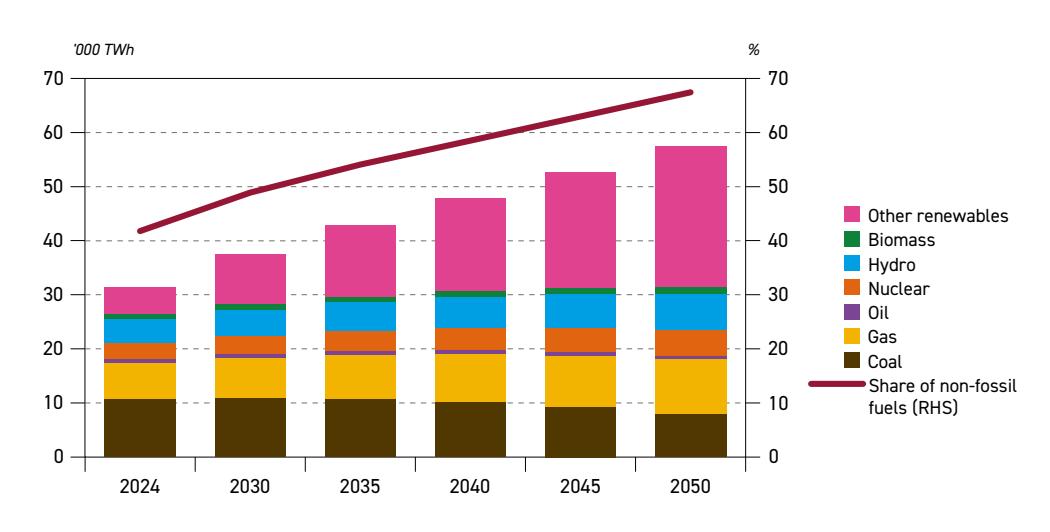

Electricity demand set to rise by over 80%, supported by growth in developing countries

Total electricity generation is expected to increase from around 31,500 terawatt hours (TWh) in 2024 to roughly 57,500 TWh in 2050, supported by demand growth in the residential/ commercial sector, industry and data centres. Around 75% of this growth is anticipated to come from developing countries, with almost 60% alone from developing countries in Asia. By far the largest increase in the generation mix is projected for other renewables (mostly wind and solar), which are expected to expand from around 4,900 TWh in 2024 to 26,000 TWh in 2050.

Global electricity generation by fuel, 2024–2050

Source: OPEC.

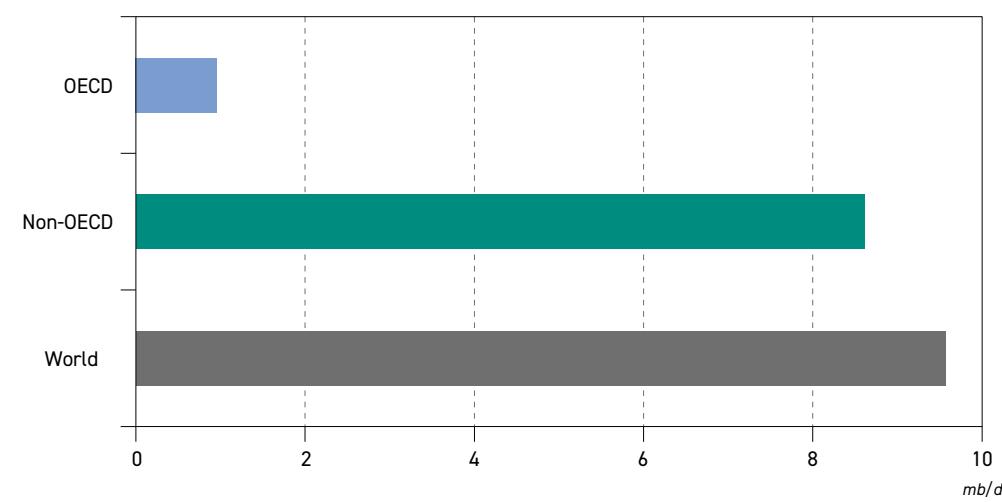

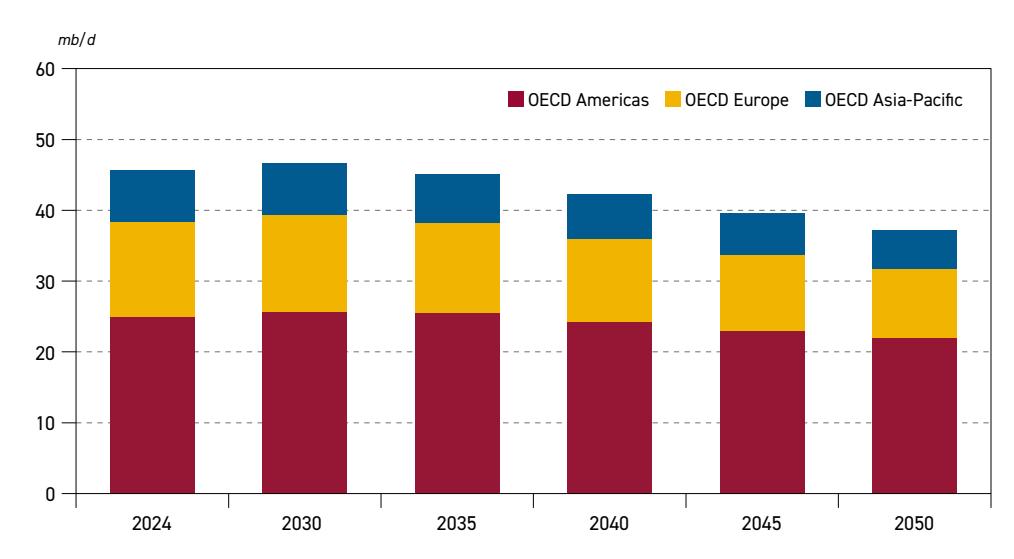

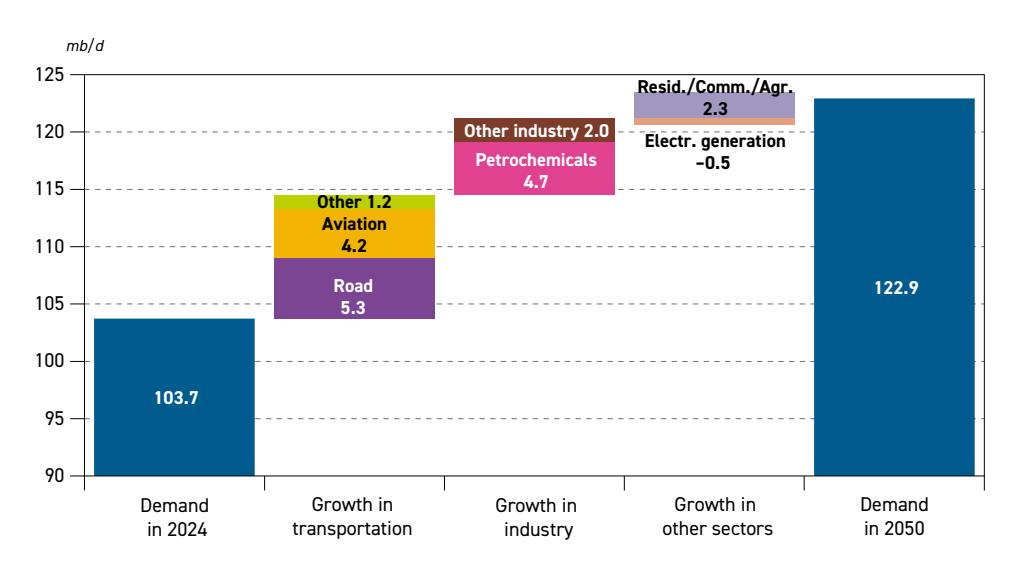

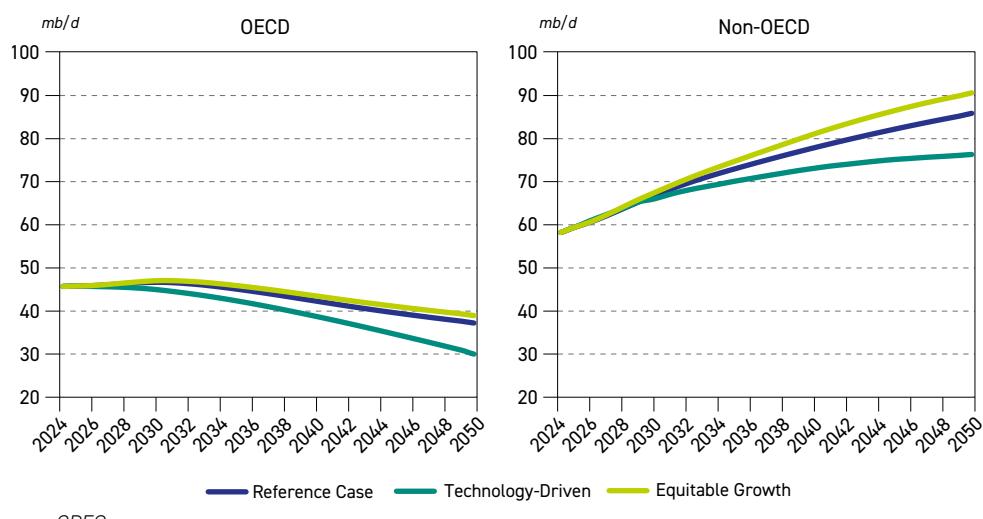

Global oil demand set for continued robust growth, reaching almost 123 mb/d by 2050 Supported by recent policy shifts and an improved economic outlook, global oil demand is set for continued robust growth of 9.6 millon barrel per day (mb/d) over the medium-term period, rising from 103.7 mb/d in 2024 to 113.3 mb/d by 2030. The primary reason for this is strong oil demand growth in non-OECD countries, which is projected to increase by 8.6 mb/d to 2030 and reach 66.7 mb/d. Moreover, OECD oil demand is also set to increase over the same period, albeit by a much smaller 1 mb/d to reach 46.6 mb/d.

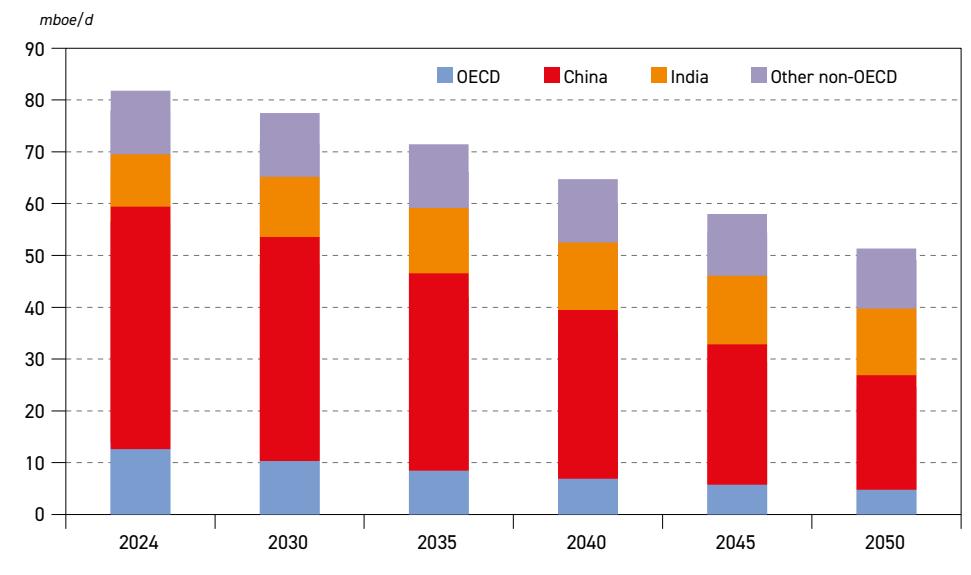

In the long term, global oil demand is projected to rise by more than 19 mb/d between 2024 and 2050, reaching almost 123 mb/d. While non-OECD oil demand is projected to increase by almost 28 mb/d over the period, OECD oil demand is set to witness a decline of 8.5 mb/d.

Long-term oil demand in the Reference Case

| 2024 | 2030 | 2035 | 2040 | 2045 | 2050 | Growth 2024–2050 | |

|---|---|---|---|---|---|---|---|

| OECD Americas | 24.9 | 25.7 | 25.5 | 24.3 | 23.0 | 21.9 | –3.0 |

| OECD Europe | 13.5 | 13.6 | 12.7 | 11.6 | 10.6 | 9.8 | –3.7 |

| OECD Asia-Pacific | 7.2 | 7.3 | 6.8 | 6.3 | 5.8 | 5.4 | –1.8 |

| OECD | 45.7 | 46.6 | 45.0 | 42.2 | 39.5 | 37.2 | –8.5 |

| China | 16.7 | 18.3 | 18.9 | 18.9 | 18.8 | 18.4 | 1.8 |

| India | 5.6 | 7.3 | 8.9 | 10.5 | 12.1 | 13.7 | 8.2 |

| Other Asia | 9.7 | 11.4 | 12.6 | 13.5 | 14.3 | 15.0 | 5.3 |

| Latin America | 6.8 | 7.8 | 8.6 | 9.1 | 9.5 | 9.7 | 3.0 |

| Middle East | 8.8 | 10.0 | 11.1 | 12.1 | 12.9 | 13.5 | 4.7 |

| Africa | 4.6 | 5.2 | 6.0 | 6.9 | 7.8 | 8.8 | 4.2 |

| Russia | 4.0 | 4.2 | 4.3 | 4.2 | 4.2 | 4.1 | 0.1 |

| Other Eurasia | 1.3 | 1.4 | 1.5 | 1.6 | 1.6 | 1.6 | 0.4 |

| Other Europe | 0.8 | 0.9 | 0.9 | 0.9 | 0.9 | 0.8 | 0.0 |

| Non-OECD | 58.0 | 66.7 | 72.8 | 77.8 | 82.1 | 85.7 | 27.7 |

| World | 103.7 | 113.3 | 117.9 | 120.0 | 121.6 | 122.9 | 19.2 |

Source: OPEC.

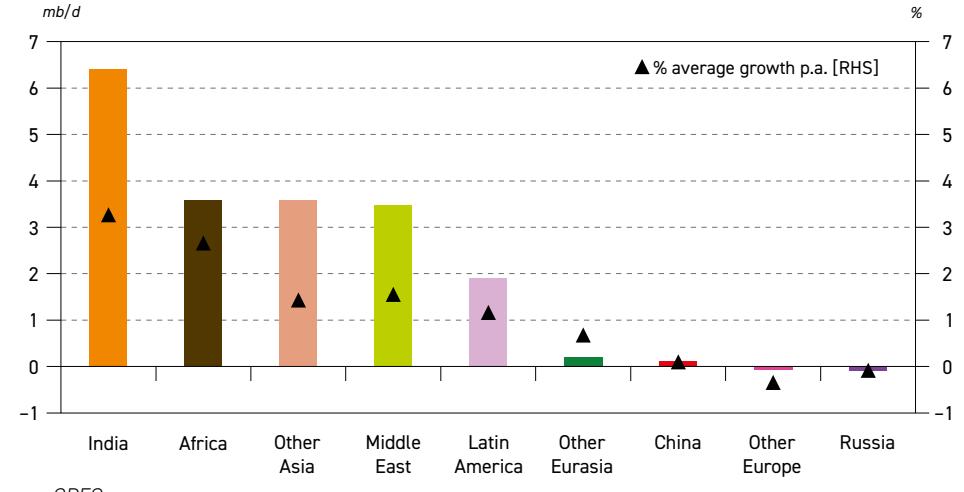

India leads incremental long-term demand growth

India, Other Asia, the Middle East and Africa are set to be the primary sources of long-term oil demand growth. Combined demand in these four regions is set to increase by 22.4 mb/d between 2024 and 2050, with India alone adding 8.2 mb/d. China's oil demand is projected to increase by less than 2 mb/d over the same time horizon. Moreover, a large part of China's

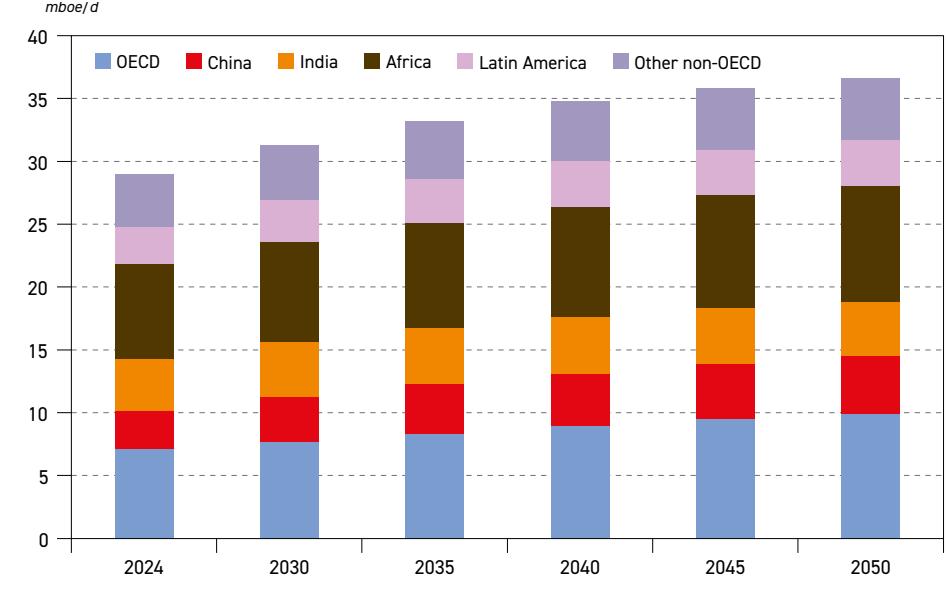

Non-OECD regional oil demand growth, 2024–2050

Source: OPEC.

increase is expected to occur over the medium term, with fewer demand changes expected for the rest of the forecast period.

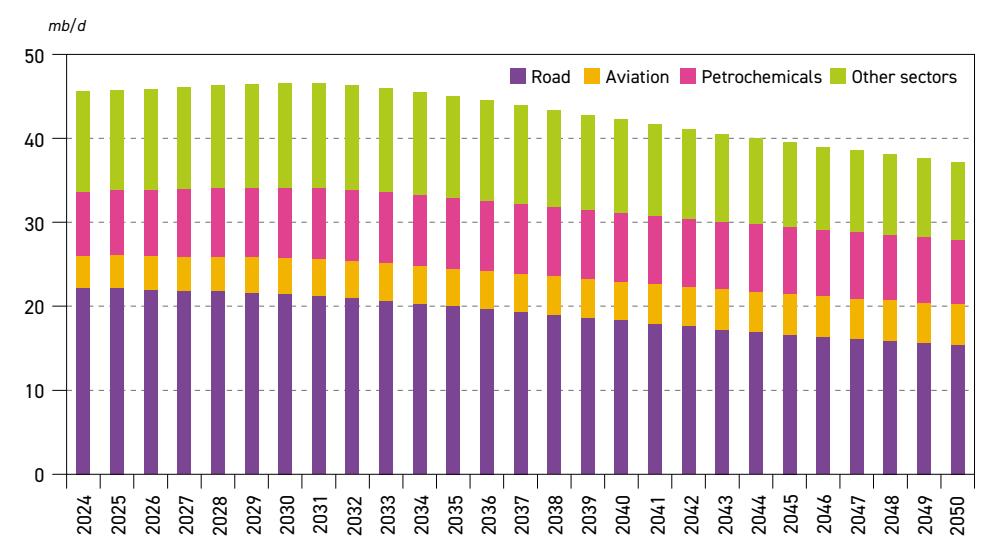

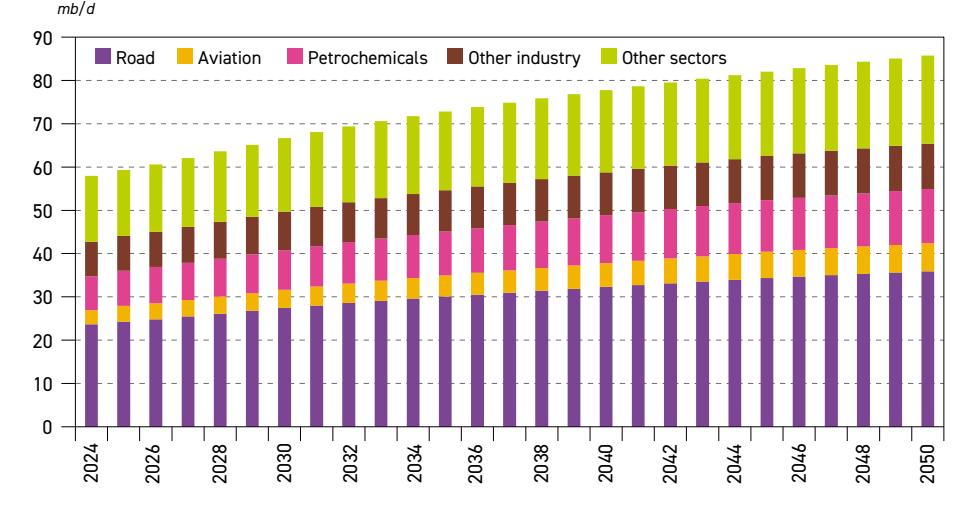

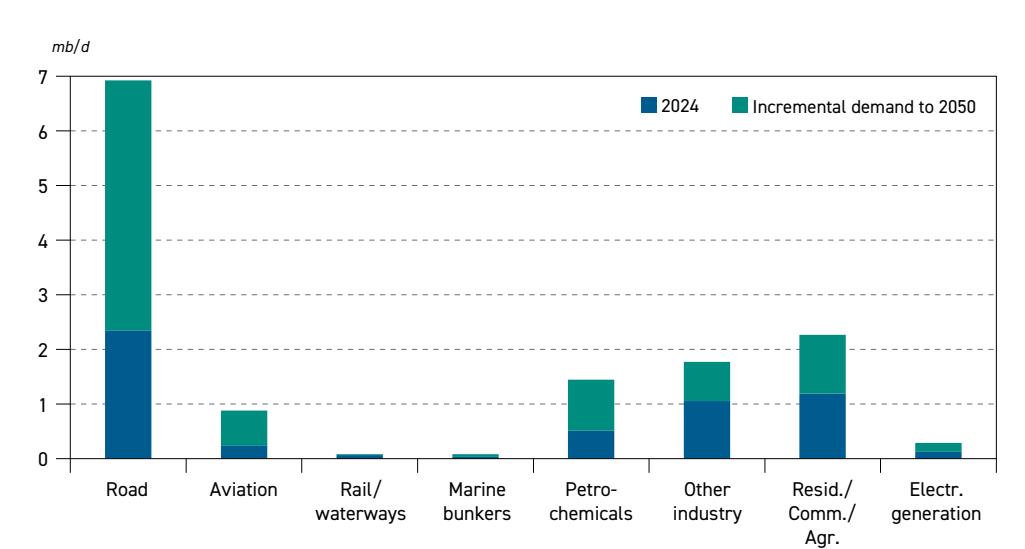

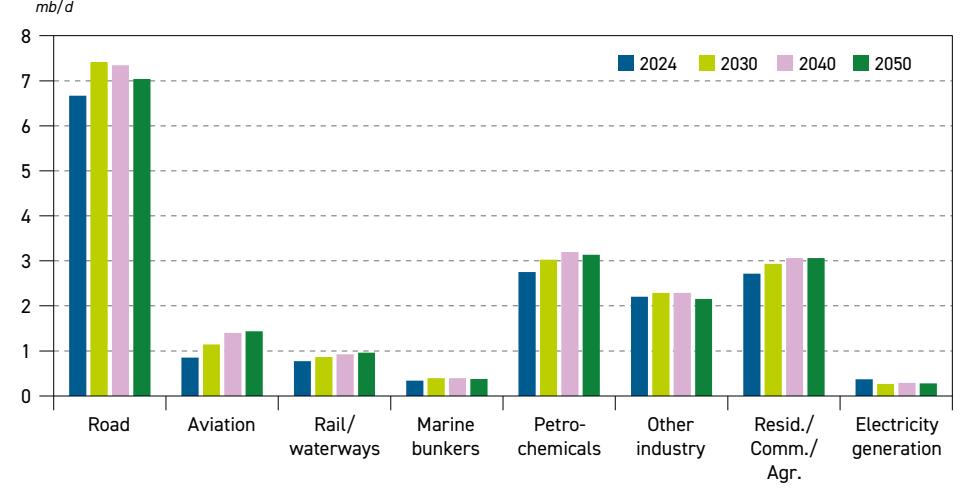

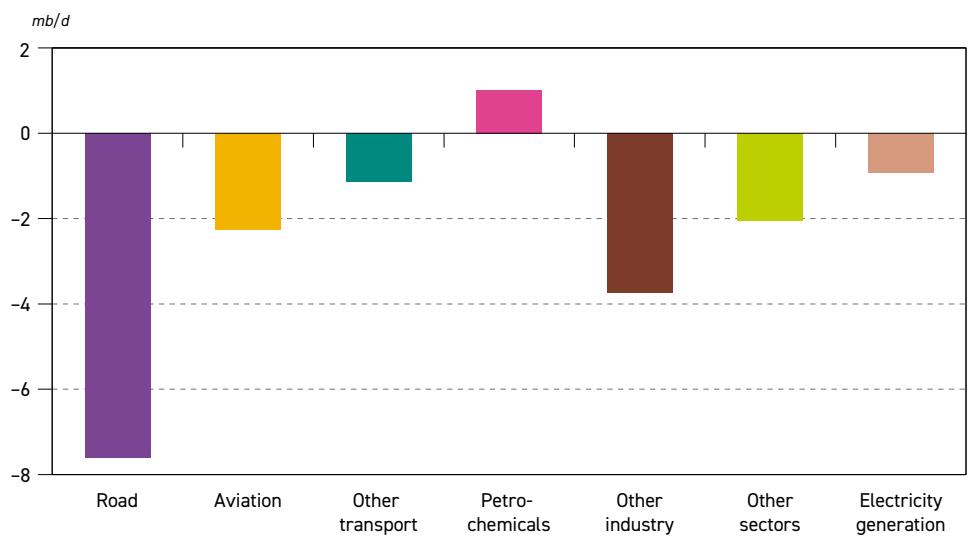

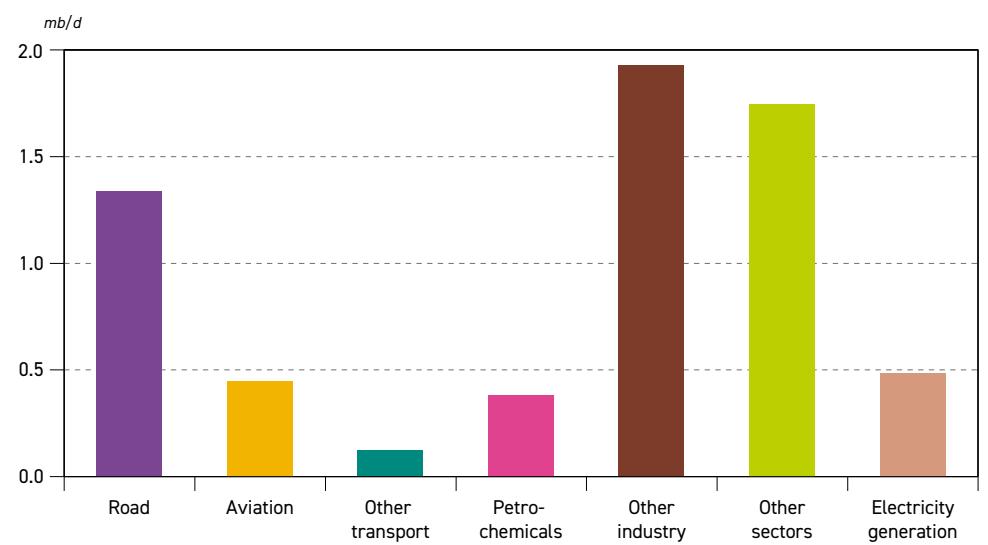

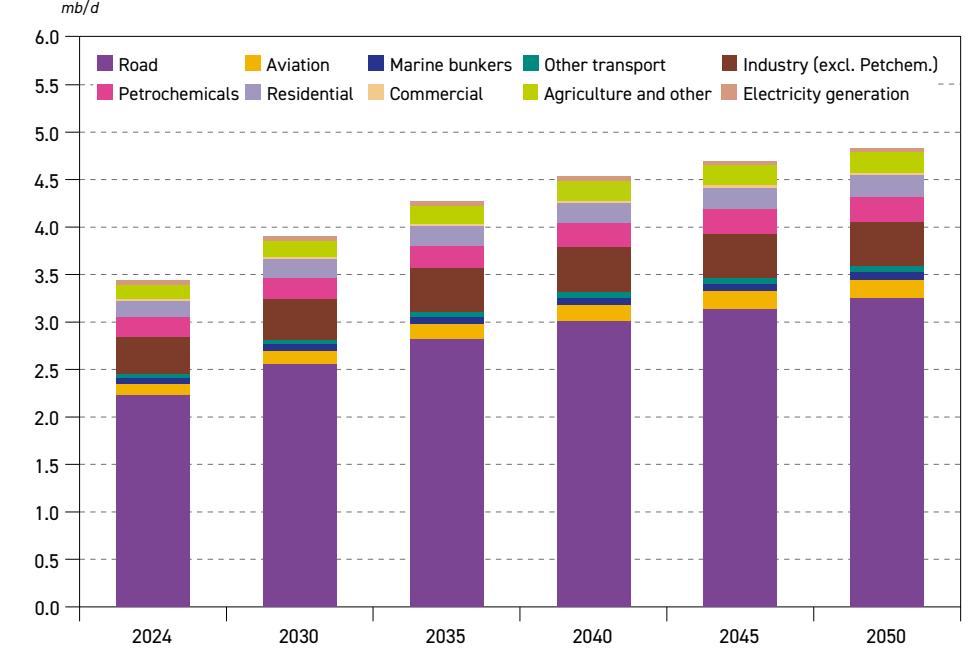

Road transport, petrochemicals and aviation are key for future oil demand growth

Oil consumption in various transportation modes constitutes the backbone of global oil demand throughout the forecast period. Indeed, the transportation sector accounted for more than 57% of global oil demand in 2024 and, with minor variations, is projected to retain this share over the entire forecast period. Within this sector, the largest incremental oil demand is expected in road transportation and aviation, adding 5.3 mb/d and 4.2 mb/d, respectively. A significant demand increase of 4.7 mb/d is also projected in the petrochemical sector.

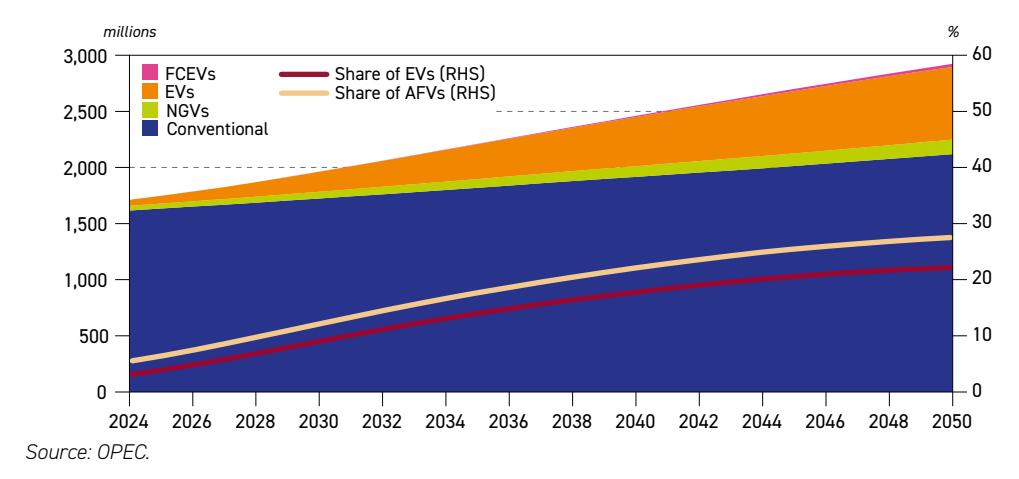

Global oil demand growth by sector, 2024–2050

Oil demand growth in road transportation is expected to come on the back of a large expansion in the global vehicle fleet, particularly in developing countries. The global vehicle fleet is expected to increase from 1.7 billion in 2024 to 2.9 billion in 2050, with the fastest growth expected in the segment of electric vehicles (EVs). Nevertheless, internal combustion engine (ICE) vehicles are set to continue dominating the global fleet and still account for around 72% in 2050.

Global fleet composition, 2024–2050

Source: OPEC.

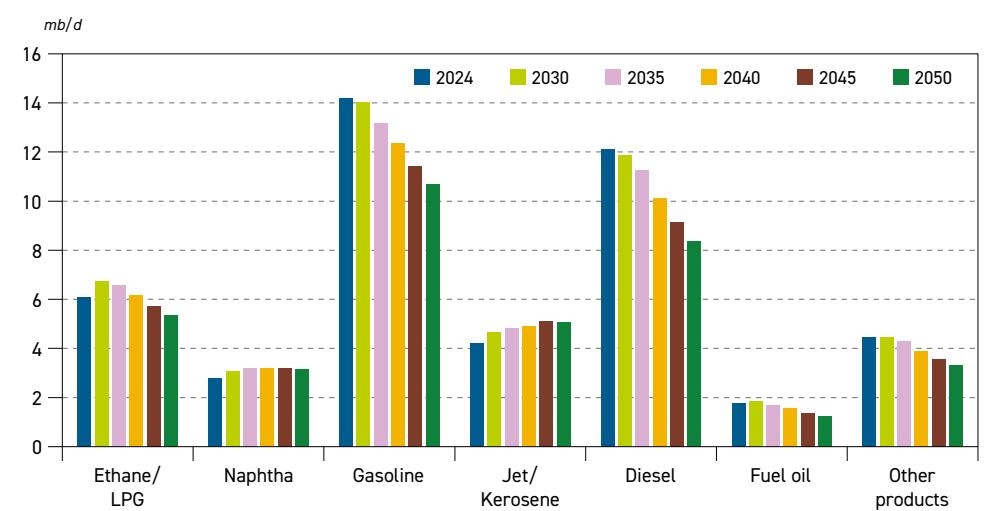

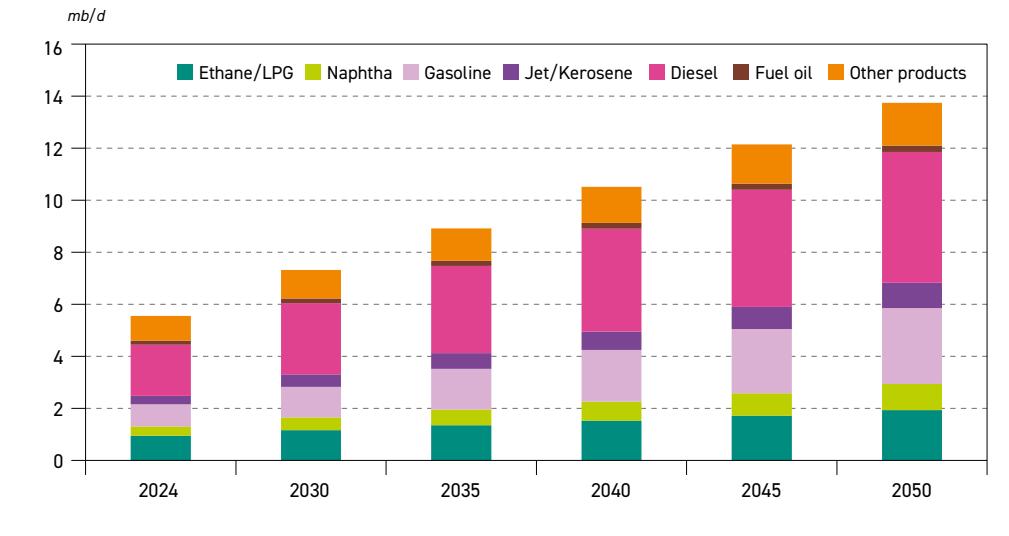

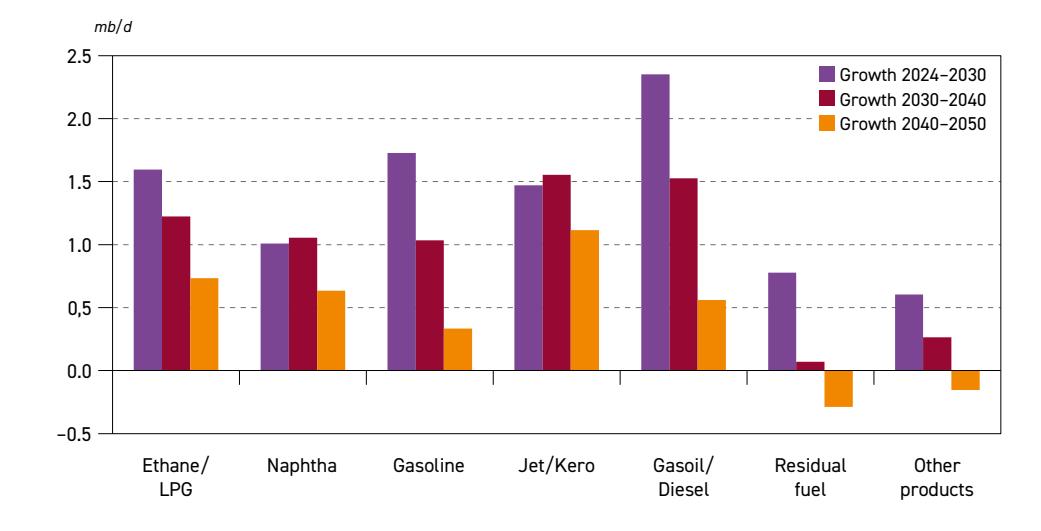

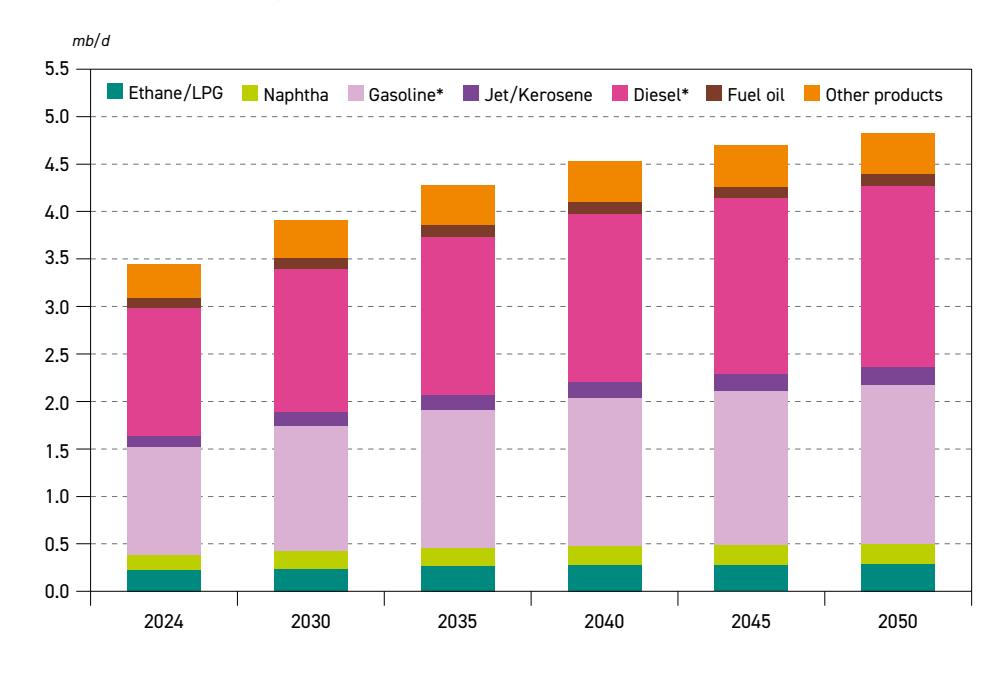

Bulk of future oil demand growth is for light products and middle distillates

Largely reflecting sectoral oil demand trends, light refined products and middle distillates are expected to drive most of the future increase, while heavy products are set to witness only modest changes due to regulatory constraints and ongoing oil substitution by alternative energy sources. As a result, major long-term demand growth is expected for gasoil/diesel (4.4 mb/d), jet/kerosene (4.1 mb/d), liquefied petroleum gas (LPG)/ethane (3.6 mb/d), gasoline (3.1 mb/d) and naphtha (2.7 mb/d).

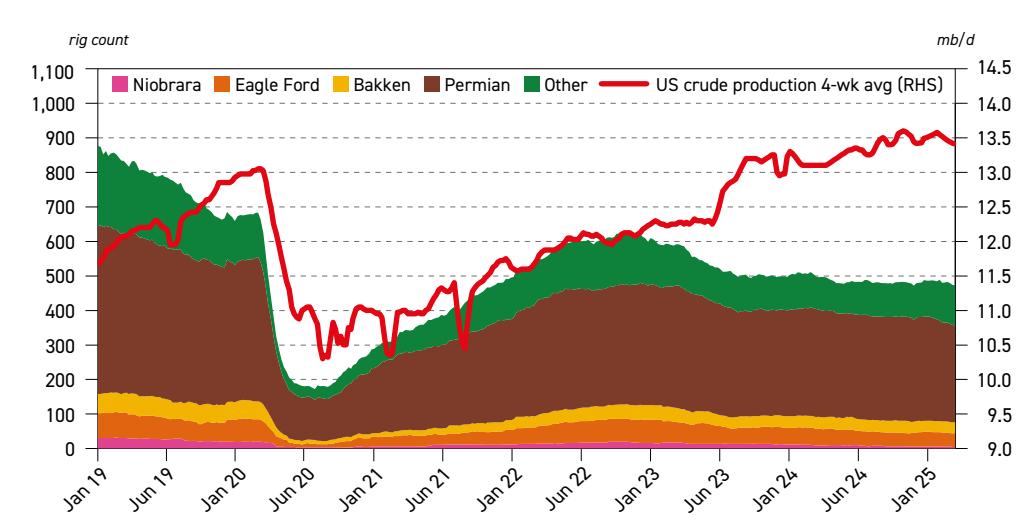

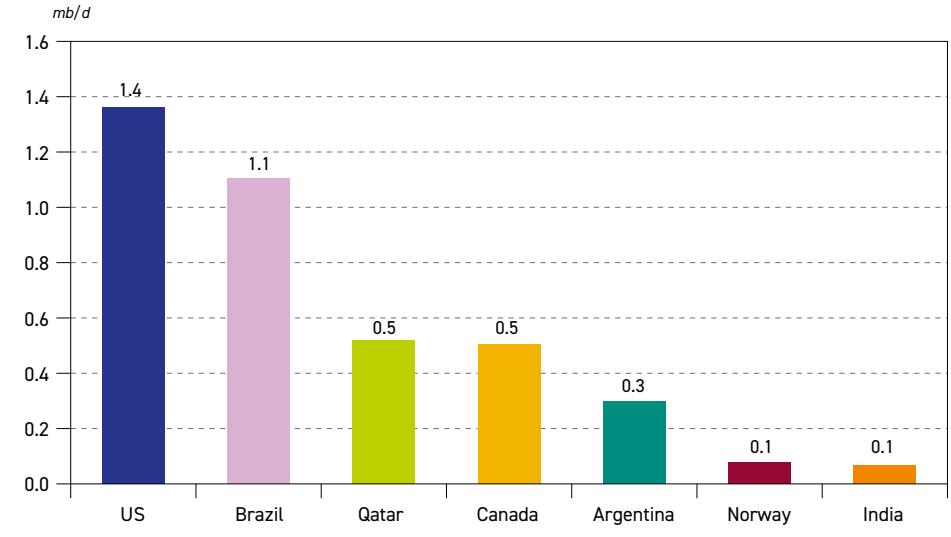

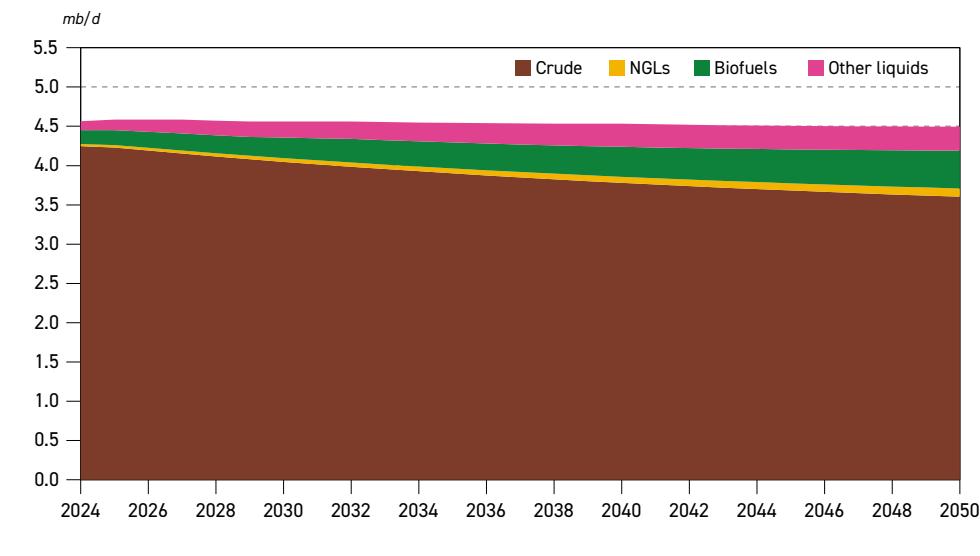

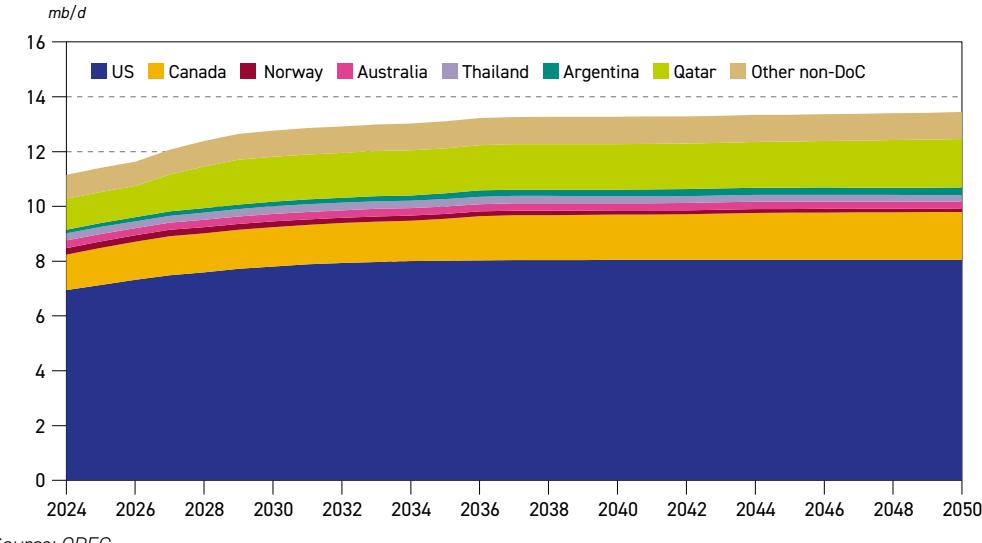

US liquids production drives medium-term supply growth, but peaks in 2030

Non-Declaration of Cooperation (non-DoC) liquids production is set to increase from 53.3 mb/d in 2024 to 59 mb/d in 2030, or by 5.7 mb/d. The US is expected to drive this growth, contributing 1.4 mb/d, or just over 25%, followed by Brazil, Qatar, Canada, Argentina and others. Tight oil remains the key element supporting rising US liquids production, with volumes increasing from 14.7 mb/d in 2024 to 16.5 mb/d in 2030. Thereafter, however, due to gradual resource depletion, output is projected to plateau around those levels for most of the 2030s, and subsequently decline to 14.8 mb/d by 2050.

Major contributors to non-DoC total liquids change, 2024–2030

Source: OPEC.

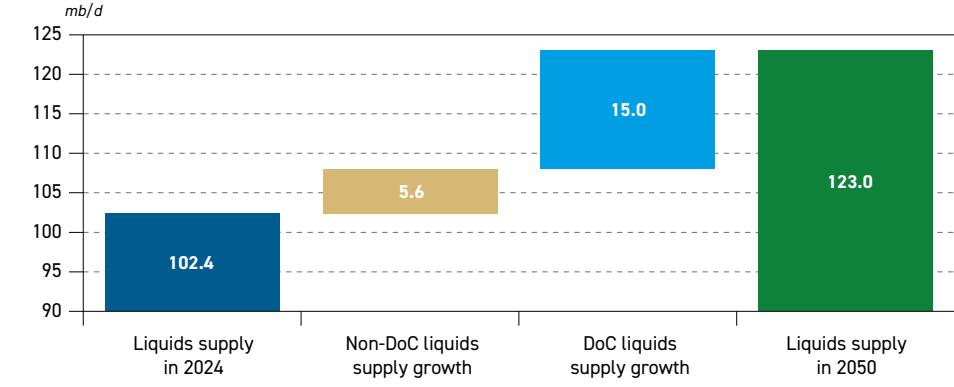

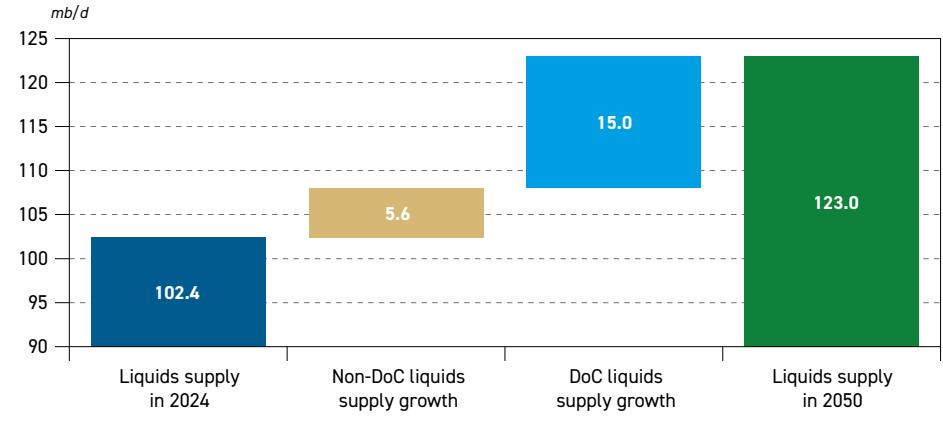

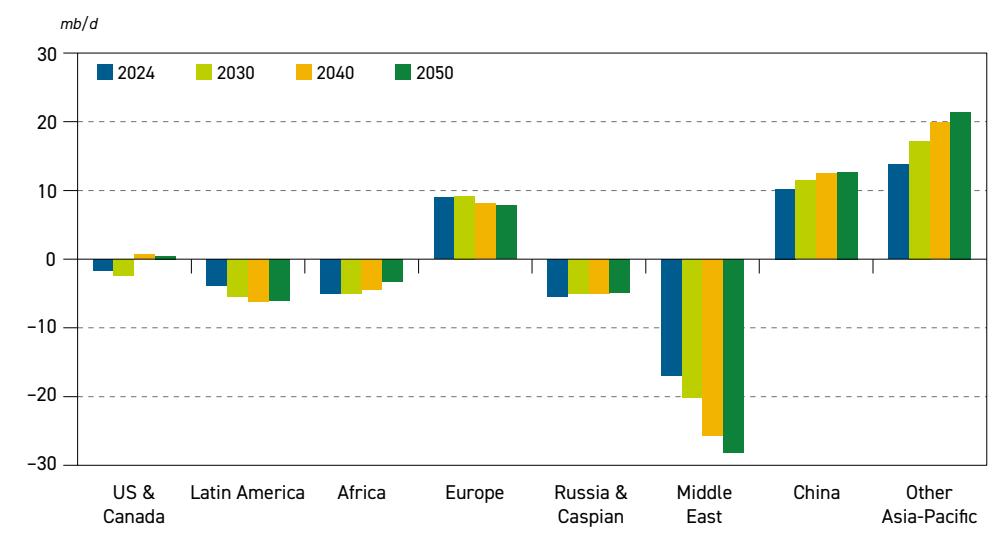

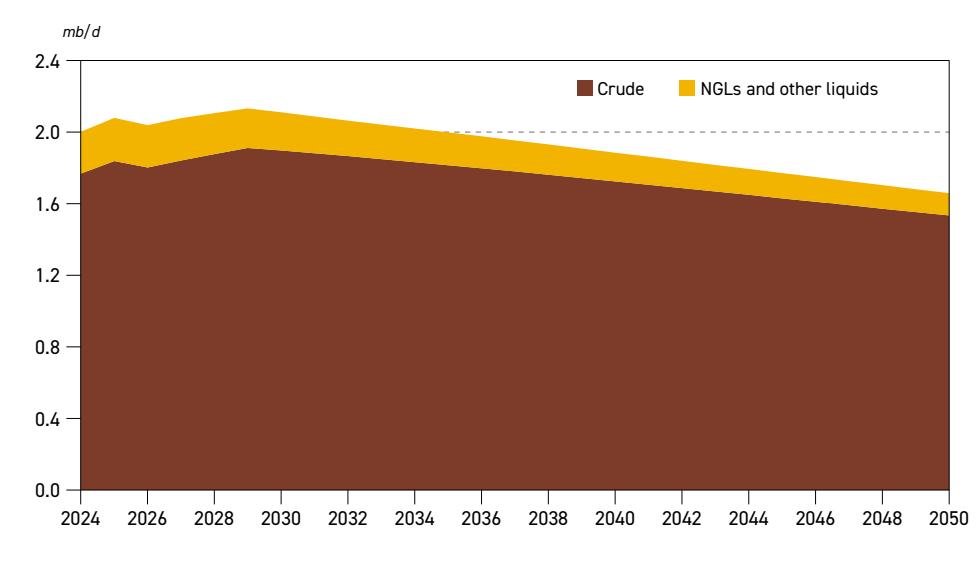

Beyond 2030, non-DoC liquids supply plateaus around 60 mb/d

US liquids supply is set to peak at just over 23 mb/d in 2030, while total non-DoC liquids are now expected to hit a peak of around 60 mb/d in the mid-2030s, and then remain at a plateau just

Composition of global oil liquids supply growth, 2024–2050

Source: OPEC.

ES

below that level until 2050. Beyond 2030, long-term non-DoC liquids supply growth only takes place in Canada, Brazil and Argentina, as well as a handful of other smaller increases, and this is offset by declines in other mature producing regions. Viewing the entire 2024–2050 period, non-DoC liquids nonetheless increase by 5.6 mb/d, from 53.3 mb/d in 2024 to 58.9 mb/d in 2050.

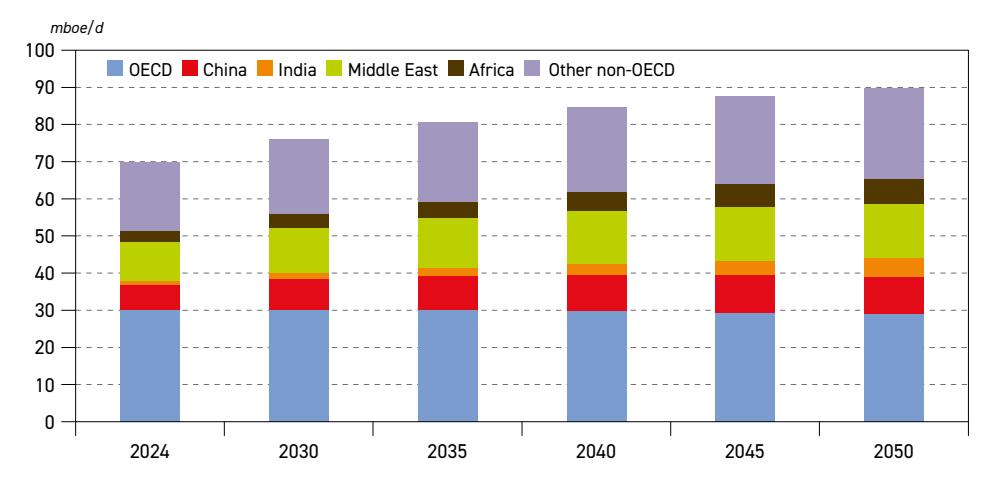

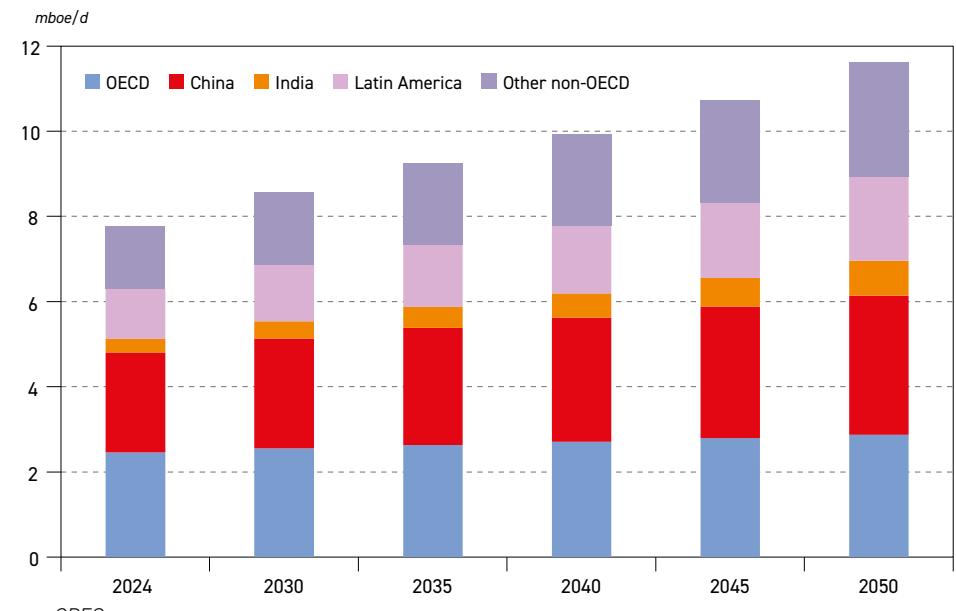

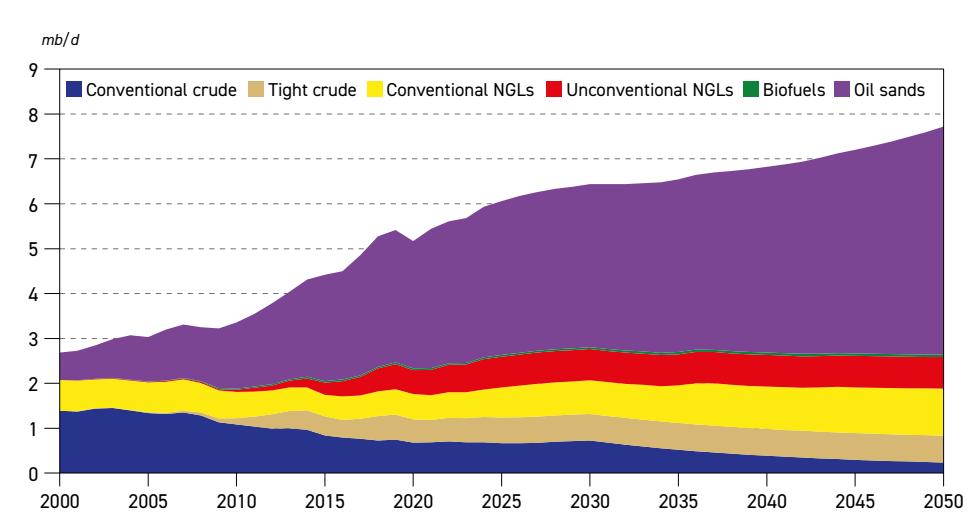

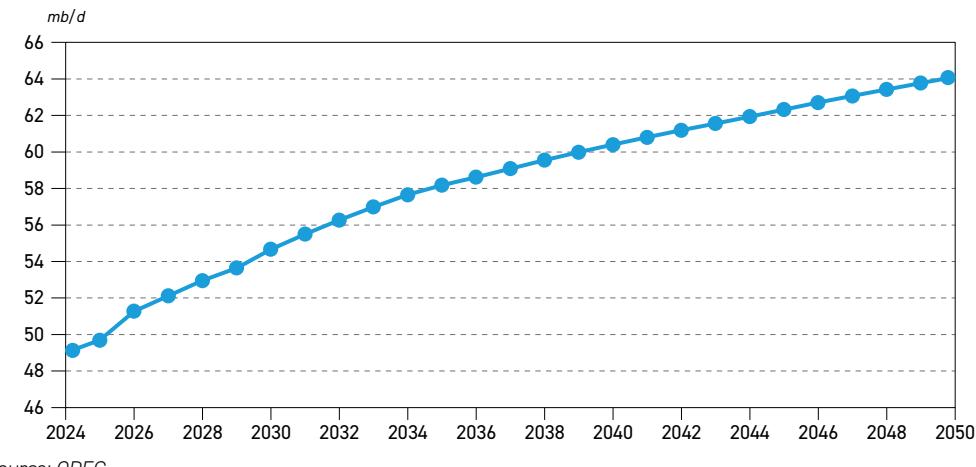

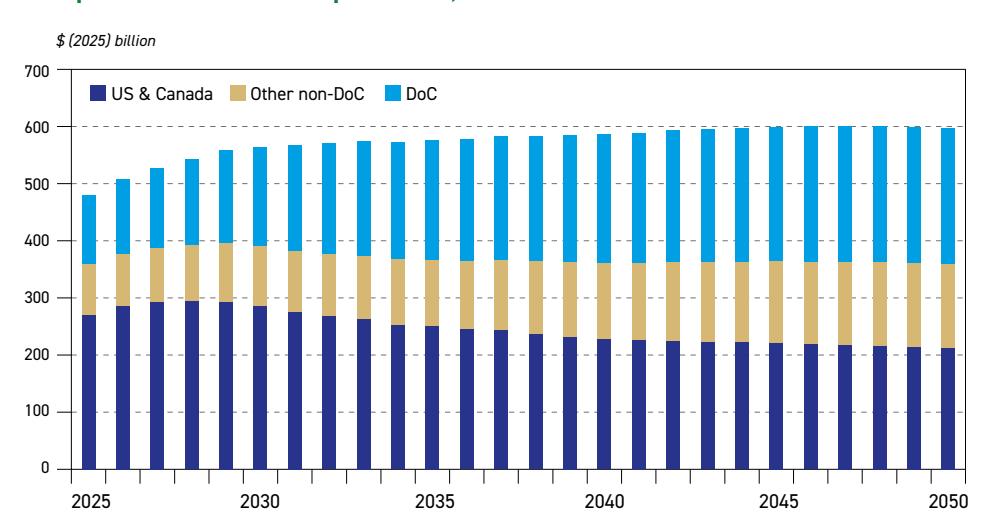

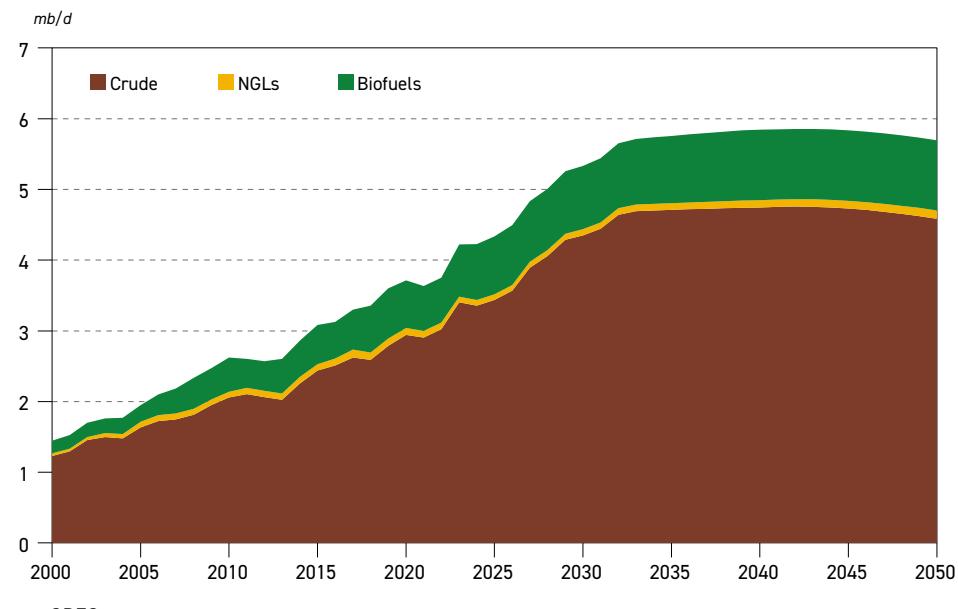

DoC liquids supply set to keep growing

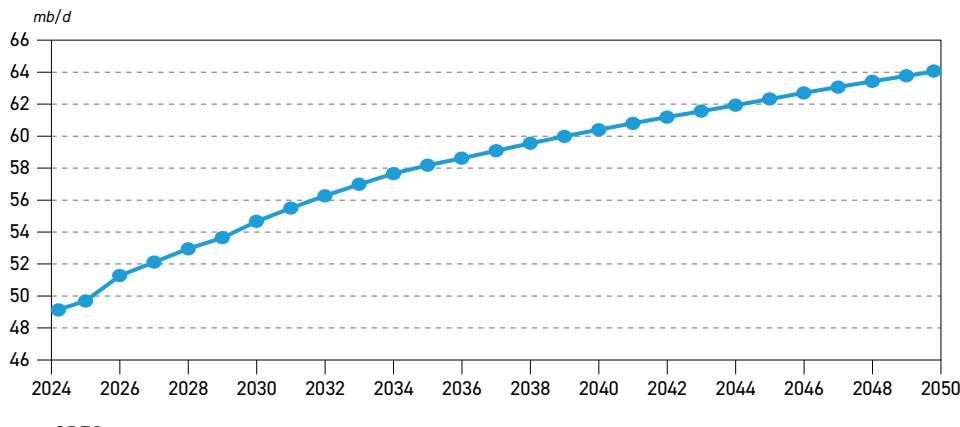

As a result of non-DoC liquids supply plateauing from the 2030s, continued demand growth means that DoC liquids are projected to keep expanding. From 49.1 mb/d in 2024, it increases to 64.1 mb/d in 2050, or by 15 mb/d. As a result, the DoC producers' share of the global liquids supply market increases from 48% in 2024 to 52% in 2050.

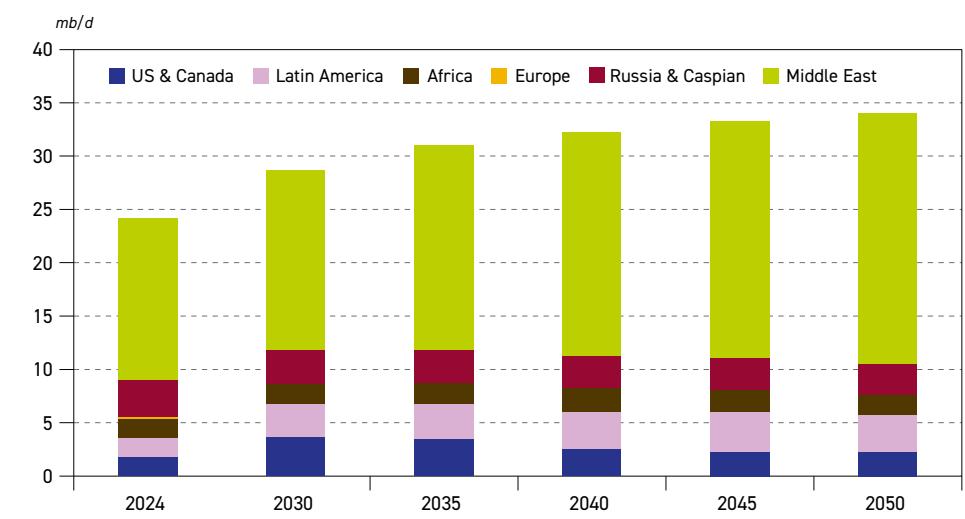

Declaration of Cooperation total liquids supply

Source: OPEC.

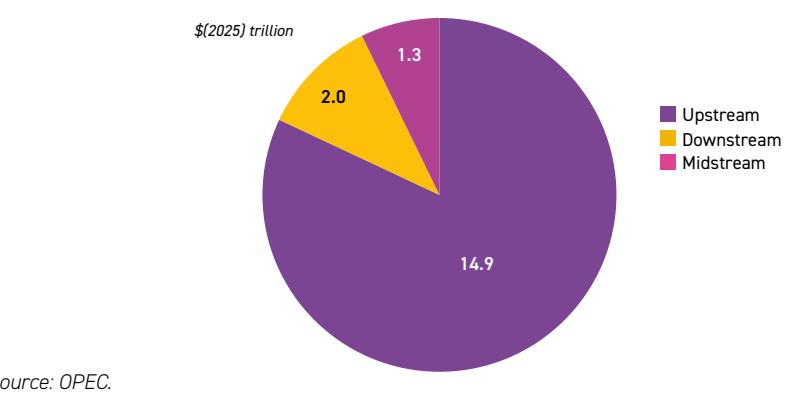

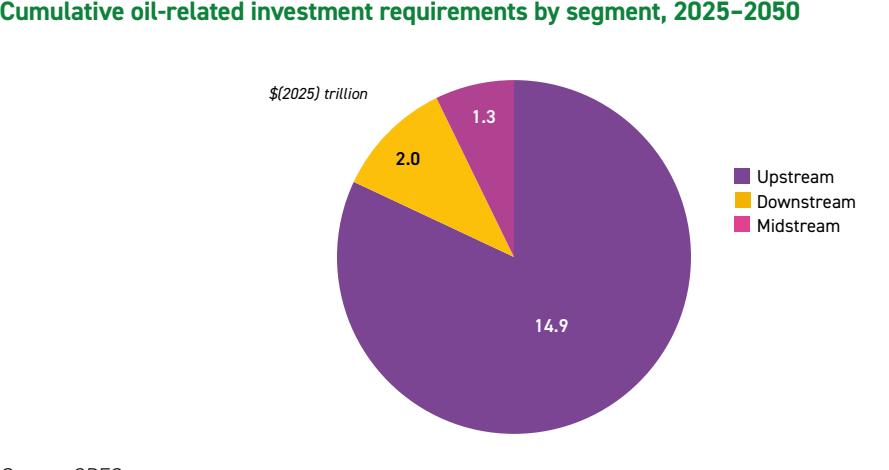

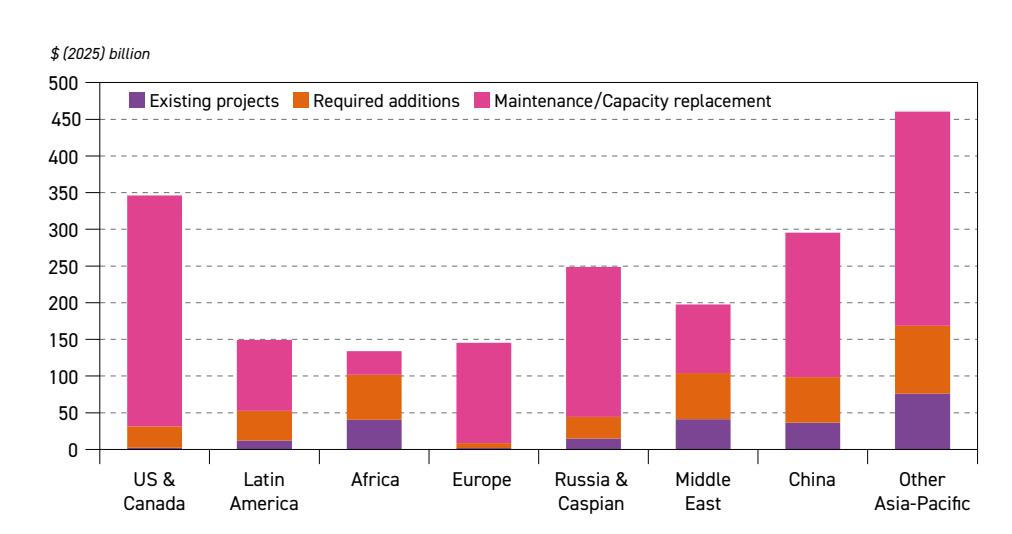

Required cumulative oil investments estimated at $18.2 trillion by 2050

To reliably supply markets, against the backdrop of rising demand, as well as to offset natural decline in mature fields, global cumulative investments of $18.2 trillion are required over the 2025–2050 period (in 2025 US$). The bulk of the required investment, $14.9 trillion, or $574 billion p.a., is for the upstream sector. The downstream and midstream sectors require another $2 trillion and $1.3 trillion, respectively. The challenge of meeting these investment requirements is huge, and any shortfall in meeting these needs could impact market stability and energy security.

Cumulative oil-related investment requirements by segment, 2025–2050

Source: OPEC.

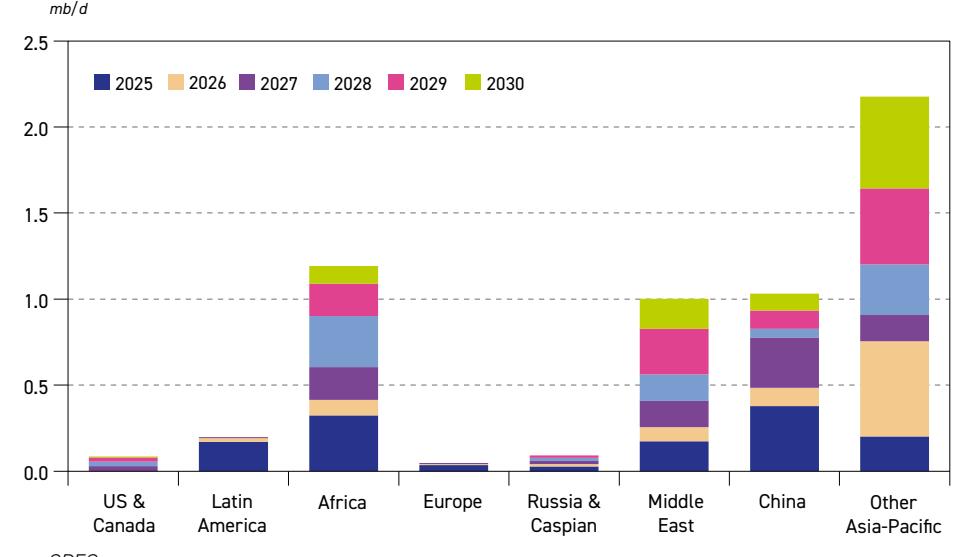

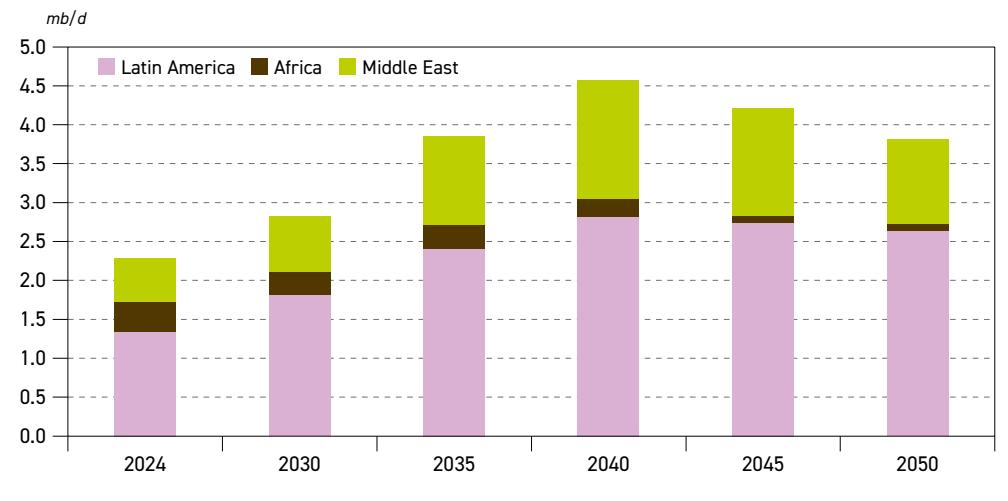

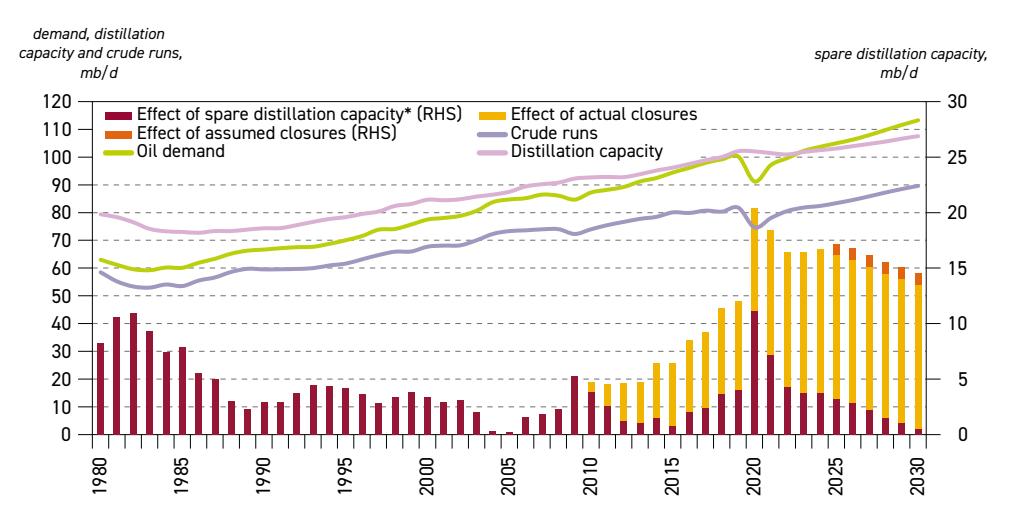

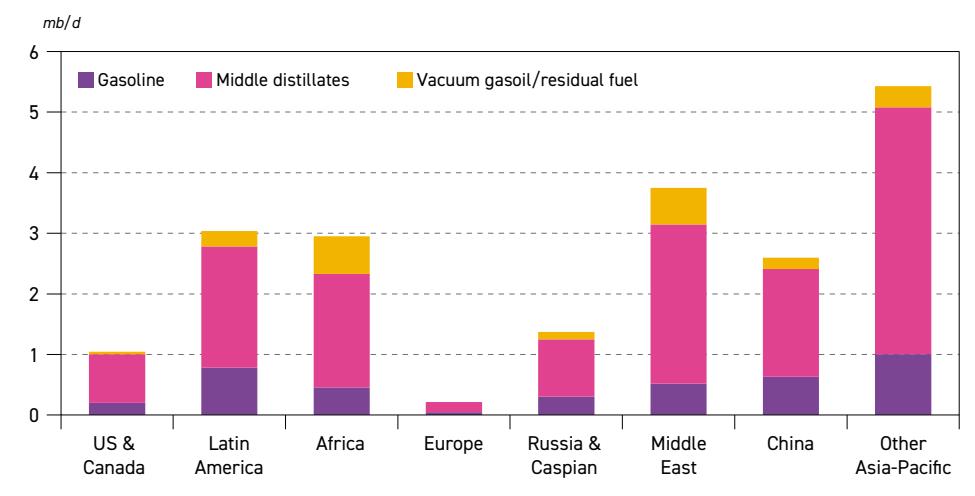

Asia-Pacific, Africa and the Middle East lead medium-term refinery capacity additions

The medium-term outlook sees around 5.8 mb/d of new refining capacity coming online. The bulk of this is set to be commissioned in the Asia-Pacific (3.2 mb/d), Africa (1.2 mb/d) and the Middle East (1 mb/d), representing over 90% of the global additions out to 2030. The global annual average rate of capacity additions for the period from 2024–2030 is estimated at just below 1 mb/d.

Distillation capacity additions from existing projects, 2025–2030

Source: OPEC.

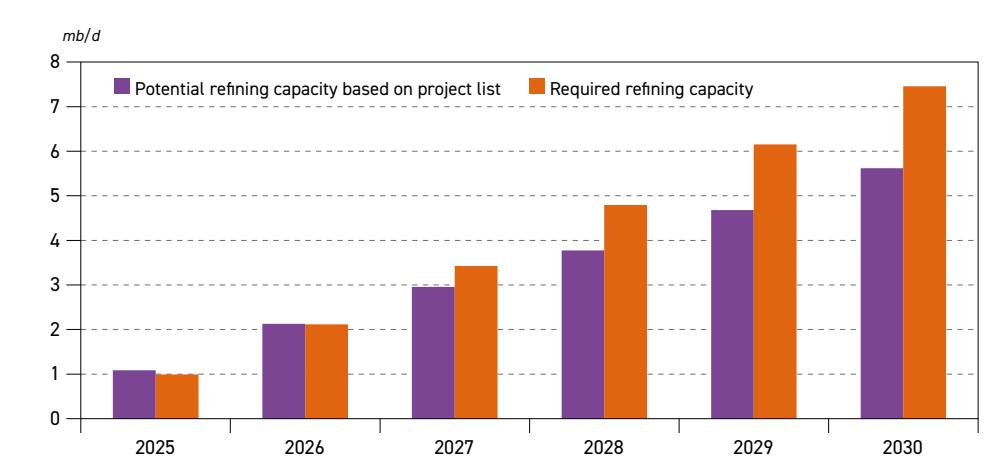

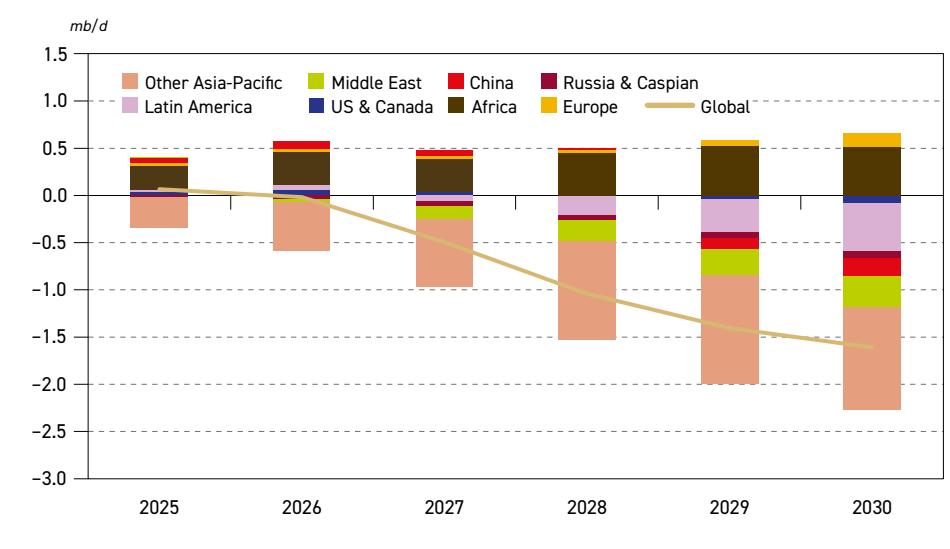

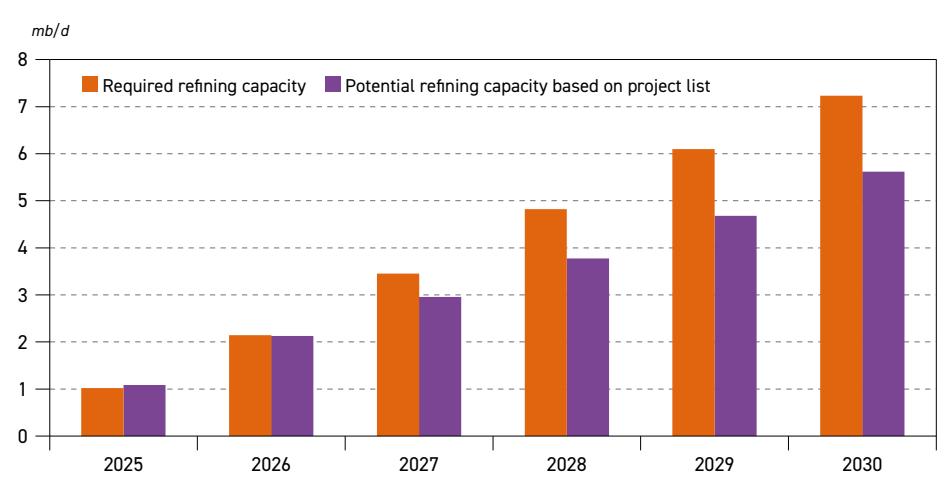

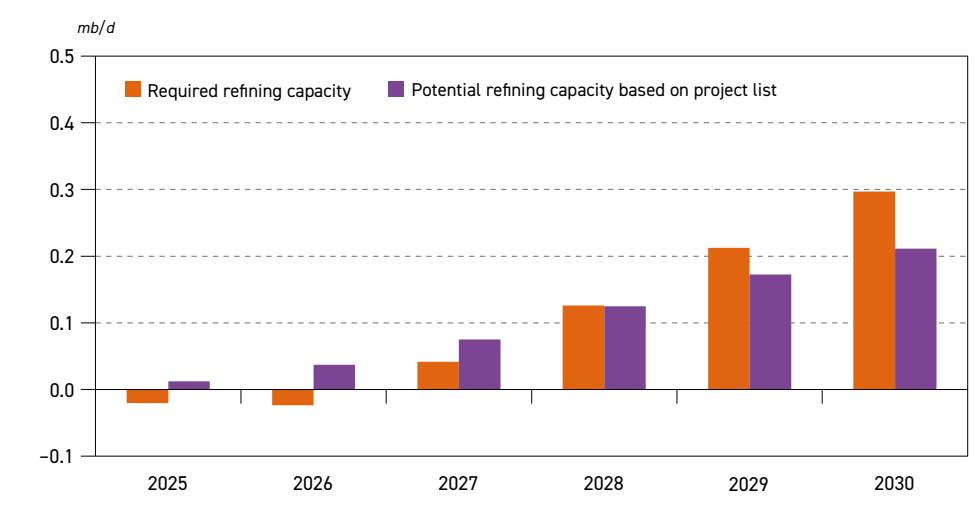

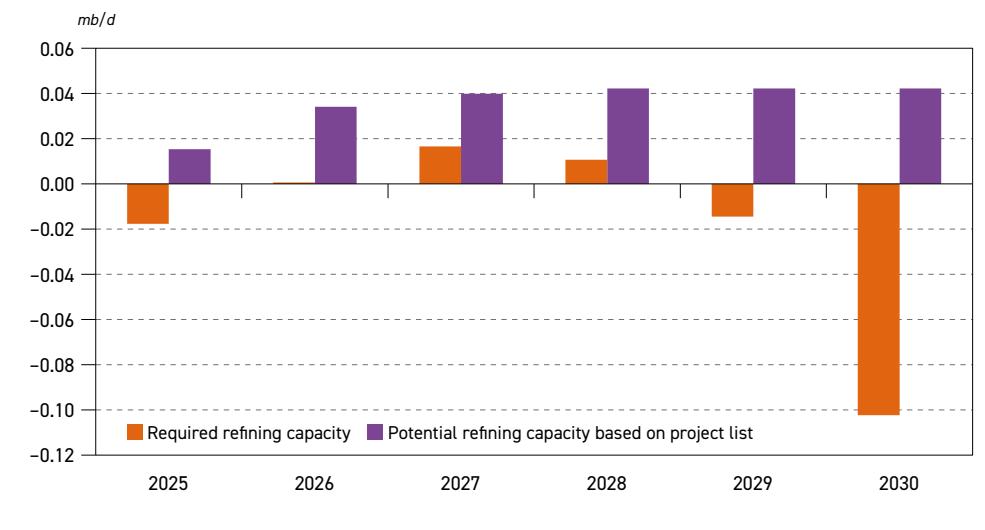

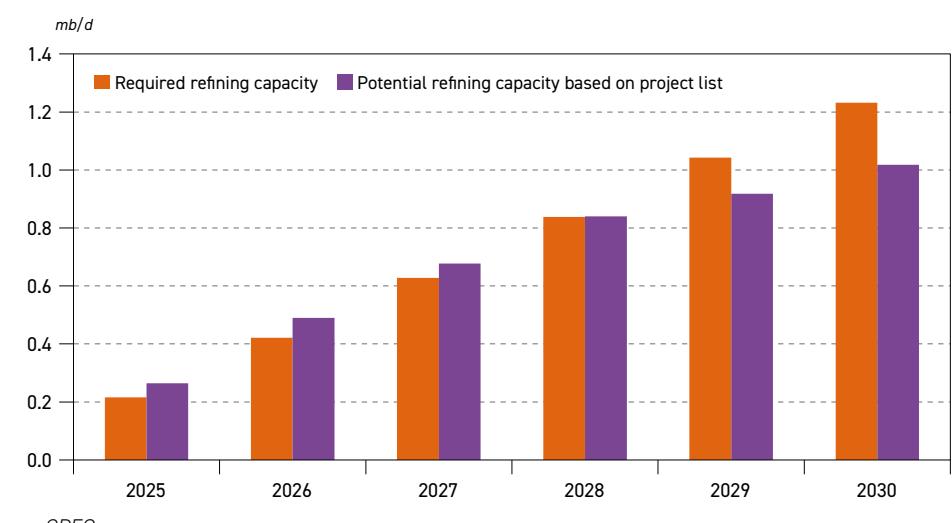

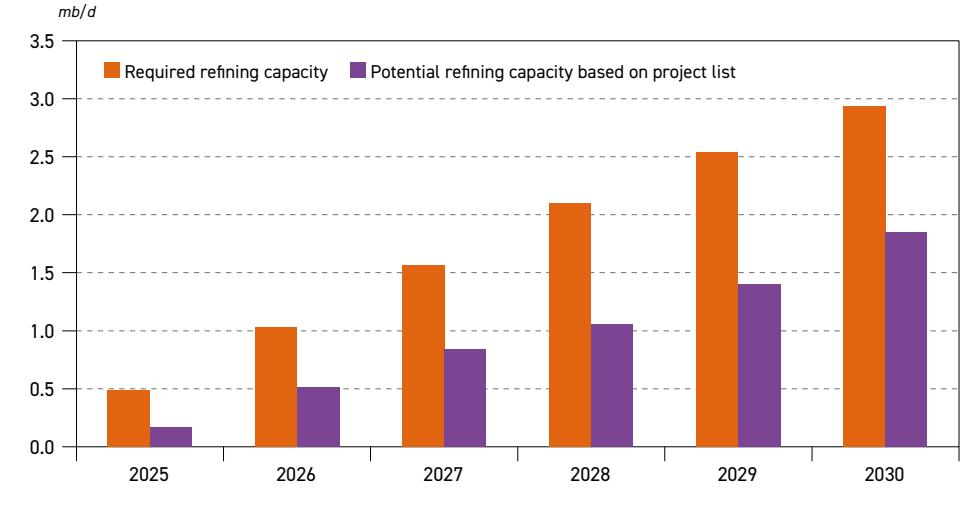

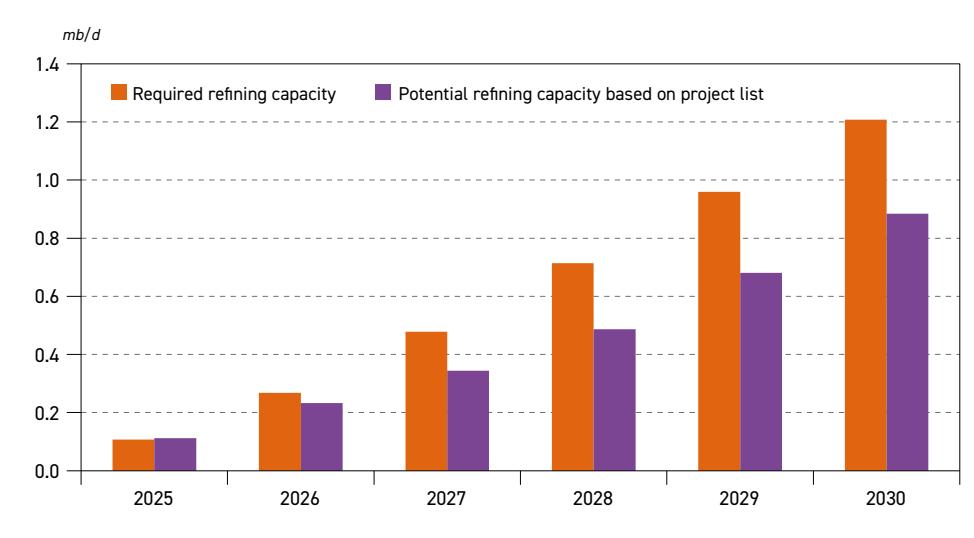

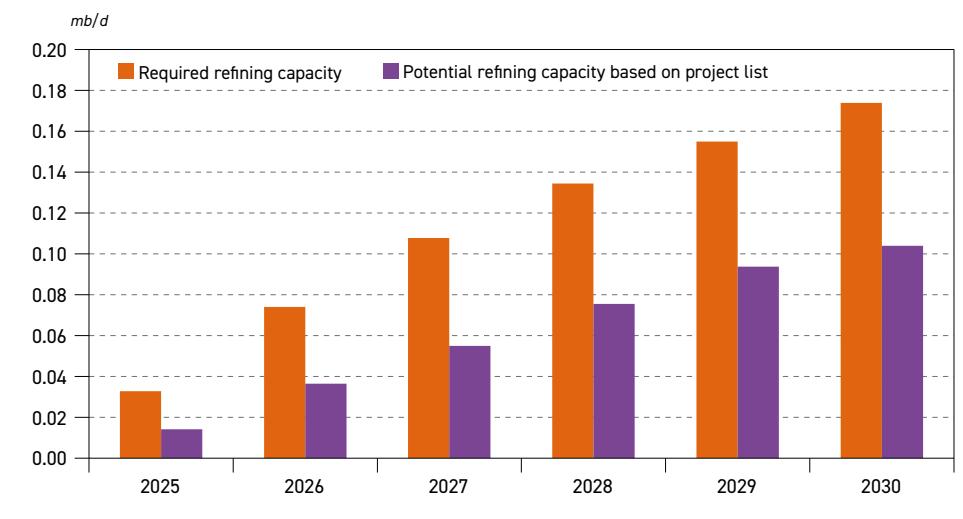

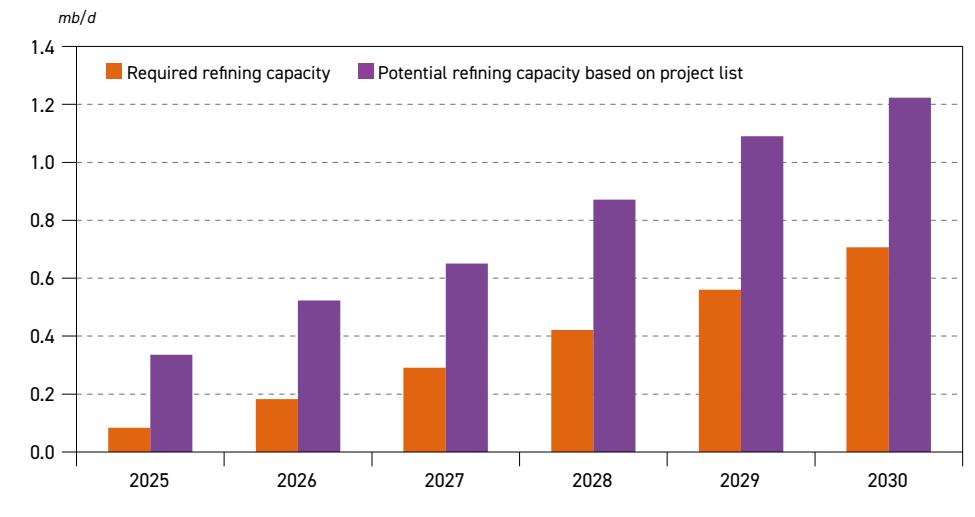

Downstream market projected to gradually tighten in the medium term

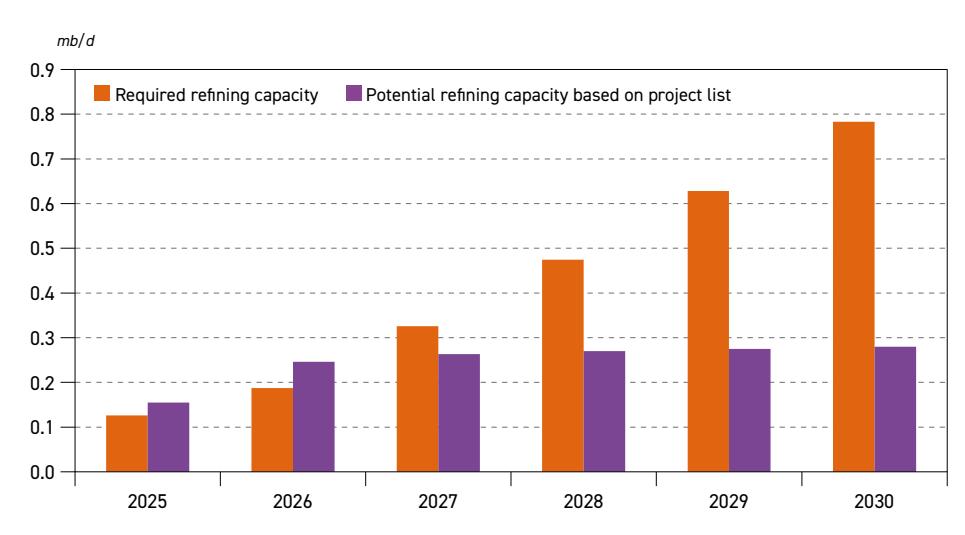

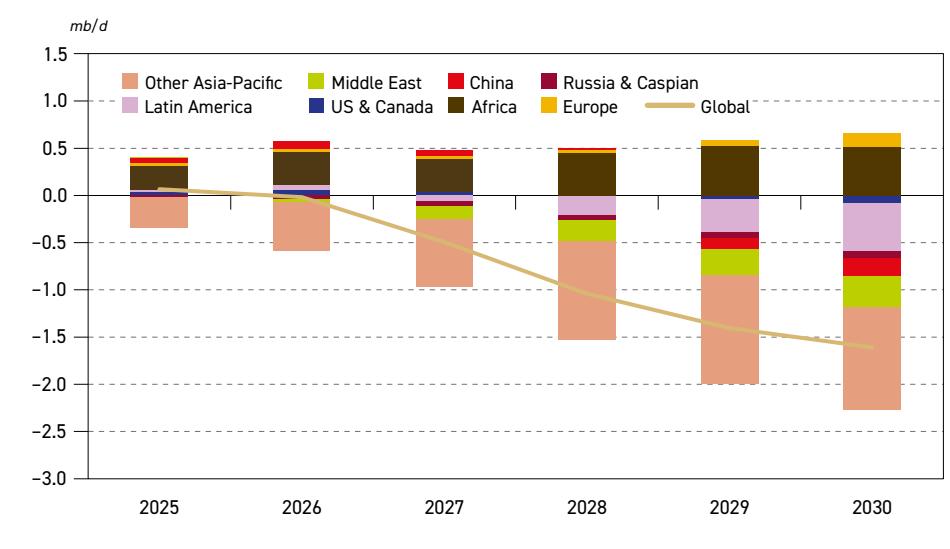

The medium-term outlook indicates a balanced downstream market in 2025 and 2026 relative to the base year. However, the downstream market is expected to increasingly tighten in the period from 2027 to 2030. The deficit between required and potential refining capacity is set

Additional global cumulative refinery crude runs, potential* and required**

* Potential: based on expected distillation capacity additions; assuming no closures.

** Required: based on projected demand increases, assuming no change in refined products trade pattern. Source: OPEC.

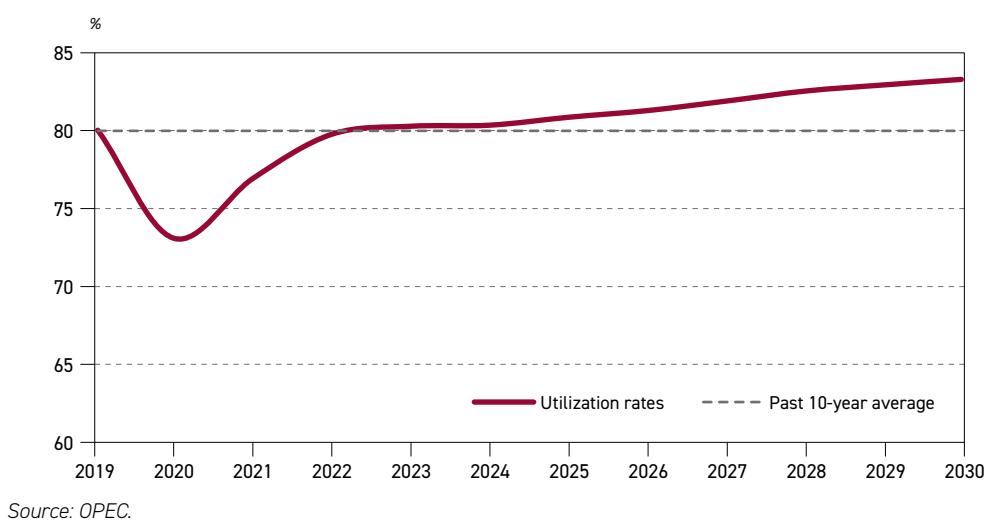

to rise steadily from almost 0.5 mb/d in 2027 to around 1.6 mb/d by 2030, leading to higher global refinery utilization rates. This is due to strong oil demand growth, which is significantly higher than projected refining capacity additions over the period.

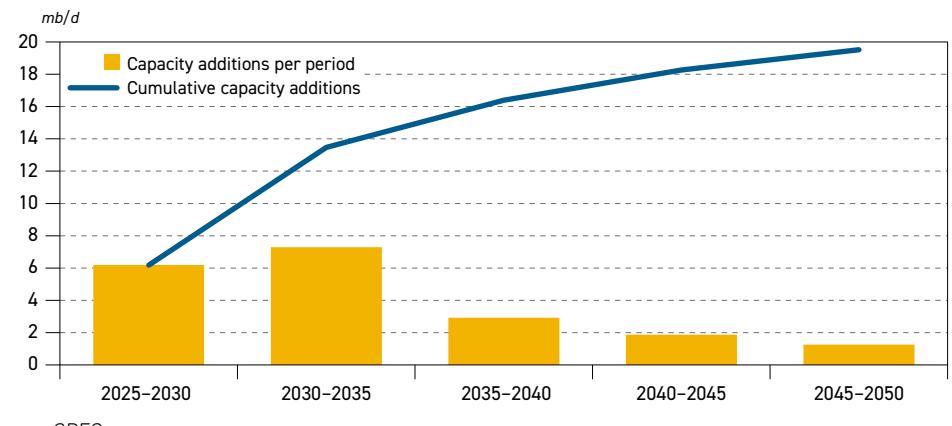

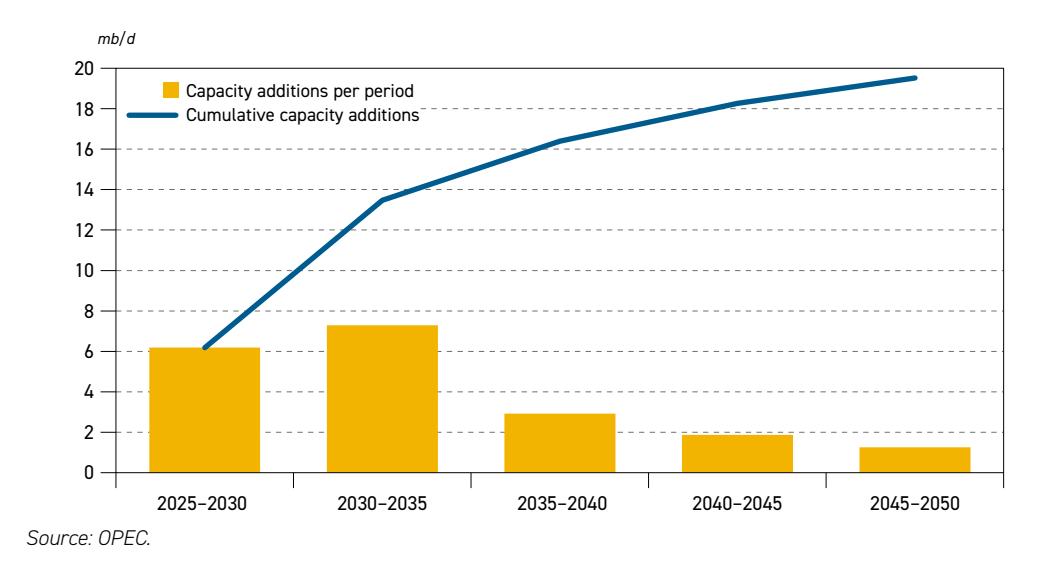

Around 70% of long-term refining capacity additions are set to materialize before 2035 Global required refining additions between 2025 and 2050 are projected at 19.5 mb/d. After the medium-term additions, refining capacity is set to increase by a further 7.3 mb/d between 2030 and 2035, which is supported by rising demand in most developing regions. The sum of additions drops significantly thereafter and is estimated at around 3 mb/d in the 2035-2040 period, before falling to only 1.2 mb/d in the 2045-2050 period. This mirrors the slowdown in demand growth towards the end of the modelling horizon. Around 86% of new refining capacity is set to be located in the Asia-Pacific, Africa and the Middle East.

Long-term distillation capacity additions by period and cumulative, 2024–2050

Source: OPEC.

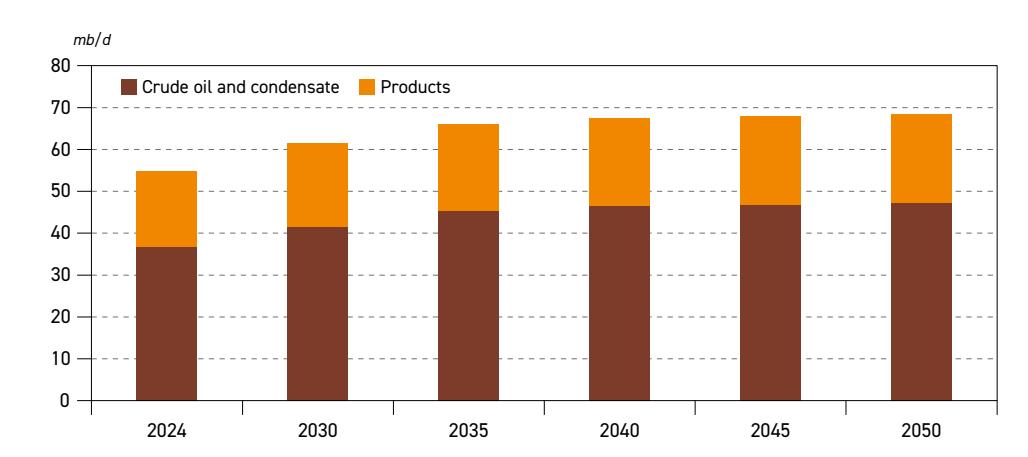

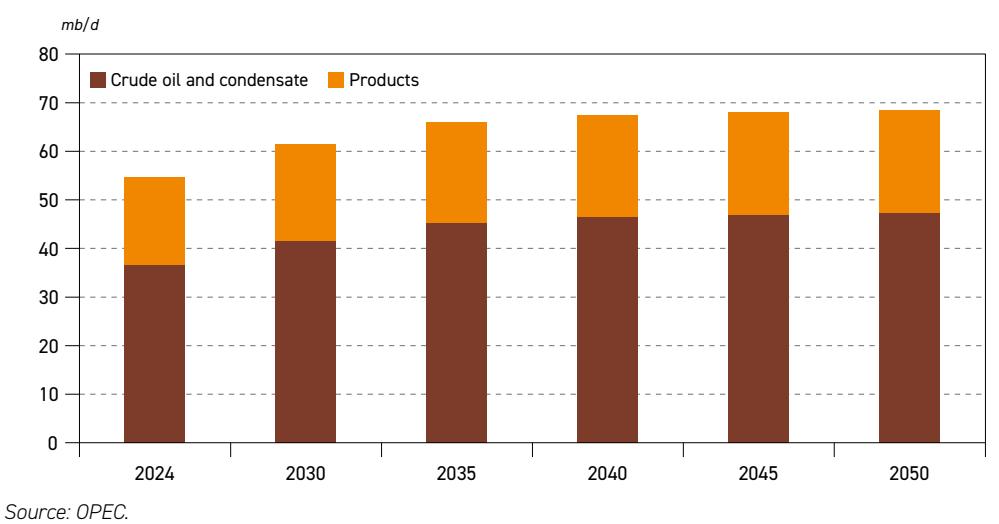

Global oil trade set to rise by nearly 25% by 2050

Global interregional oil trade, including oil, condensate and refined products, is estimated at almost 55 mb/d in 2024. By 2030, trade is projected to increase significantly to above 61 mb/d, with a gradual increase thereafter to 67.5 mb/d in 2050.

Interregional oil (crude oil, condensate and product) exports, 2024–2050

Source: OPEC.

World Oil Outlook 2025 Organization of the Petroleum Exporting Countries

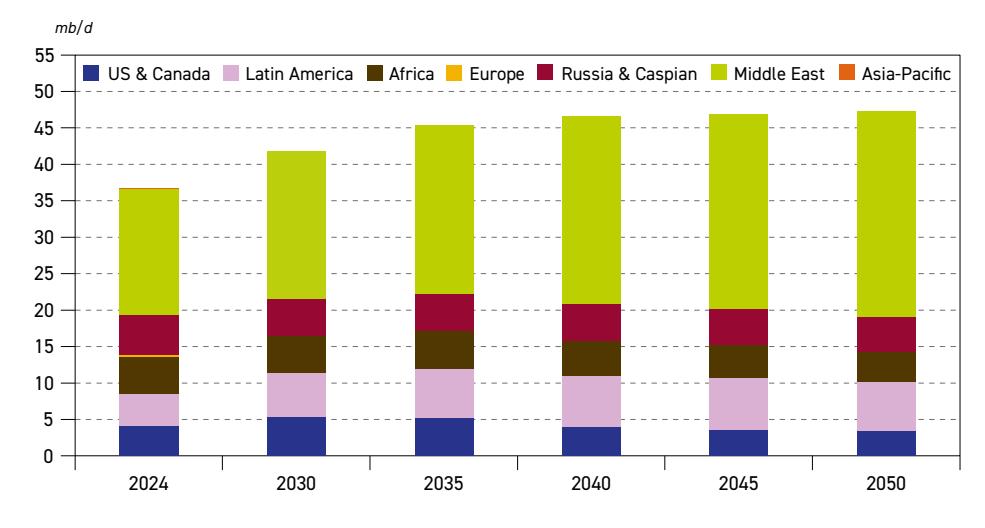

Interregional crude and condensate trade stood at around 36.8 mb/d in 2024 and by 2030 it is expected to increase to 41.7 mb/d, supported by rising oil demand in major consuming regions. After 2030, the trade growth is expected to slow, although it rises to levels of around 47.3 mb/d by 2050. Total oil product trade is assessed at 18 mb/d in 2024 and it is expected to rise above 21 mb/d by 2050. This is in line with higher demand in the Asia-Pacific and growing exports from the US & Canada and the Middle East.

Middle East to Asia-Pacific trade to grow in importance

Crude and condensate exports from the Middle East are expected to increase from 17.4 mb/d in 2024 to 20.2 mb/d in 2030. In the long term, exports are projected to increase further to 28.2 mb/d by 2050. Middle East crude and condensate exports are likely to increase to all major importing regions. However, more than 80% of Middle Eastern exports are set to be shipped to the Asia-Pacific, increasing from 15.2 mb/d in 2024 to 23.5 mb/d in 2050. The trade route between the Middle East and Asia-Pacific is expected to represent 50% of the global interregional crude and condensate trade in 2050.

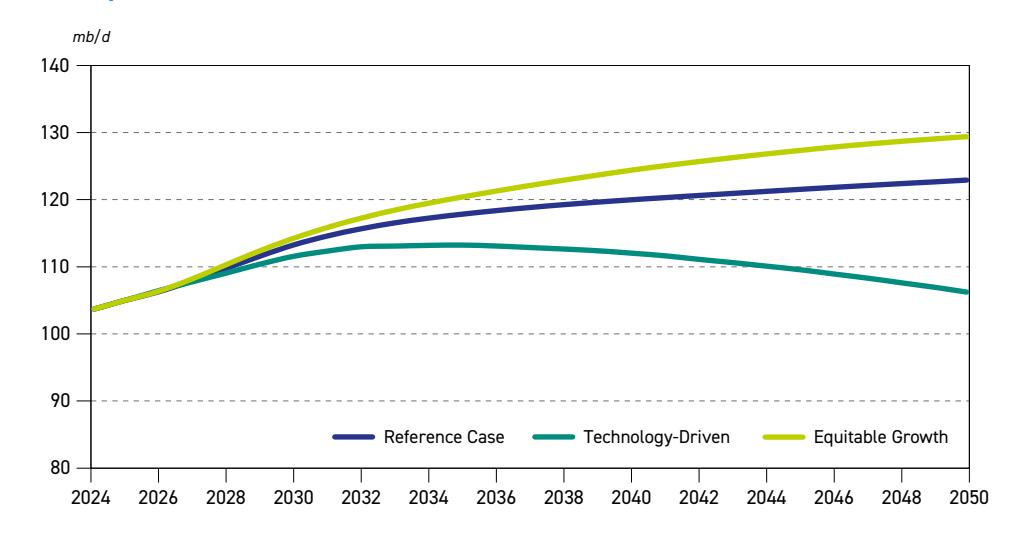

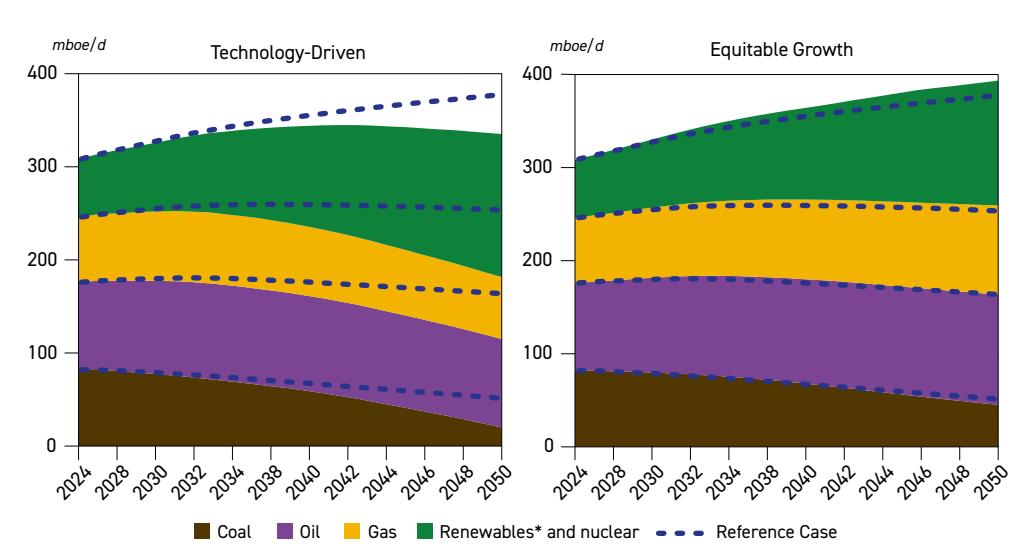

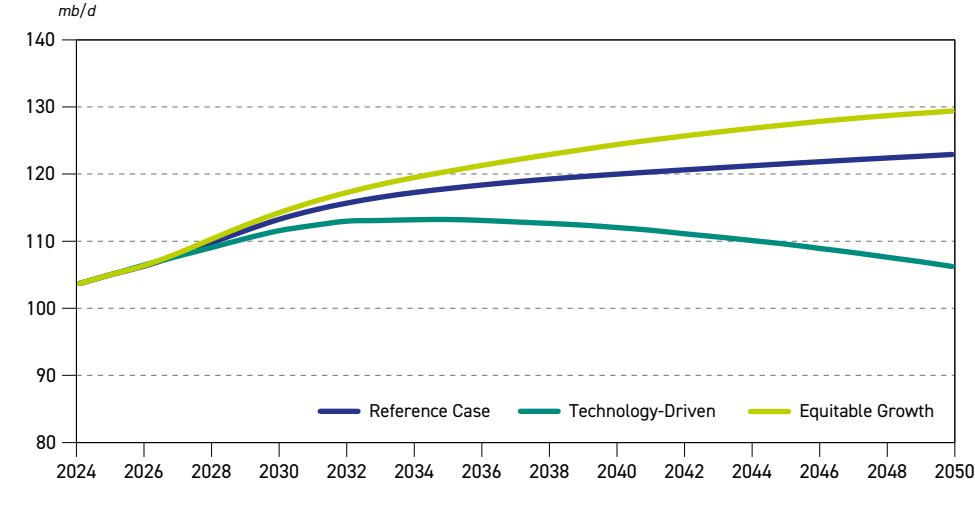

Scenarios highlight uncertain road ahead for oil and energy demand

Besides the Reference Case, the Outlook also features two alternative scenarios that shine a light on a range of different, albeit viable outcomes, and their impact on energy demand, the future energy mix and oil demand, specifically. The 'Technology-Driven Scenario' assumes accelerated investments in advanced technologies that affect energy consumption at a more rapid pace than assumed in the Reference Case. These investments result in both significant fuel substitutions and energy efficiency improvements that lead to lower primary energy demand and a significantly different energy mix. Global oil demand in this scenario gradually departs from the Reference Case trajectory. This pathway opens up a demand gap vis-à-vis the Reference Case of close to 5 mb/d in 2035, which then expands to 16.7 mb/d in 2050. In this scenario, total oil demand is under 107 mb/d by 2050.

By contrast, the 'Equitable Growth Scenario' envisages a more equitable and prosperous economic future for developing countries, coupled with a differentiated approach to how and when to achieve emission reduction targets. This scenario results in higher long-term energy

Global liquids demand in the Reference Case and alternative scenarios, 2024–2050

Source: OPEC.

demand, in general, and oil, in particular. Oil demand in this scenario reaches 120 mb/d by 2035 and continues growing to 130 mb/d in 2050. Compared to the Reference Case, this is almost 3 mb/d higher by 2035, which then expands to 6.5 mb/d in 2050.

Introduction

There have been many important developments since the release of the previous Outlook in September last year. A review of 2024 clearly shows that demand for all primary energy sources reached new historical highs. Demand for oil rose to a record 103.7 mb/d. Renewable electricity generation capacity increased by almost 600 GW, driven by the largest-ever solar PV and wind capacity additions in China. Demand for gas, coal and nuclear energy increased too, driven by significant growth in global electricity needs.

China surprised many with its impressive surge in renewables, strong growth in EV sales, and, alongside this, a significant increase in coal demand too. The latter is partly linked to its rapid wind and solar deployment, given their intermittency and the inherent need for continuous balancing. As the recent huge blackout in Spain and Portugal indicates, a rising renewable electricity share brings with it increased needs for grid investments and maintaining backup capacity, including the wider deployment of batteries. All this, however, leads to additional costs for final consumers, even while the risk of blackouts remains.

Moreover, growing energy demand takes place amid substantial shifts in energy policies. Undoubtably the most consequential recent event was the formation of a new US administration, which has focused on domestic economic growth, lowering the US trade deficit in goods and bringing back the 'energy dominance' agenda. At the same time, it withdrew from the Paris Agreement and the Just Energy Transition Partnership, reduced clean energy tax incentives, cut renewable energy funding and provided incentives to reinvigorate domestic oil supply.

Some shifts, though less dramatic, are also visible in Europe. A new EU Commission, reflecting the results of the 2024 European Parliament election is set to give a much higher priority to enforcing defence capabilities and improving Europe's economic competitiveness. While the Commission continues to stress that the 'Green Deal' remains a priority, in practice the heightened focus on defence and economic competitiveness will likely see less emphasis placed on decarbonization efforts. Indeed, in the recent discussion on setting targets for 2040, the EU Commission has called for flexibility and pragmatism in climate change issues rather than strictly adhering to specific targets.

To some extent, the uncertainty about future trends in major consuming countries is also spilling over into other regions. This is especially the case in developing countries where energy security and affordability have always been important and where eradicating energy poverty often tops the priority list. As a result, a tendency to temper climate change ambitions is also visible in a number of developing countries, most obviously reflected in their hesitancy to update policy goals. To date, for instance, under the circumstances highlighted, only a few countries have submitted their updated NDCs to the UNFCCC by early 2025, as required by the Paris Agreement.

Despite these uncertainties, and building upon the analytical foundation of previous WOO editions, this year's Outlook offers fresh insights through 2050 into the evolving dynamics shaping energy demand, oil demand and supply, refining, trade and investment, as well as in-depth scenario analysis and sectoral breakdowns.

As a result, the WOO 2025 offers stakeholders – governments, industry leaders, investors, and researchers – a robust and balanced reference for understanding the future of oil within the broader energy framework. As always, the WOO reflects OPEC's values and emphasis on the need for continued dialogue, cooperation and realistic approaches to future energy

pathways. Ones that not only look to lower emissions, but also ensure energy security and the world's growing need for ample, reliable and affordable supplies of energy.

As the energy world becomes more complex and interdependent, OPEC remains committed to fostering transparency, stability, and sustainability in global oil markets. The WOO 2025 is a central part of this.

INT

Key assumptions

Key takeaways

- • The global population is expected to rise by about 1.5 billion, from a level of around 8.2 billion in 2024 to almost 9.7 billion by 2050. Global demographic changes and population growth will be driven almost entirely by the non-OECD region.

- • The global working-age population is expected to increase by 805 million to surpass 6.1 billion by 2050. Almost 1.9 billion people are expected to move to cities by 2050. By then, an estimated 68% of the world's population, or over 6.6 billion people, are expected to live in urban areas.

- • Global GDP growth between 2024 and 2050 is expected to remain robust, increasing at an average rate of 2.9% p.a. Non-OECD expansion is set to be the primary contributor to global expansion, averaging 3.7% p.a., while the OECD is expected to grow at 1.5% p.a.

- • In absolute terms, the global economy is set to more than double in size, increasing from $171 trillion in 2024 to $358 trillion in 2050.

- • Global average income is expected to rise from approximately $21,000 (2021 PPP) in 2024 to $37,100 (2021 PPP) by 2050.

- • Energy policies across major economies are undergoing a significant recalibration as nations navigate an array of complex challenges. A noticeable trend of policy pushback with intensified scrutiny is evident as decision-makers address a plethora of priorities, including energy security, energy affordability, sustainability and industrial competitiveness.

- • With the Paris Agreement reaching its tenth anniversary in 2025, its full implementation remains increasingly challenging given the uncertain and fragmented global landscape. UN climate negotiations continue to evolve with a backdrop of rising geopolitical tensions, urgent adaptation needs, calls for ambitious mitigation and competing priorities for sustainable development. Concurrently, the announced withdrawal of the US from the Paris Agreement for a second time creates further uncertainty.

- • The WOO assumes a gradual evolution of technology, with no sudden technological breakthroughs, the timing and impact of which are challenging to forecast.

- • The trend towards electrification is expected to continue across several sectors. In the power sector, advancing technology and supportive policies are likely to increase the role of renewables in the energy mix. Electrification in the transport sector will advance, but it is set to continue to face challenges related to battery supply chains and the available charging network, as well as consumer concerns about driving range. The residential sector is also anticipated to experience further electrification through policies incentivizing heat pump adoption and distributed solar photovoltaic (PV) generation.

The Reference Case in this year's WOO is underpinned by a number of key assumptions that play an important role in developing an outlook for the future of all major energy sources. This chapter provides insights into four broad areas of assumptions: population and demographics, economic growth, energy policies and technology and innovation.

1.1 Population and demographics

Global living standards and human longevity have seen remarkable improvements in recent decades, fundamentally reshaping the well-being of populations. This positive trend has been supported by advancements in healthcare and access to water and sanitation services. These improvements are also closely linked to parallel progress in agricultural productivity, which has enabled better dietary health and a reduction in malnutrition-related illnesses. Additionally, transformative technology has connected individuals to vital information and healthcare resources, fostering innovation, improving overall quality of life and collectively enhancing human welfare globally.

However, despite these factors contributing significantly to growth, the rate of global population expansion is noticeably slowing, given the decline in the global total fertility rate, a trend particularly evident within OECD countries. While some developing regions are anticipated to mirror the patterns observed in OECD countries, others may not, presenting a mixed global demographic landscape.

This section provides a detailed examination of these demographic factors, forming the foundation for the population projections within the WOO's Reference Case to 2050. For this purpose, it draws upon the 2024 revision of the United Nations Department of Economic and Social Affairs' (UNDESA) World Population Prospects, which encompasses critical demographic indicators.

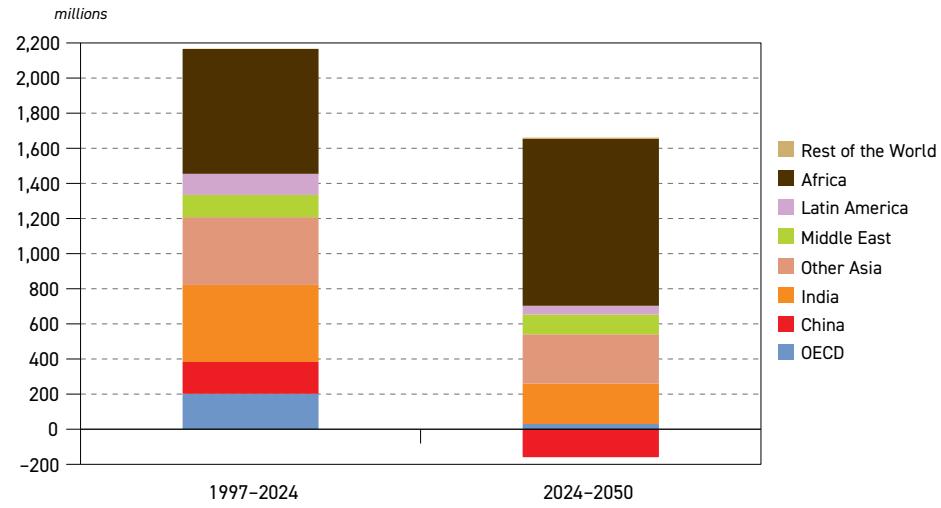

Projections indicate that the global population is set to expand from almost 8.2 billion in 2024 to just under 9.7 billion by 2050, an increase of around 1.5 billion (Table 1.1). However, an important demographic trend underscored in recent data is the persistent decline in global fertility rates, a factor that will significantly shape long-term population trajectories across different regions and countries.

On a regional basis, as per the WOO's regional classifications (see Annex B), the OECD's projected population growth between 2024 and 2050 remains modest, estimated at around 31 million. This limited growth contrasts sharply with a 203 million increase observed in a similar timeframe up to the year 2024 (Figure 1.1). Within the OECD, population growth in OECD Americas is projected to offset the combined declines witnessed in OECD Europe and OECD Asia-Pacific, resulting in a slight gain for the OECD region.

Population growth is set to be overwhelmingly concentrated in non-OECD nations, with growth expected to surpass 1.4 billion through to 2050. Africa is expected to contribute the most to this expansion, with Other Asia and India also set to experience significant increases.

Among non-OECD countries, China is projected to experience a significant population contraction. The substantial decline of around 159 million is primarily attributed to past population policies and continually low fertility rates, which have fallen well below

millions

1

Table 1.1 World population by region

| Growth | |||||||

|---|---|---|---|---|---|---|---|

| 2024 | 2030 | 2035 | 2040 | 2045 | 2050 | 2024–2050 | |

| OECD Americas | 539 | 558 | 571 | 582 | 592 | 599 | 59 |

| OECD Europe | 591 | 590 | 589 | 587 | 583 | 577 | –14 |

| OECD Asia-Pacific | 217 | 215 | 212 | 209 | 205 | 202 | –15 |

| OECD | 1,347 | 1,363 | 1,372 | 1,378 | 1,380 | 1,377 | 31 |

| China | 1,419 | 1,398 | 1,373 | 1,343 | 1,306 | 1,260 | –159 |

| India | 1,451 | 1,525 | 1,579 | 1,623 | 1,656 | 1,680 | 229 |

| Other Asia | 1,292 | 1,367 | 1,428 | 1,484 | 1,533 | 1,575 | 283 |

| Latin America | 510 | 527 | 540 | 549 | 555 | 558 | 49 |

| Middle East | 286 | 315 | 337 | 359 | 379 | 398 | 112 |

| Africa | 1,515 | 1,727 | 1,910 | 2,096 | 2,282 | 2,467 | 952 |

| Russia | 145 | 142 | 140 | 138 | 137 | 136 | –9 |

| Other Eurasia | 149 | 157 | 161 | 165 | 169 | 173 | 23 |

| Other Europe | 48 | 47 | 45 | 44 | 42 | 41 | –8 |

| Non-OECD | 6,815 | 7,206 | 7,513 | 7,799 | 8,060 | 8,287 | 1,472 |

| World | 8,162 | 8,569 | 8,885 | 9,177 | 9,440 | 9,664 | 1,502 |

Source: UN.

Figure 1.1 World population growth, 1997–2024 versus 2024–2050

Source: UN.

replacement levels in recent decades. Compounding this trend are the rising costs of living and societal shifts, which have further depressed birth rates. This contraction represents the largest population drop among major economies and contrasts sharply with China's population growth in the recent past.

In contrast to China's decline, India, already the world's most populous country, is projected to see a population increase of approximately 230 million by 2050. Population growth, while moderating over the outlook period, is sustained by a younger demographic structure and stillabove-replacement fertility rates, particularly in certain regions.

Regionally, as illustrated in Figure 1.2, while China lost its position as the world's most populous nation to India in 2022, Africa's population as a whole has already surpassed that of India and is on a substantial growth trajectory. By 2050, the continent's population is projected to increase by 952 million. Given this significant expansion, it is expected by 2050 that Africa will be home to slightly more than a quarter of the world's population.

Figure 1.2 World population by region, 1990–2050

1.1.1 Working-age population

The global working-age population (defined as individuals between 15 and 64 years old) is projected to increase by 805 million workers between 2024 and 2050 (Table 1.2). This growth is set to bring the total global working-age population to over 6.1 billion by 2050. However, this workforce expansion occurs amidst an ageing global population. Consequently, as the world's total population continues to expand, the share of the population that is of working age is set to drop slightly from more than 65% in 2024 to 63% in 2050. It should also be noted that regional disparities in working-age population trends are projected to be significant.

OECD countries are projected to experience a drop in their working-age population, with an expected loss of around 55 million workers. This decline is set to lead to a noticeable smaller working-age share in OECD country populations, dropping from 64% overall to around 59%.

Within the OECD, regional disparities are evident. OECD Americas is the only region projected to experience growth in its working-age population, primarily attributed to immigration. In contrast, OECD Europe is projected to see a substantial contraction it its working-age

Source: UN.

| 2024 | 2030 | 2035 | 2040 | 2045 | 2050 | Growth 2024–2050 | |

|---|---|---|---|---|---|---|---|

| OECD Americas | 353 | 361 | 366 | 369 | 372 | 372 | 18 |

| OECD Europe | 380 | 373 | 365 | 355 | 344 | 333 | –47 |

| OECD Asia-Pacific | 135 | 131 | 126 | 119 | 113 | 109 | –27 |

| OECD | 868 | 865 | 857 | 843 | 828 | 813 | –55 |

| China | 984 | 972 | 930 | 859 | 807 | 745 | –239 |

| India | 990 | 1,053 | 1,092 | 1,118 | 1,133 | 1,134 | 144 |

| Other Asia | 845 | 903 | 945 | 979 | 1,007 | 1,027 | 183 |

| Latin America | 345 | 357 | 364 | 366 | 364 | 359 | 14 |

| Middle East | 190 | 213 | 229 | 242 | 255 | 264 | 74 |

| Africa | 867 | 1,018 | 1,150 | 1,286 | 1,423 | 1,559 | 692 |

| Russia | 95 | 93 | 92 | 90 | 86 | 82 | –13 |

| Other Eurasia | 96 | 101 | 104 | 107 | 108 | 108 | 12 |

| Other Europe | 31 | 30 | 28 | 27 | 25 | 24 | –8 |

| Non-OECD | 4,444 | 4,740 | 4,934 | 5,073 | 5,208 | 5,304 | 860 |

| World | 5,312 | 5,605 | 5,791 | 5,916 | 6,036 | 6,117 | 805 |

Table 1.2 Working population by region

Source: UN.

population, likely exceeding a 12% reduction that leads to a noteworthy decline of 47 million. OECD Asia-Pacific faces a similar downward trend with a drop of 27 million, suggesting a working-age population fall that could approach or even exceed 20%. In absolute and proportional terms, this is a considerable loss to the workforce.

Non-OECD countries are projected to be the primary driver of global working-age population growth, experiencing a significant increase of almost 860 million individuals. These nations are expected to maintain a higher proportion of working-age individuals, representing 64% of the overall non-OECD population by 2050.

Among non-OECD regions, Africa is poised to experience the most substantial increase in its working-age population of around 692 million (Figure 1.3). This aligns with the continent's overall population growth and will significantly elevate Africa's share of the global workingage population. Other Asia is also expected to see considerable growth in its working-age population, corresponding to an increase of around 183 million.

India is set to add 144 million to its working-age population, a reflection of its overall population growth. This contributes to a slightly increased proportion of India within the global working-age pool. The Middle East is also anticipated to experience a notable increase in its working-age population of around 74 million. This growth is likely to see the region maintain a relatively stable proportion of the global workforce.

Other Eurasia is estimated to experience a modest increase in its working-age population, corresponding to around 12 million. This is expected to result in a slightly increased proportion in the global workforce. Latin America also sees a modest increase of around 14 million, with a smaller, albeit positive, increase in its working-age population. Consequently, its share of the global working-age population is expected to remain largely unchanged.

Figure 1.3 Working age population growth, 1997–2024 versus 2024–2050

Source: UN.

Other Europe is expected to witness a drop in its working-age population, with a decline of 8 million. This will lead to a minor reduction in its share of the global workforce. Russia is set to see a decline of around 13 million, which suggests a shrinking working-age population and a slightly reduced percentage of the global total.

Finally, China presents a starkly different trajectory given its anticipated working-age population decline of 239 million. This substantial drop represents a significant reduction, accounting for a notable proportion of the global working-age population.

1.1.2 Urbanization

Urbanization, a key driver of improved energy access, plays a vital role in helping to mitigate energy poverty, and is intertwined with economic development and rising energy consumption. In 2024, over 57% of the global population resided in urban areas, a notable increase from 47% in 2000. The global urbanization rate is projected to reach approximately 68% by 2050 (Figure 1.4), indicating a continued trend of global urban expansion across all regions.

Figure 1.4 Urbanization rate by region, 2000–2050

Source: UN.

In 2024, OECD countries and Latin America exhibited the highest levels of urbanization globally, both exceeding 80%, signifying mature urban landscapes. Within the OECD, both the Americas and Asia-Pacific regions demonstrated particularly advanced stages of urbanization. Despite these already advanced levels, projections indicate continued urbanization in OECD countries and Latin America. By 2050, further increases are anticipated for OECD and Latin America, with the OECD Asia-Pacific remaining the most urbanized.

Urbanization levels in the Middle East are higher than the global average but remain well below those seen in the OECD and Latin America. Starting at 65% in 2024, these levels are projected to gradually increase to 72% by 2050.

China's urbanization transformation has been particularly remarkable. At the start of the 21st century, the country had a relatively low urbanization rate of approximately 36%, but in the period thereafter it experienced rapid urbanization on the back of strong economic growth. This surge resulted in an urbanization rate of over 65% by 2024. As China's economy matures, the pace of urbanization is projected to moderate, yet still reach an estimated 80% by 2050.

India presents a contrasting urbanization experience. While China urbanized rapidly, India's urban population shift has been more measured, resulting in an urbanization rate of less than 37% in 2024. For the past three decades, India has consistently recorded the lowest urbanization rate among the regions examined, a trend projected to persist in the longer term. Nonetheless, India's urbanization rate is projected to accelerate to nearly 53% by 2050.

The urbanization trajectory of Other Asia and Africa are almost completely aligned throughout the projection period, starting at around 47% in 2024 and ending at 60% in 2050.

The results of the above urbanization trends are shown in absolute terms in Table 1.3. Between 2024 and 2030, the urban population is projected to increase significantly by 444 million people,

Table 1.3 Urban population by region

| Levels | Growth | ||||||

|---|---|---|---|---|---|---|---|

| 2024 | 2030 | 2035 | 2040 | 2045 | 2050 | 2024–2050 | |

| OECD Americas | 449 | 472 | 490 | 506 | 520 | 532 | 83 |

| OECD Europe | 461 | 471 | 478 | 485 | 490 | 493 | 32 |

| OECD Asia-Pacific | 193 | 192 | 191 | 189 | 188 | 186 | –7 |

| OECD | 1,102 | 1,134 | 1,158 | 1,180 | 1,198 | 1,211 | 108 |

| China | 930 | 987 | 1,015 | 1,026 | 1,023 | 1,009 | 78 |

| India | 535 | 612 | 682 | 752 | 821 | 888 | 353 |

| Other Asia | 604 | 679 | 743 | 809 | 875 | 939 | 335 |

| Latin America | 417 | 439 | 455 | 468 | 479 | 487 | 71 |

| Middle East | 186 | 210 | 229 | 248 | 267 | 286 | 100 |

| Africa | 706 | 857 | 997 | 1,149 | 1,312 | 1,485 | 779 |

| Russia | 109 | 109 | 110 | 111 | 112 | 113 | 4 |

| Other Eurasia | 86 | 92 | 97 | 102 | 108 | 115 | 29 |

| Other Europe | 28 | 28 | 28 | 28 | 28 | 28 | 0 |

| Non-OECD | 3,607 | 4,020 | 4,362 | 4,701 | 5,033 | 5,354 | 1,746 |

| World | 4,710 | 5,154 | 5,521 | 5,881 | 6,231 | 6,565 | 1,855 |

Source: UN.

millions

with the OECD contributing only 32 million to this growth. Over the entire outlook period extending to 2050, the urban population is expected to increase by around 1.9 billion.

1.1.3 Migration

Migration is a key driver of regional demographic change, potentially offsetting population declines in low-fertility OECD countries and strengthening their economies through workingage population growth. As highlighted in Table 1.4, net migration, which quantifies population change due to migration, is defined by the UN as the difference between its medium variant projection and a zero-migration scenario.

While short-term migration patterns are sensitive to contemporary geopolitical events and can cause significant inter-regional population movements, long-term projections suggest a return to established historical trends. These trends are marked by a consistent net migration flow from non-OECD to OECD countries. Despite this long-term pattern, future migration dynamics are expected to remain responsive to evolving geopolitical landscapes and major global developments.

Table 1.4 Net migration by region millions

| 2024–2030 | 2030–2035 | 2035–2040 | 2040–2045 | 2045–2050 | |

|---|---|---|---|---|---|

| OECD Americas | 8.7 | 7.0 | 7.0 | 7.1 | 7.1 |

| OECD Europe | 3.9 | 4.1 | 3.9 | 3.8 | 3.7 |

| OECD Asia-Pacific | 2.1 | 1.6 | 1.6 | 1.6 | 1.6 |

| OECD | 14.8 | 12.8 | 12.5 | 12.5 | 12.5 |

| China | –1.5 | –1.1 | –1.1 | –1.0 | –1.0 |

| India | –2.7 | –1.9 | –1.9 | –1.9 | –1.9 |

| Other Asia | –11.4 | –5.8 | –5.8 | –5.5 | –5.2 |

| Latin America | –2.0 | –1.3 | –1.0 | –0.9 | –0.9 |

| Middle East | 3.6 | 0.0 | –0.3 | –0.3 | –0.3 |

| Africa | –3.5 | –3.5 | –3.3 | –3.8 | –4.3 |

| Russia | 0.8 | 1.5 | 1.5 | 1.6 | 1.7 |

| Other Eurasia | 2.5 | –0.4 | –0.4 | –0.3 | –0.3 |

| Other Europe | –0.5 | –0.3 | –0.3 | –0.3 | –0.3 |

| Non-OECD | –14.8 | –12.8 | –12.5 | –12.5 | –12.5 |

Source: UN.

1.2 Economic growth

Understanding future energy market developments requires a thorough analysis of the global economic outlook, including key trends, challenges, and opportunities. This overview offers valuable insights into the global economy's trajectory in the medium to long term.

Economic growth in the years preceding the pandemic was relatively robust and stable, laying a solid foundation for resilience. This provided a strong base for the challenges the global economy has had to deal with in recent years, specifically the pandemic, as well as rising protectionism, increasing fragmentation and a gradually slowing growth dynamic

in key regions. Recent shifts in US policy appear to have further reinforced some of these trends, with the overall dynamics contributing to structural transformations in the global economic landscape.

Nevertheless, economic growth is expected to remain resilient, with major economies providing sustained support in the medium to long term. In particular, OECD North America – led by the US – along with robust growth in China and India, are projected to be the primary economies in future global economic expansion, benefiting from both significant economic weight and continued strong growth trajectories.

Developing and emerging economies are expected to experience significantly higher growth rates over the outlook period, narrowing the gap not only in per capita income, but also in overall wealth accumulation. This trend will further enhance the impact of these economies within the global economy, with their growing economic presence playing an increasingly important role in shaping future energy demand dynamics.

1.2.1 Current situation and short-term growth

Economic growth in 2024 was well supported, building a sound basis for global economic growth in 2025 and 2026 and beyond. Ongoing steady growth dynamics in the US, China and India support this expectation despite trade-related uncertainties accelerating the trend towards fragmentation. However, the easing of high tariffs between the US and its major trading partners, including China, suggests a move toward normalization that is expected to continue to support growth. Additionally, with Brazil and Russia also expected to see generally healthy growth trends, the momentum in global economic growth observed in 2024 is projected to continue in 2025, 2026 and thereafter. Moreover, while the Eurozone and Japan lagged in 2024, they are projected to experience a rebound in 2025 and in subsequent years.

Economic growth trends will depend on a variety of key elements and these dynamics provide a sound footing for the years to come, although numerous challenges for the global economy remain. For example, it is unclear how the new political and economic framework of the US administration will play out. However, inflation at the global level is expected to continue declining gradually in 2025 and to normalize towards 2026 and beyond. Consequently, monetary policy accommodation is expected to continue in major advanced economies in the near term, albeit at a more cautious pace. The Bank of Japan is likely to continue to gradually tighten its policy, while China is expected to maintain its monetary easing policy, alongside fiscal measures aimed at achieving sufficient growth. The industrial sector is projected to gradually pick up, although the services sector is set to remain the primary driving force for near-term global economic growth, with services sector growth dynamics normalizing in 2025 and continuing into 2026.

1.2.2 Medium-term economic growth

While it is projected that global economic growth remains well supported over the medium term, and with upside potential, several key trends could influence the outlook. One major factor is the ongoing fragmentation of the global economy, which continues to challenge international trade, multilateral cooperation and potentially future economic growth. This fragmentation is possibly further exacerbated by a persistent inflationary dynamic, particularly in advanced economies, such as the US and the Eurozone. As a result, tight financial conditions, coupled

with elevated global debt from pandemic-related fiscal measures, could weigh on economic growth in the years ahead.

Moreover, mounting fiscal pressures, increasing government revenue requirements due to debt obligations and expanding defence budgets, among various factors, could lead to higher taxes and other duties globally. The expected continued shortage of skilled labour, further impacted by stagnant or shrinking working-age populations in major economies, could counterbalance productivity gains. Nevertheless, advancements in artificial intelligence (AI) and robotics have demonstrated the ability to boost productivity growth despite the noted challenges. Emerging and developing economies are projected to outgrow advanced economies in the medium term. However, some of these economies will likely see growth rates level off, or even gradually decelerate, amid maturing domestic economies, particularly in China.

Looking ahead, the following major factors are considered for medium-term growth dynamics, with a subsequent impact extending into the early years of the long-term growth trend.

Inflation is expected to witness a continued gradual decline in the coming years and then normalize towards the end of the medium-term period. While global inflation stood at more than 4% in 2024, the level is expected to retract to stand at around 3.5% in 2025 and then around 3% in 2026. From 2025 onwards, the medium-term inflation path is anticipated to see a further gradual slowdown, reaching around 2.5% by 2030.

Consequently, monetary policies are set to continue with a relatively more accommodative policy stance in key economies, the exception being Japan, which is expected to continue on a monetary tightening policy path. In China, there is some flexibility, given the ongoing low inflationary trend and India's gradual inflation retraction points to continued policy accommodation. Brazil, and especially Russia, are facing more persistent inflationary dynamics, but they are also anticipated to ease their monetary policy stance over the medium term.

In the OECD, interest rates are expected to be lowered further in the coming years to around the expected inflation rates. While Japan has maintained a considerably more accommodative monetary policy stance in recent years, expectations are for an ongoing shift towards a tightening of its key policy rate in the coming years. However, it is projected to remain modest, likely at around 1% until the end of the medium-term period. Interest rates in major emerging markets are expected to stay at relatively higher levels throughout the period, but in these economies, there remains flexibility to lower interest rates given an anticipated drop in inflation.