JPMorgan Launches Climate Note by Ex-NOAA Science Chief

Length: • 3 mins

Annotated by Hemanth

Hemanth: JPMorgan Chase has unveiled a new climate report under the leadership of former NOAA chief scientist Sarah Kapnick, aimed at equipping clients with essential insights on climate-related risks. The report emphasizes the pressing need for businesses to adapt their strategies in the face of increasing extreme weather events and their economic repercussions. As climate change continues to reshape the landscape, understanding these dynamics is crucial for maintaining competitiveness and resilience. (This blurb will not be that good until you heavily personalize the prompt.)

The JP Morgan Chase & Co. headquarters in New York City.

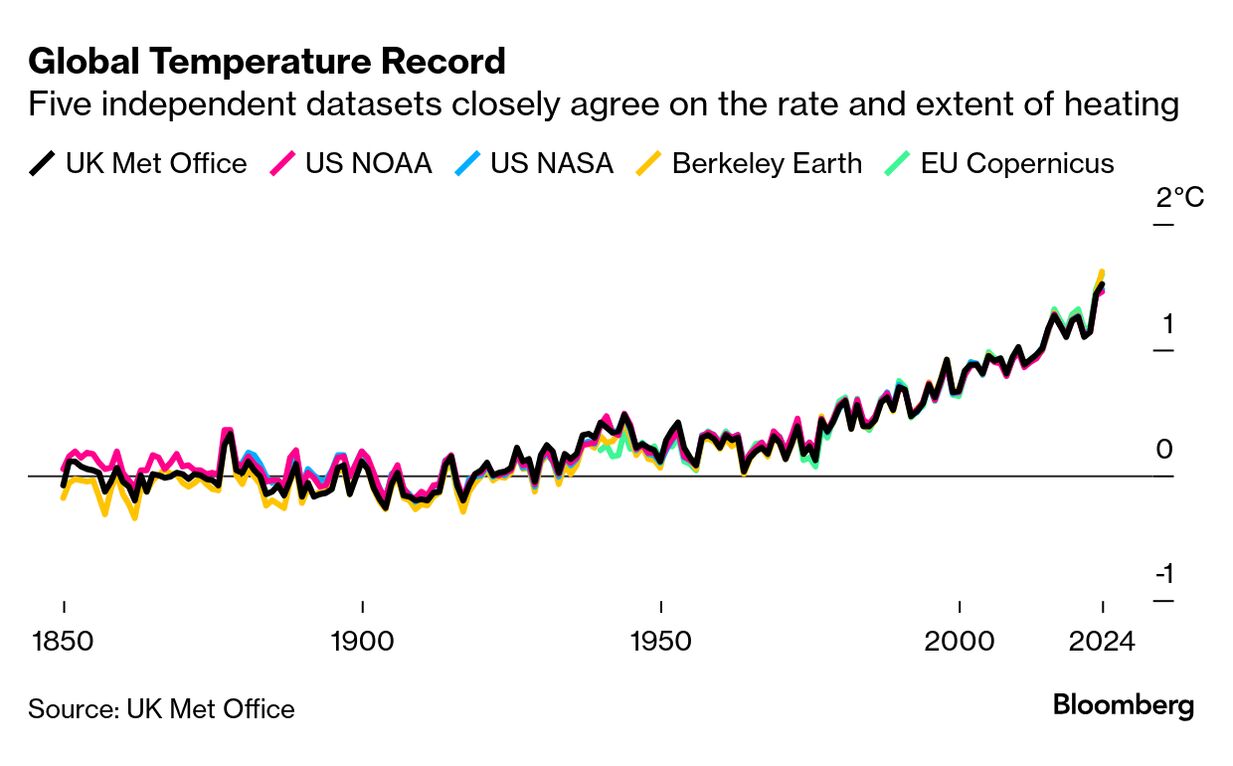

/ Photographer: Michael Nagle/BloombergResearchers last month declared 2024 the hottest year on record, finishing 1.5C or more above the pre-industrial average. It was a concerning signpost that the Paris Agreement’s central goal may already be unattainable — logic backed by two studies published this week.

To the chorus of thermometer-watchers, add a different kind of observer: JPMorgan Chase & Co.

The biggest US bank today launched a new climate communique, prompted by clients’ demand for information about the topic across industries and globally, according to its author Sarah Kapnick, the global head of climate advisory. Previously a strategist in the asset and wealth management division, she returned to the company in October after serving for more than two years as chief scientist of the US National Oceanic and Atmospheric Administration.

“There is a demand for understanding how to strategically think about climate issues,” said Kapnick, who has a PhD in atmospheric and oceanic sciences. “And particularly making sure that it’s rooted in science and facts.”

The Climate Intuition report poses a stark contrast to current events in Washington, DC, where many climate-relevant US agencies and programs are either reeling from Trump administration policy changes or girding for new ones. NOAA, where Kapnick formerly worked, has been thrown into bureaucratic chaos in recent weeks.

The first note, published today, announces a “new climate era” in which people who understand global warming to be an economic problem, and who build that awareness into strategy, are likely to beat out competitors who don’t.

There is no uniform company response to climate change, and corporate policies may change over time, she writes. There are, however, uniform facts. The world is already 1.3C hotter than before industrialization, with unprecedented weather extremes in some places.

As climate change worsens, people need newer kinds of data. For example, Kapnick includes an illustration of how extreme temperatures are increasing faster than mean temperatures. That’s a critical fact to hear for officials of any stripe charged with preparing for future events of a severity no one’s ever seen.

“People get used to making their decisions and their strategy based on the mean,” she said. “And they’re not thinking about those extreme types of events that might pressure them in ways that they haven’t experienced.”

Extreme weather also threatens to compound inequality, and even the perception of growing unfairness “can fuel social unrest or conflict,” Kapnick writes in the note, citing the US National Academies’ work on climate change and national security.

The work-in-progress nature of public and corporate climate policies applies to JPMorgan itself. In early January the bank joined peers by leaving the Net-Zero Banking Alliance, the industry’s biggest climate initiative, as Republican Party politicians attacked “woke” capitalism. JPMorgan has said it will continue to work with initiatives that “advance pragmatic solutions” to the energy transition.

The bank is the biggest issuer of bonds and loans to fossil fuel companies, overseeing financing worth $396 billion since the end of 2015 when the Paris climate accord was adopted by nations globally, according to data compiled by Bloomberg. A recent BloombergNEF review of banks’ energy financing showed that JPMorgan had a clean-tech to fossil-energy ratio of 0.8 to 1 in 2023, better than Wells Fargo & Co. and Citigroup Inc., but behind BNP Paribas SA and Bank of America Corp. To reach net zero, that ratio should be closer to 4 to 1, analysts say.

As the atmosphere, oceans and land change, so too will the planet’s most influential determinant of mass behavior: prices. The new world “may even require looking at traditional macroeconomic metrics through a new climate-adjusted lens,” Kapnick writes, “as climate change and societal responses influence the economy.”

Listen on Zero: How to Stop Banks’ Funding of Fossil Fuels, No Protests Required

Some content could not be imported from the original document. View content ↗