Mammon

Length: • 8 mins

Annotated by 🕋 John Philpin

I just paused my Hulu subscription — pretty sure that means I’m blackmailing Bob Iger. The real tragedy of Andrew Ross Sorkin’s interview with a co-founder of OpenAI is that ketamine addicts deserve a better spokesperson. But that’s another post.

The collapse and rebirth of the Valley’s preeminent private company was the most bewildering business story of 2023 and an object lesson in a truth that’s hiding in plain sight: When capital and ideals clash, capital smothers ideals in their sleep. The end of the charade that OpenAI was a nonprofit signals the beginning of the end of ESG.

We are always ready, and want, to believe that this time it’s different, we will do good while making billions. The last big corporate jazz hands was the ESG movement, purporting to prioritize environmental, social, and governance concerns over shareholder returns. Succumbing to this siren call, we abdicated our responsibility to discipline corporations and curb the externalities wrought by the pursuit of profit, believing instead that one profit-seeking entity could cajole another profit-seeking entity to seek something else.

Mission Aborted

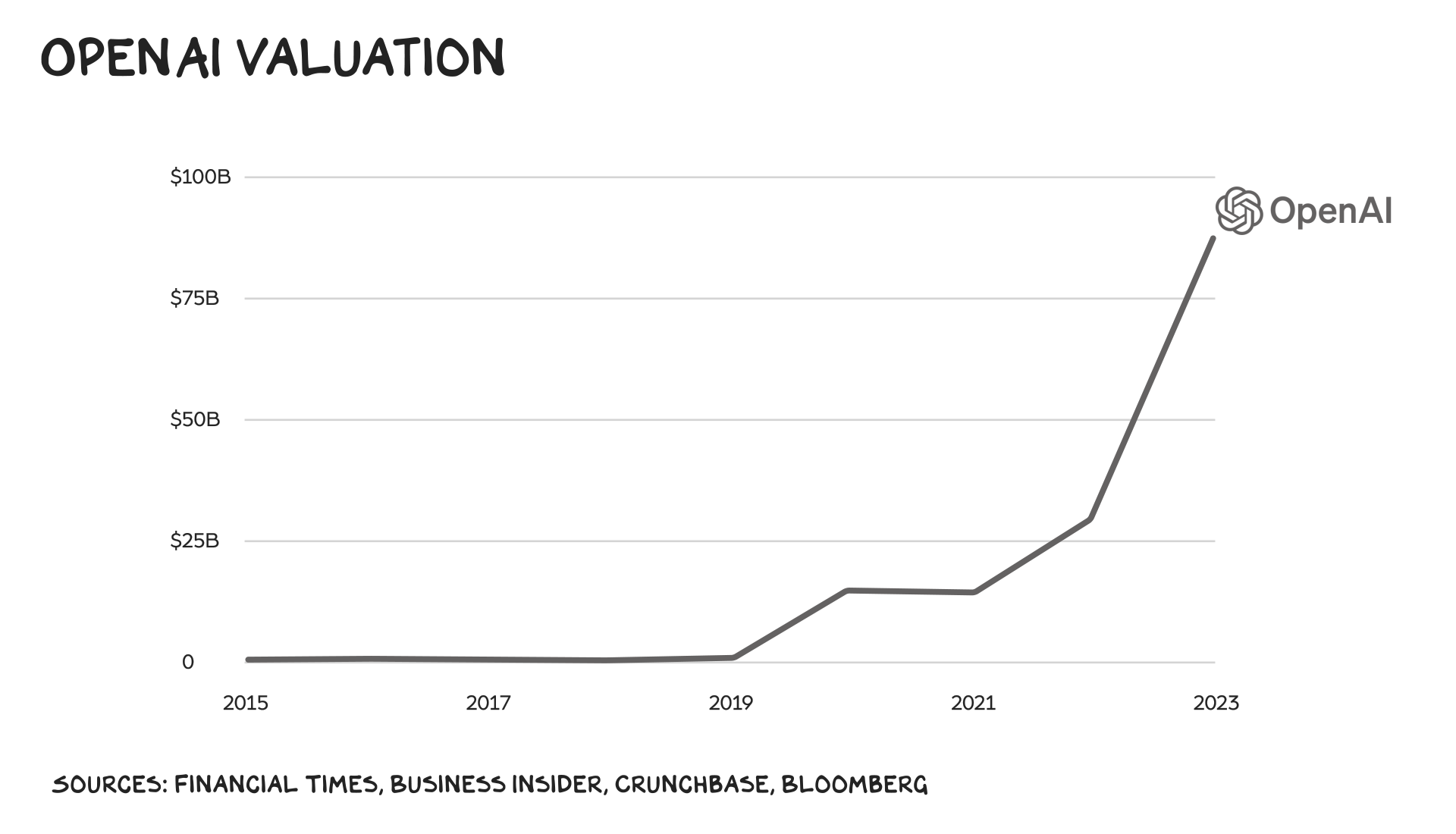

Elon Musk and Sam Altman founded OpenAI eight years ago with a specific, altruistic mission: to invent the most transformative technology ever known and then ... give it away for free. They had amassed vast wealth from private enterprise and didn’t believe a for-profit company could be a responsible steward of the AI tech they planned to build. Fast forward: One box was checked with a pen the size of the Hercules–Corona Borealis Great Wall. OpenAI is likely the most important private company in the world, and it’s already one of the most valuable. But the tsunami of private capital washed over its founding ideals. Once the water receded, one house of worship, the pursuit of shareholder value, stood unblemished. Note: In this instance, “shareholder” should not be confused with “stakeholder.”

Drawn & Quartered

OpenAI’s founding mission was drawn and quartered the moment the company took its first billion-dollar investment from Microsoft, in 2019. Four years in, the company determined it would need billions to build the team and computing infrastructure that advanced AI would require. It’s possible they always knew this, and expected Elon to foot the bill. But he severed ties in 2018, either because of conflicts or because he lost a power struggle. Regardless, the company needed capital. It raised a billion dollars from Microsoft and restructured itself as a for-profit “controlled” by the original nonprofit. When a “nonprofit” takes a billion dollars from a for-profit, it has been bitten by the dead and is now also a profit-seeking White Walker.

Don’t Be Evil

OpenAI was not the first company whose founders thought they could breathe and swallow at the same time. Tech in particular is a museum of grandiose mission statements, eventually cast aside in the pursuit of profit. Google, from which Sam and Elon poached some of the first OpenAI hires, famously espoused the mantra “Don’t be evil,” putting the motto in its 2004 IPO prospectus. Steven Levy used the phrase as a thematic touchstone in his history of the company, In the Plex. The book highlights the crisis the company faced balancing principles against profit. Over and over, it asked itself, “Is this evil?” ... and chose evil: building its own browser (page 210), tracking users to sell ads (338), building AI for weapons (405), and, most famously, agreeing to censor search results on behalf of the Chinese government (284). (Not to mention radicalizing young men and undermining the business of journalism.) In 2018 the company passively acknowledged what it had become, relegating the phrase to an HR scold at the end of its Code of Conduct.

Gravity

Sports analysts refer to the impact of a great player as their “gravity” — they pull defensive players toward them, leaving other players open. Messi, Steph Curry, everyone in Man City’s attack has gravity. Capital bests them all (see Ronaldo’s Al Nassr contract). Everything you want to do at a company, including hiring employees, buying raw materials, and renting space, requires capital. Your shareholders demand a return on theirs, i.e. profits. A manager’s task is difficult, but simple: Allocate finite capital to generate a greater return than their peer group gets. And when the ROI-maximizing decision isn’t one that “benefits humanity,” capital wins. Sam may have his hands on the wheel, but he’s sitting on Satya’s lap as he drives. Capital is in charge.

Beginning of the End of ESG

The saga at OpenAI is playing out at macro scale in the markets, with the decline of the ESG movement. ESG stands for “Environment, Society, Governance,” and it’s what fashionable multinationals are wearing this season. It comes in a few styles — a management strategy, an investment thesis, a product offering — but they’re all the same masquerade: that for-profit corporations and the markets can police themselves. The question of whether they can is bested by the evidence. They don’t.

Over the past decade, a crop of funds has surfaced offering to invest your money in sustainable ways while still delivering competitive returns. The experiment has been a failure. ESG is neither an investment strategy nor altruism; it’s branding. As my colleague at NYU, Aswath Damodaran, highlights, corporate ESG scores increase every year. Is that because corporations are becoming “better”? Or is it because the bar is getting lower? When a company like American Airlines, which emits 49 billion metric tons of CO2 per year, makes the Dow Jones Sustainability Index for the second consecutive year, it’s the latter.

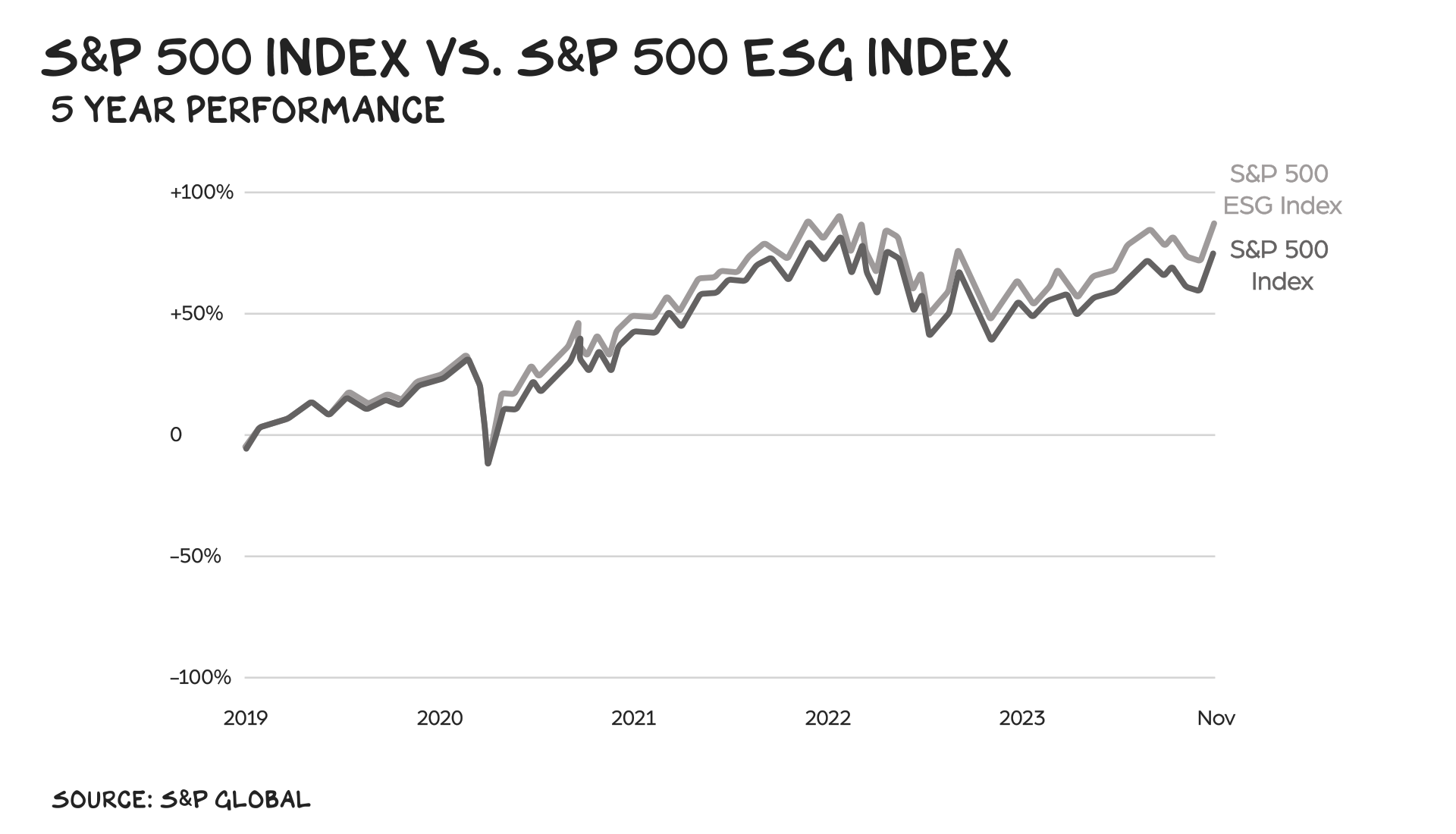

The hollowness of ESG investing is reflected in its returns, which are neither good nor bad — but average. So average that the S&P 500 and the S&P 500 ESG indexes’ returns are nearly identical every year. And that’s by design: The top five weighted companies in the S&P 500 ESG Index are Microsoft, Apple, Amazon, Nvidia, and Google. It’s no coincidence these are also the five most valuable companies in the U.S. Meanwhile, investors pay a greater expense ratio on the ESG ETF (0.10%). And by ESG standards, even that’s low. The iShares ESG Aware ETF charges 0.15%, and the FlexShares ESG ETF almost trebles that to 0.42%. It’s the definition of branding: Create intangible associations that evoke emotion vs. product benefit, resulting in pricing power. Or, more simply, slap a green label on your fund, marginally adjust your weightings, and charge more.

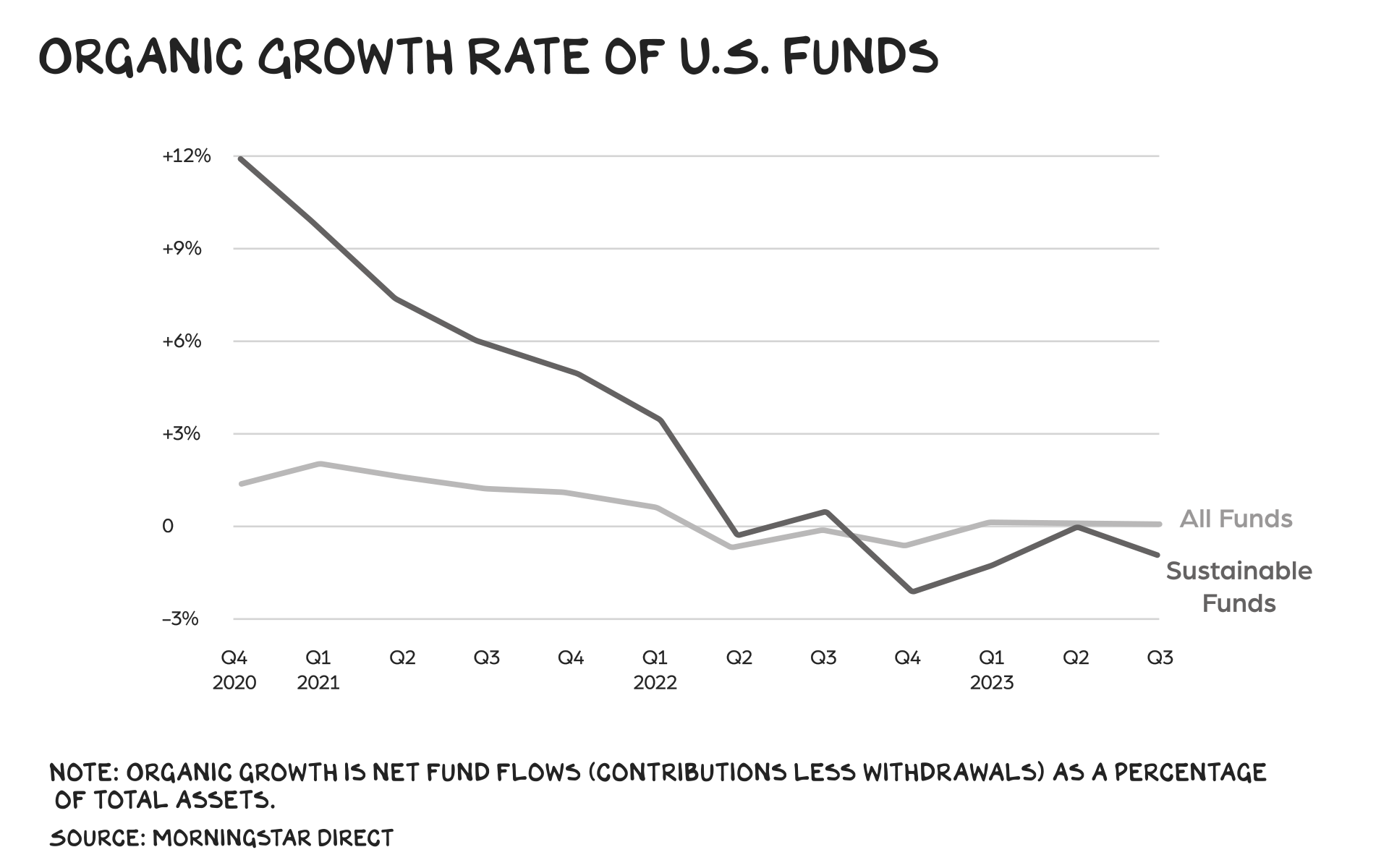

The ESG movement is waning. Investors withdrew $14 billion from sustainable funds this year. The shift is partly structural — traditional funds have also seen net withdrawals (aka negative organic growth) — but ESG funds are facing steeper declines, likely because people are catching on to their sleight of hand.

Weaponization

We wrote about a greenwasher extraordinaire two years ago, Aspiration, which promised to save the planet with a debit card. The planet is still under threat, and the company fired its founder-CEO, laid off hundreds of staff, and pivoted toward selling carbon credits to corporations. Aspiration is a case study in the deeper cost of buying into the mythology of do-gooder capitalism: Capitalists weaponize it for profit.

Two months ago, Deutsche Bank agreed to pay a $19 million settlement for claiming it made investment decisions based on ESG but not actually doing that. Which is fraud, but also dumb, as being labeled “ESG” is not a big lift. (See above: American Airlines.) Before that, oil giant Shell was accused of misleading investors on its green credentials. In the past year, corporate greenwashing incidents have risen 70%.

Misdirect

The danger bigger than usurious fees is that we don’t invest in the democratic institutions focused on preventing a tragedy of the commons, because we believe “market solutions” can handle carbon emissions and forced labor. It’s not the fault of the businesses but the citizenry, which continues to engage in a consensual hallucination that tech innovators can cosplay world leaders and solve our most pressing problems, all while making us/them rich. I don’t know if/how climate change is remedied, but I’m certain the solutions will cost money before they make any.

Corporations are so good at making money, they shouldn’t be trusted to do anything else. Treating your employees well, investing in the community, and generally supporting the commonwealth all offer short- and long-term benefits to stakeholders, and so stakeholders — us — should ensure it all happens. This is not an abdication of corporate responsibility or reheated Milton Friedman, but a call for more robust government oversight and regulation, including antitrust actions and a rebalancing of power from the top 1% and corporations.

(Do)n’t Be Evil

Larry and Sergey weren’t being disingenuous when they founded Google as a “different kind of company” or adopted “don’t be evil” as their guiding principle. In their original paper introducing the Google search engine, they included an appendix about the evils of advertising: “Advertising funded search engines will be inherently biased towards the advertisers and away from the needs of the consumers.” I’m sure they believed that — because it’s true. Their original sin was naiveté, not deceit. They thought they could defy gravity.

Likewise, I don’t believe that John D. Rockefeller founded Standard Oil intending to heat the planet to an unlivable temperature, or that the thousands of good people who work at Chevron or Exxon or Shell are rooting for the mass migrations and economic collapse their continued carbon production will cause. All the worst people in the world didn’t decide to go work for tobacco companies in the 20th century, nor have Meta’s recruiters developed a skills-based assessment to find evil geniuses. There are bad people in business, and immoral conduct (recruiting underage children to a product that gnaws at their mental health, promoting antisemitism) remains immoral. We should call bad acts out where we see them, and withhold our business or capital from bad actors when we can. But don’t expect it to change anything. As the late Charlie Munger put it, “Show me the incentive and I will show you the outcome.”

Door 1 or 2

If you could keep the executives and change the incentives vs. change the executives and keep the incentives, I’d argue Door 1 is the better way to go. And the upside incentives are, most definitely, in place. There is no country on Earth minting as many millionaires and billionaires as the U.S. Regardless of the odds, and the harsh reality that success is more about when and where you are born than your talent, most Americans believe they have a shot at extraordinary prosperity. And that’s a good thing.

We can’t — and shouldn’t — weaken the pull of capital. The profit motive is capitalism’s driving force, and it’s driven a greater increase in prosperity than any other human creation. The problem is our better angels are outmatched; we need counterweights to the incremental rationalizations made in conference rooms named “Only Good News.”

It’s the lack of regulation and the disincentives that have let externalities run amok. Government prosecutors sending SBF and (likely) Zhao to prison will do more to clean up crypto than any ESG fund overcharging investors. If we want to stop Meta from sending images of nooses to bullied young girls, we need to make that behavior a crime. Or, at least, let those girls’ parents sue (i.e. reform Section 230, as I advocated for here).

ESG and (in-)Effective Altruism are heat shields against real limits on action. They allow corporations to retain their power (and their capital) while expectorating exhaust into a headwind. Every time I write about the abuses of tech companies, I get the response, “Well, if you don’t like the companies, don’t use their products.” This is the cry of the defeated, those so broken on the wheel of corporate exploitation they’ve unilaterally disarmed, abandoning the one power we the people possess that’s equal to capital: democracy. It’s not up to each of us to protect the commonwealth, it’s up to all of us. Put another way, the most effective ESG is not a fund charging higher fees to invest in American Airlines. It’s a perp walk.

Life is so rich,

P.S. No Mercy / No Malice is offering exclusive sponsorships. Details here.

P.P.S. You can now take my Section brand strategy class in a two-hour, TikTok-style course on Pair. Usually $179 — free for subscribers. Enroll here.

The post Mammon appeared first on No Mercy / No Malice.