The Family That Builds For the U.S. Government The Family That Builds For the U.S. Government

Length: • 23 mins

Annotated by Umer

Some content could not be imported from the original document. View content ↗

The Bechtel Corporation has been a family business and government construction contractor for a century. After declining revenue abroad, it turns increasingly to domestic projects in the U.S.

Jun 28, 2023

∙ Paid

Last night, we celebrated our #NYC office opening. Our Chairman & CEO Brendan Bechtel shared how we can help #NY realize its vision of reducing carbon emissions, improving transport, expanding digital technology & providing safe, reliable infrastructure bit.ly/bechtelnyc

The privately-held Bechtel Corporation, led by the eponymous Bechtel family, is one of the world's largest construction and engineering contractors. In 2022, the Northern Virginia-based company had 55,000 employees, grossed $17.5 billion in revenue, and was the twentieth-largest private company in the U.S. [1] In 2023, it was ranked the second-largest U.S. construction contractor after only the Turner Corporation, which is a subsidiary of a publicly-traded German company. [2] The Bechtel family itself had a net worth of $8.3 billion in 2020. [3] Bechtel is one of a small number of companies specialized in delivering complex megaprojects that would be too financially risky for most firms and, in its history dating back to 1898, has worked on the Hoover Dam, the Channel Tunnel connecting Britain to France, and the majority of U.S. nuclear plants.

You can listen to this Brief in full with the audio player below:

Some content could not be imported from the original document. View content ↗

The U.S. corporate world is typically assumed to be dominated by publicly-traded companies run on top of merit-based bureaucracy and the executive fiat of the occasional dynamic founder-CEO. In fact, more than a few strategically relevant U.S. companies, including top government contractors like Bechtel, are run by family dynasties—other examples include the Koch family, the Walton family of Walmart, and the Sulzberger family behind The New York Times. Such family control enables new kinds of long-term strategy and has helped countries as diverse as Sweden and South Korea industrialize, through the Wallenberg family and the Lee family, respectively. Bechtel is in its fifth generation of family leadership, under the currently 42-year-old Brendan Bechtel.

Bechtel is essentially a part of the U.S. federal government’s wider empire, due to its dependence on both contracts and good relationships with the U.S. government. Throughout its history, Bechtel has been both a former and future employer for high-level U.S. officials and has supported U.S. foreign policy goals through its contracts to develop infrastructure abroad, such as in Saudi Arabia’s oil industry or Iraq after the U.S. invasion. As the company has faced rising competition abroad and the U.S. has taken a new interest in reindustrialization, Bechtel’s future now seems to lie in domestic projects.

What Bechtel Builds

Bechtel is not a general construction company, but instead one of the few that specializes in so-called “engineering, procurement, and construction” (EPC) contracts. EPC contracts are comprehensive and generally related to novel or challenging infrastructure, such as power plants, refineries, gas terminals, large tunnels, solar farms, space launch systems, and more. In addition to airports, highways, and railways, Bechtel has built all of these things and more in recent years—it even won a NASA contract to build a mobile launcher for the Artemis mission to send people back to the Moon. [4] Such contracts are inherently risky ventures, because, in addition to high capital costs, they tend to entail novel engineering challenges and coordination with governments which can both frequently lead to cost overruns and longer-than-expected construction timelines.

As a result, major EPC contractors tend to perform poorly as publicly-traded companies on stock exchanges. For example, the stock price of Bechtel’s main rival, the publicly-traded Fluor Corporation, declined by about -93% from 2008 to 2020. [5] More often than not, EPC contractors are rather privately-run or connected to large state or family-owned conglomerates. While some are more specialized in certain sectors, such as oil and gas, others, including Bechtel, cover multiple sectors. Bechtel, Fluor, and the smaller privately-held Kiewit Corporation are the major American-owned EPC contractors.

As a private company, Bechtel is insulated from the scrutiny of shareholders and does not have to cut costs or guarantee significant profits every year. It has the flexibility to make long-term investments in personnel and equipment. For example, publicly-traded EPC contractors lease heavy equipment like excavators, tunnel boring machines, and forklifts from suppliers. This increases returns on invested capital, but can also mean it takes additional time to acquire the right equipment for a job, leading to wasted time. Bechtel owns its own fleet of equipment and so has a competitive advantage. [6]

Bechtel has several prominent business divisions focusing on different sectors. Its nuclear business is based in the company’s global headquarters in Virginia, near Washington, D.C. It builds other energy infrastructure as well, primarily related to oil and gas, with headquarters in Texas. The mining and metals business unit is based in Chile, which is the largest producer of copper and the country with one of the largest proven reserves of lithium. The civil infrastructure division is headquartered in London. The United Kingdom has been one of Bechtel’s most fruitful markets and London is an ideal location for a business unit focused on international contracts, especially in the Middle East, since many Arab elites have social networks in London.

Bechtel completed Tennessee’s Watts Bar Unit 2 nuclear reactor in 2015 after the plant suffered severe delays. In 2022, it finished the Vogtle Units 3 and 4 in Georgia. [7] This means Bechtel has completed the only new nuclear reactors built in the U.S. in the 21st century. The company also has contracts for the management of government-owned U.S. nuclear infrastructure, particularly relating to research, waste, and weapons development. Since 2007, Bechtel has managed and operated the Lawrence Livermore National Laboratory, which has made some advances in nuclear fusion. [8]

Between 2006 and 2018, Bechtel also operated the Los Alamos National Laboratory and, from 2008 to 2018, the Knolls and Bettis labs, which together constitute the naval nuclear laboratory. Under this contract, Bechtel designed, developed, and built the A1B nuclear reactor designed to be fitted into the Gerald R. Ford-class aircraft carrier, the latest generation of U.S. carriers.

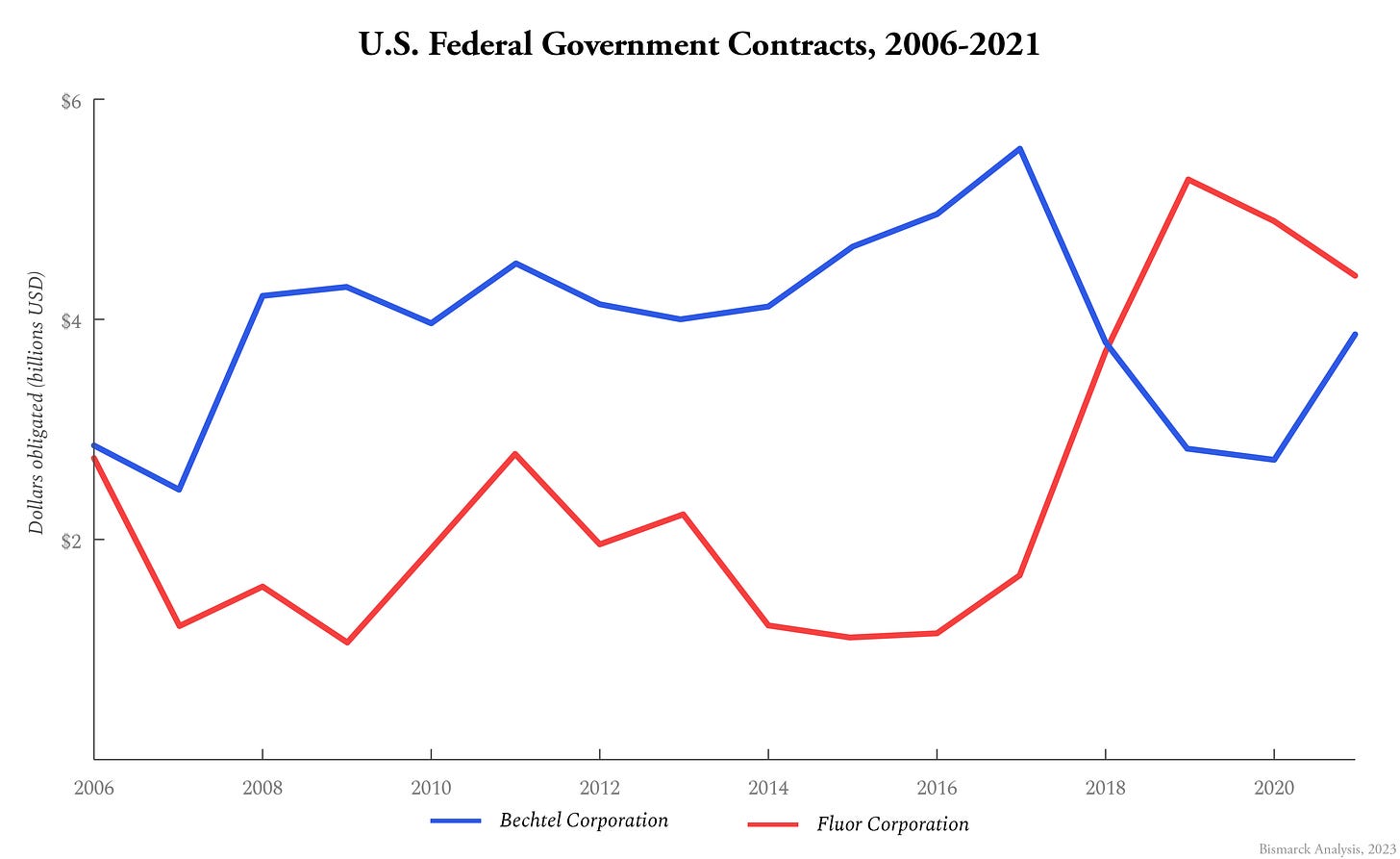

In 2018, Bechtel was replaced as the principal operator of the nuclear naval propulsion program by its rival Fluor Corporation, which will run the program until 2028. [9] It lost the Los Alamos contract the same year, reportedly for safety violations. [10] The loss of these contracts was a major setback for Bechtel’s U.S. government contracting revenue and put Bechtel behind Fluor for the first time since at least 2006. As recently as 2017, Bechtel was the ninth-largest federal contractor overall, even including defense contractors. Since 2019, however, the trend has reversed and Bechtel seems set to surpass Fluor again to become the top federal construction engineering contractor.

Bechtel has enjoyed a new stream of revenue from the U.S. fracking boom, which has also created customers in Europe as the political costs of importing Russian gas have increased. As of 2023, Bechtel has built about a third of worldwide liquefied natural gas (LNG) exporting capacity through terminals, more than any other company. [11] Bechtel built the first LNG export terminal in the U.S., the Sabine Pass facility in Louisiana. [12] U.S. LNG terminal infrastructure has only existed since 2016, with Bechtel playing the leading role. [13] Between 2022 and 2027, the U.S. is projected to add 79 million metric tons of LNG export capacity—nearly doubling—and to have the largest export capacity in the world at 168 million metric tons by the end of that year. [14]

Currently, Bechtel’s mining and metals division essentially has two focuses on copper and aluminum. [15] The company has multiple copper mining and processing projects in Chile and Peru. It is also working on numerous aluminum smelting projects in Canada, Iceland, Oman, the United Arab Emirates, Australia, and Bahrain, the latter of which has the largest aluminum smelter outside of China. Other projects include a prospective lithium mine in Serbia, coal mines and terminals in Australia, and a new industrial city for mineral extraction in the north of Saudi Arabia.

Bechtel has built many key pieces of civil infrastructure in recent years. It worked on the recent extensions to the Bay Area Rapid Transit (BART) rail lines to San Jose, the new extensions to the Washington, D.C. area Metro lines to Dulles International Airport, and the AirTrain which connects New York City’s JFK Airport to the subway. [16] It is working on new metro systems in the Saudi capital of Riyadh and in Sydney, Australia. [17] Bechtel also has or has had notable contracts to extend London City Airport, the port of Abu Dhabi, the Jubail Industrial City in Saudi Arabia, and the international airports of Dubai, Las Vegas, and Hong Kong. Bechtel also built the tremendous Boston Central Tunnel, an underground highway in the heart of the city.

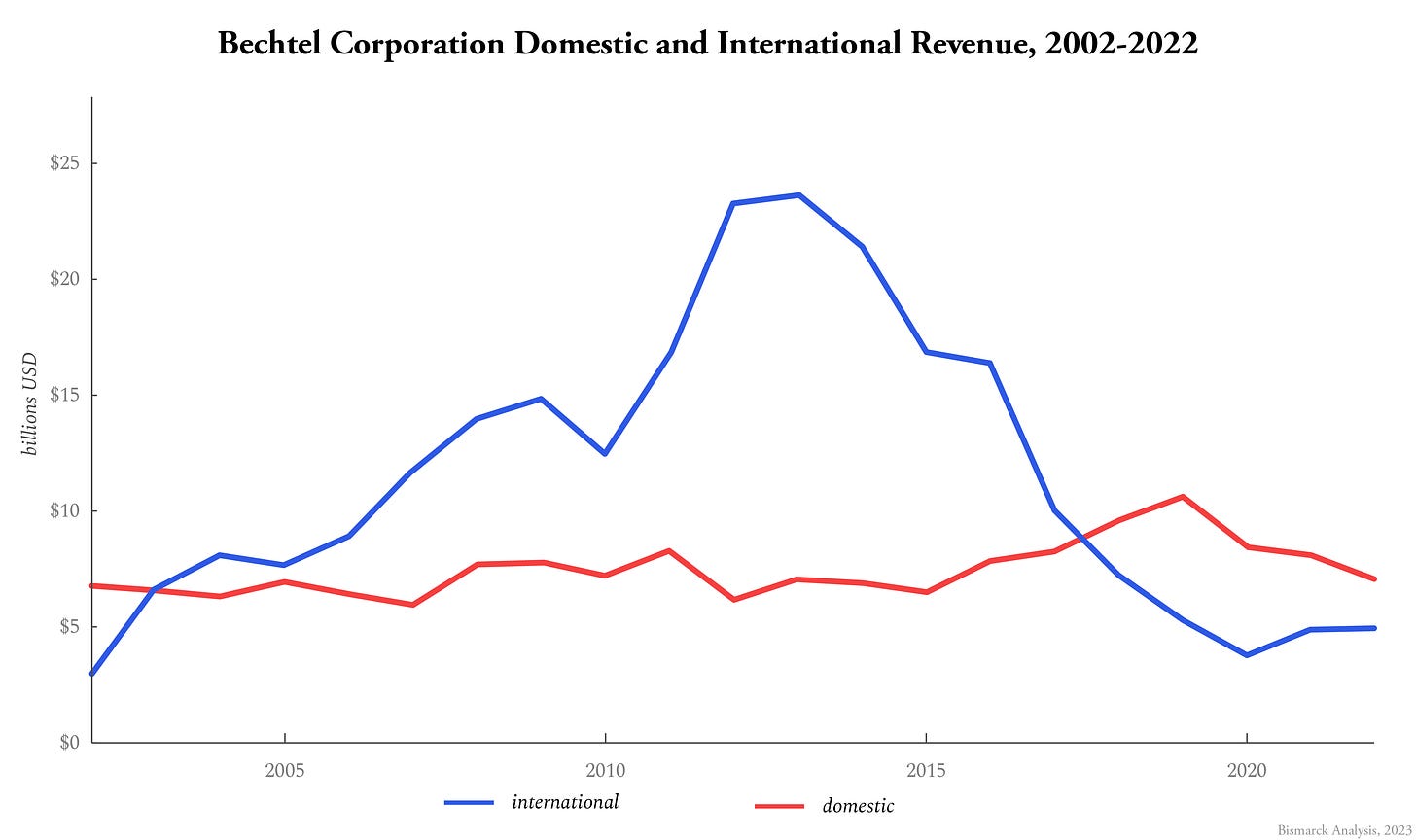

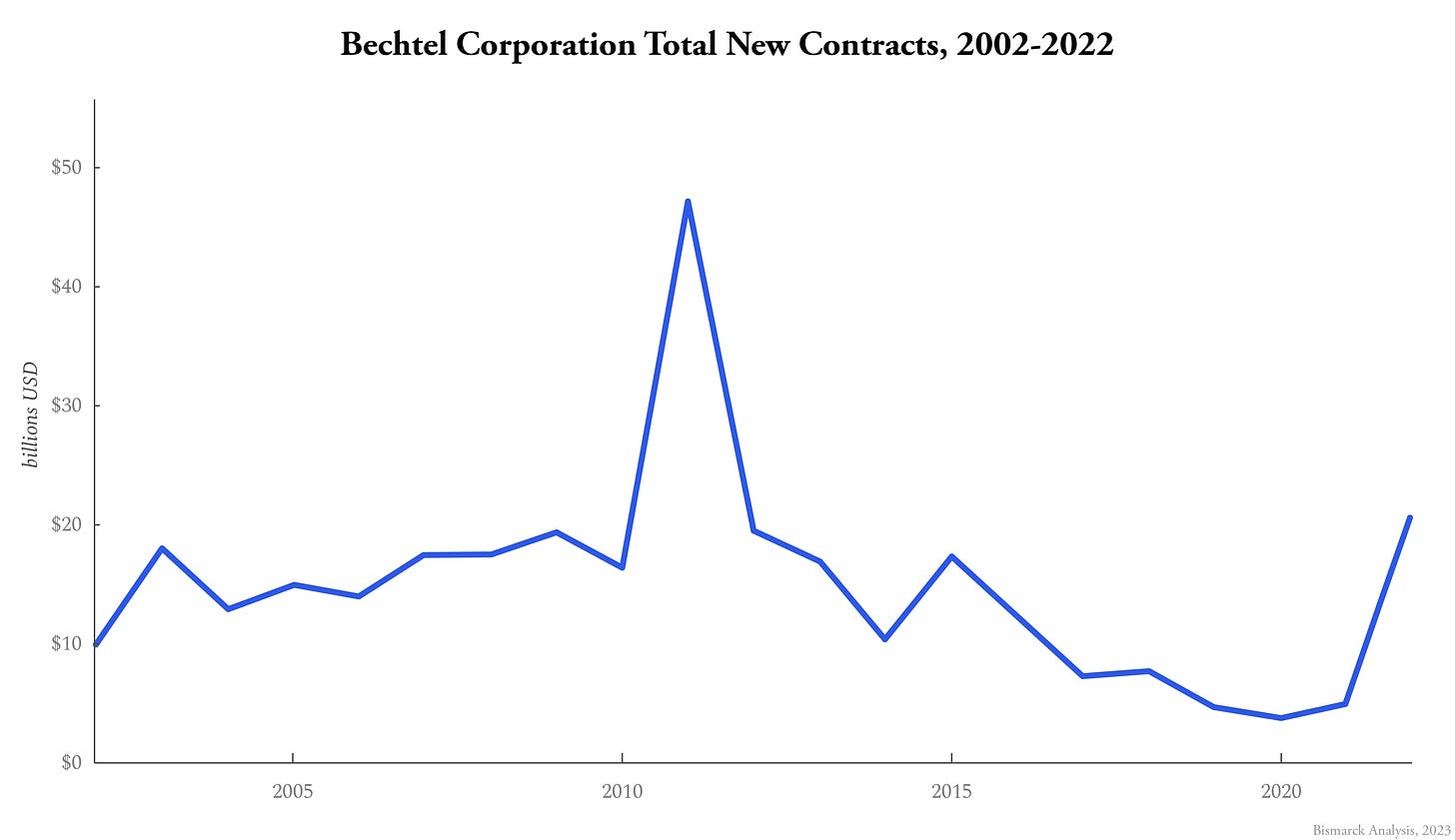

Bechtel’s U.S. revenue has suffered somewhat in recent years, and its overall revenue has dropped steeply since the early 2010s due to a loss of international contracts. In 2020, Bechtel lost the status of top U.S. construction contractor by revenue for the first time since at least 2002. Its decline in revenues has occurred even as the overall contracting market for the U.S. has grown from $309 billion in 2012 to $421 billion in 2021. In that time, Bechtel’s total market share among the top 400 U.S. contractors has gone from 10% to 3%. [18] But given the reliance of EPC companies on large discrete contracts, it is also too early to say that this heralds a long-term decline for the company, and 2022 was a boom year for the firm. Whether Bechtel can close new deals and grow the company again will depend on the long-term leadership of the Bechtel family.

The Bechtel Family Dynasty

Bechtel has been run by the Bechtel family for five generations. In 2016, Brendan Bechtel, the eldest of three children, took over as CEO and in 2017 was elected chairman. His father, Riley Bechtel, stepped down in 2013 due to being diagnosed with Parkinson’s disease, but remains on the board as a non-executive director. [19] Riley himself took over in 1990 from Stephen Bechtel Jr., the third generation of leadership, who passed away in 2021. [20] Bechtel itself was informally founded in 1898 by Warren A. Bechtel, a railway worker and civil engineer in Kansas, who eventually moved the family and company to California, where they would stay.

To control the company, rather than using circular cross-shareholdings, family foundations, or shares with special voting rights, the Bechtel family uses a unique arrangement that can ensure control without even owning a majority of shares. The company is structured as a partnership limited to fifty shareholders, of which about 35 are executives, nine are executive directors of the board, and seven are outside directors. [21] As of 2016, Brendan, Riley, and Stephen Bechtel together reportedly owned just 40% of the company’s shares, which carried no special voting rights. [22]

However, Bechtel employees can only purchase stock in the company after being promoted to senior vice president, which means the family can easily select for shareholder loyalty through carefully making such promotions. The company will not provide loans to purchase shares, so prospective partners must secure financing from a bank or other sources. Finally, all employees of the company must retire after turning 65 years old and, upon leaving the company, sell their shares back. [23] Bechtel family members, however, may leave their shares to family trusts upon retiring. It is unknown whether other Bechtels who currently work for the company own further shares, but this arrangement essentially turns the shares into a method of compensation for favored employees, without any possibility of being used against the Bechtels’ leadership.

Family members must also retire at the age of 65, a rule which has been followed for multiple generations. Stephen Bechtel Sr., who took over from the founder Warren Bechtel in 1933, left in 1960 at the age of 60. His son, Stephen Jr., stepped down as CEO in 1990 at the age of 65. Riley stepped down as chairman in 2017 at 65. The current CEO Brendan Bechtel took over a few years early at the age of 35 due to his father’s condition, but he can now potentially lead for another 23 years up to 2046.

Brendan studied geography at Middlebury College in Vermont. After graduating in 2003, he spent two years working for the Conservation Fund, a small environmentalist non-profit in Northern Virginia that pursues land and water conservation projects. He then went to Stanford University and graduated with an MBA and master’s degree in engineering. He joined Bechtel after that, having fulfilled a family rule that family members must work outside the company for two years before joining. [24] Assuming it took Brendan three years to finish both degrees, this would mean he joined Bechtel around the age of 27 years old.

This early career path might be a kind of cursus honorum similar to, but less demanding than, that of the Sulzberger family that runs The New York Times. Forcing family members to first work outside the family firm makes it likelier they will both learn and demonstrate genuine skill that can be impartially evaluated, rather than receive sinecures or overly positive evaluation at the family business right away, and thus eventually endanger the company through incompetence. Such work is also an opportunity to build their own personal networks, helping the family expand connections over time. But it is unclear whether Brendan’s non-profit work and academic studies were truly relevant for managing construction engineering projects, or simply fulfillment of such a family rule in letter but not in spirit.

Brendan rapidly climbed the ladder at Bechtel from 2010 to 2016. His father, grandfather, and senior executives planned a career path to test his ability for leadership. [25] For example, in 2012, he was put in charge of a $10 billion LNG plant off the coast of Australia, near the small but remote city of Gladstone, where he reportedly stayed for 18 months. [26] He also worked on projects in Angola, Equatorial Guinea, and the U.S., including the Dulles metro extension. He was then promoted to lead Bechtel’s oil and gas division, then quickly promoted to president and chief operating officer, and finally CEO and chairman as his father’s health declined.

Brendan Bechtel has argued that the company doesn’t need to grow and can pick and choose promising projects, while competitors are taking on risky contracts with low bids to boost sales in an environment where governments and potential private clients are increasingly cash-strapped. [27] He is also a supporter of expanding nuclear energy in the U.S., saying that nuclear power is the only long-term option for clean energy. [28] This seems to comport with Bechtel’s decline in revenue since he took charge. Whether it is a sign of poor leadership or forward-thinking strategy will be ultimately determined in the coming years.

Brendan has notably shifted the company’s center of gravity to Washington, D.C. While its Reston office outside the capital had effectively become the company’s operational headquarters since 2011, Brendan officially made Reston the headquarters in 2018, moving 150 managers and employees from San Francisco to the Washington area. [29] San Francisco had been the company’s previous official headquarters for over 100 years and the family members had attended Stanford for generations, including both of Brendan’s siblings. Bechtel was one of the initial corporate funders of the Stanford Research Institute, known today as SRI International, and the family has evidently donated enough to the university to have several university buildings named after them. Since then, the San Francisco office has apparently been shut down entirely. [30]

Brendan seems to be socially connected in Washington, or at least intent on becoming so. In addition to spending two years working in Northern Virginia, his wife Lyn is reportedly a “third-generation Washingtonian,” and he was quickly inducted into the elite Alfalfa Club in the city shortly after becoming CEO, alongside U.S. Senators Amy Klobuchar and Chuck Schumer. [31] Brendan has also served as a trustee or board member at the National Geographic Society, the Center for Strategic and International Studies, the Federal City Council, and the Economic Club of Washington, D.C. [32] All of this dovetails with the company’s likely future as a major U.S. government contractor.

Brendan’s younger sister Katherine currently works for Bechtel as the project controls manager for its gas liquefaction project in Corpus Christi, Texas. [33] Darren, his younger brother, went into venture capital. He is the managing director and a source of funding for Brick & Mortar Ventures, a San Francisco-based venture fund focused on companies trying to improve productivity in construction. [34]

Bechtel is Part of the Federal Government’s Empire

Bechtel is a family historically tied to the Republican Party, though the Bechtels’ political action committee has donated relatively evenly between Democrats and Republicans. [35] But the company has always been closely tied to the U.S. federal government, as well as dependent on government contracts for revenue, and the company is thus best-modeled as a middle player in the U.S. government’s overall empire. The company’s first famous project, Hoover Dam, was a federal megaproject. From the mid-twentieth century to the present day, much of the company’s revenue has come from foreign projects, especially in countries that are U.S. allies, and notably in many countries where Bechtel was implicitly part of U.S. economic and developmental aid as part of U.S. foreign policy, or where certain infrastructure needed to be built in order to further U.S. government goals.

Warren Bechtel, the founder of the dynasty and company, died in 1933 while on a business trip in the Soviet Union to inspect the Dnipro Dam in Ukraine. The company’s first major success in foreign infrastructure was in Saudi Arabia, where it managed the construction of the Trans-Arabian Pipeline in 1950, building the first initial infrastructure for what is today Saudi Aramco. [36] It was the primary contractor for the pipeline connecting the Kirkuk oilfield in Iraq to the Mediterranean Sea in 1952. Bechtel’s most extensive project in the Persian Gulf, starting from 1975 to the present day, has been the construction of the Jubail Industrial City, home to the Saudi petrochemical industry, which refines the country’s vast crude oil reserves into petroleum products. [37] After the U.S. invasion of Iraq in 2003, Bechtel won nearly $2 billion in contracts from USAID, the government’s development agency, to rebuild Iraq’s infrastructure.

From 1974 to 1982, the U.S. statesman George Shultz was an executive at Bechtel, rising to the position of president and negotiating contracts with Saudi Arabia. Before Bechtel, Shultz had served as U.S. Secretary of Labor, Director of the White House’s Office of Management and Budget, and U.S. Treasury Secretary, all under President Richard Nixon. After leaving Bechtel, Shultz became President Ronald Reagan’s Secretary of State from 1982 to 1989. The businessman and politician Caspar Weinberger had served, under Nixon, as chair of the Federal Trade Commission and U.S. Secretary of Health, Education, and Welfare. He also joined Bechtel after leaving, then became Reagan’s Defense Secretary from 1981 to 1987.

Shultz and Weinberger were not the first high-powered government officials to work at Bechtel at some point during their careers. Decades earlier, John McCone, a Bechtel executive in the 1930s, would go on to become the head of the Atomic Energy Commission (AEC) from 1958 to 1961, before becoming the Director of the CIA from 1961 to 1965. Richard Helms, the CIA director from 1966 to 1973, had also worked for Bechtel as a consultant.

The company’s historic relationship with governments in the Arab world has led it to occasionally quietly deviate from official U.S. foreign policy. In the 1970s, Bechtel unofficially complied with the Arab boycott of Israel, even when it was illegal for U.S. companies to do so. [38] More recently in 2011, David Welch, a Bechtel employee and former Bush-era State Department official, met with and gave advice to Libyan ruler Muammar Gaddafi regarding his ultimately unsuccessful fight against Libyan rebels. [39] Welch, in his previous governmental role, had helped thaw relations between the U.S. and Gaddafi.

The majority of contracts Bechtel has with the government are “cost-plus.” This means even if Bechtel experiences cost overruns, it is guaranteed a profit as a certain percentage of the total costs. For private work, it often is forced to rely on lump-sum contracts, which do not guarantee a profit. Cost-plus contracts effectively temporarily provide private companies with the financial security of government bureaucracies and are a form of government patronage to favored contractors. Bechtel has also been historically supported through the U.S. Export-Import Bank, which provides loans to foreign buyers of Bechtel’s services. Brendan Bechtel championed the bank, which has in recent years been hampered by Republican lawmakers who perceive it as a form of crony capitalism. [40]

Today, however, Bechtel’s ties to the U.S. government appear more limited. The most prominent former Bechtel employee of the Trump administration was Theodore Garrish, a senior advisor at the Department of Energy between 2018 and 2021. [41] Stuart Jones, Bechtel’s president of corporate relations and who joined in 2018, had spent three decades as a Foreign Service Officer. Catherine Hunt Ryan is Bechtel’s president of manufacturing and technology. She joined in 2007 after previously working for the World Bank. These are much weaker ties compared to Bechtel’s ties in previous decades and probably indicate a generational decline in social networks on the Bechtel family’s side.

This might also put the move to Washington in a new context, since arguably, in order to grow its influence, Bechtel must now engage in more traditional lobbying efforts and more social networking in Washington, whereas previously it could have relied on existing strong ties to senior U.S. cabinet secretaries and CIA directors, which have now been lost. But if Bechtel’s success was based on such networking, then it is a smart strategy to move to Washington. It is worth noting that the Bechtel family has also greatly declined in relative financial influence. In 1982, Stephen Bechtel Jr. was among the top ten richest Americans. [42] Today, no single Bechtel family member is in the top 400 richest Americans. [43]

Rising International Competition in Construction

For decades, it was difficult to complete demanding EPC projects without relying on U.S. companies like Bechtel. For projects like nuclear reactors, Europeans and East Asians needed to license U.S. technology and rely on advisers from Bechtel to build their plants. The massive mid-twentieth century expansion in hydrocarbon extraction in the Middle East was made possible by U.S. engineers, many of them from Bechtel. But this expertise and knowledge has since diffused globally.

U.S. companies now face fierce foreign competitors in construction engineering. South Korean firms are very competitive, including Samsung Engineering, but also companies like Daewoo and GS Engineering. In Europe, there are firms like Germany’s Hochtief, which owns Turner Corporation, as well as Britain’s Petrofac, Italy’s Saipem, and the French companies Eiffage and Bouygues. Enormous Chinese state-owned corporations like China Railway Engineering or China Civil Engineering Construction Corporation have also diminished the U.S. advantage. While historically contained to the Chinese market, they have been the main beneficiaries of Chinese paramount leader Xi Jinping’s Belt and Road Initiative, which has led to $500 billion in foreign infrastructure investments between 2013 and 2018. [44]

In 2012, out of Bechtel’s $29 billion in revenue, an estimated 78% was related to international contracts. [45] In 2021, 38% of Bechtel’s $13 billion revenue was international. This is part of a wider trend. Between 2011 and 2021, the U.S. trade balance in architecture, engineering, and construction services decreased markedly from $14 billion per year to $1.6 billion. [46] The accumulated revenue of the top 250 contractors for international business has decreased from $511 billion in 2012 to $398 billion in 2021. [47] Within this smaller market, U.S. firms are crowded out by European and Asian competitors. In 2021, 46% of international business from contractors went to European firms, while 28% went to Chinese firms. Only 6% went to American firms.

These figures overestimate Europe because many of these international contracts would be intra-European, but U.S. presence has declined in every region except Latin America. The Chinese Belt and Road contracts are primarily fueled by loans from Chinese state banks, with a great proportion being dubious in quality. [48] This influx of new, highly-subsidized, state-controlled construction services has had a deflationary impact on EPC contractors worldwide. With explicit financial backing from the Chinese government, these companies can bid far lower than U.S., European, or other East Asian contractors. This limits players like Bechtel to more challenging projects where Chinese counterparts have limited experience.

Despite this overall decline, Bechtel still has plenty of notable international projects. Bechtel is unsurprisingly involved in current megaprojects funded by the Saudi Public Investment Fund, including the well-known NEOM megacity project. In 2020, NEOM hired Bechtel to oversee its transport and utility development. [49] In 2022, Bechtel was named the project management consultant for the Trojena artificial ski resort, a component of the proposed megacity. [50] Bechtel is also partnering with U.S. nuclear reactor designer Westinghouse in developing a team to export reactors to Poland. [51] Bechtel has a decent number of projects in “Five Eyes” countries including the United Kingdom, Canada, and Australia, where U.S. companies might be preferred to European or Asian companies for cultural or national security reasons. With its South American mining projects, the company is also well-placed to take part in the worldwide expansion of mineral extraction capacity demanded by renewable energy, electric vehicles, and batteries. [52]

Bechtel’s Future Has Returned to the United States

With weaker prospects and more competition abroad, Bechtel’s future is likely to be focused primarily on the United States for perhaps the first time in nearly a century. The LNG market has been Bechtel’s most notable new success in recent years, but it is just part of a wider opportunity to contract with the U.S. government for the goal of reindustrializing the U.S. Bechtel set up a new “Manufacturing and Technology” unit in April 2022, in explicit anticipation of the massive windfall in industry-related investment due to the provisions of both the Inflation Reduction Act and the CHIPS and Science Act, which were passed by Congress in August 2022.

This business unit is aimed at acquiring contracts resulting from major new investments, both public and private, in semiconductors, electric vehicles, batteries, and renewable energy. Since 2021, U.S. companies have announced $480 billion in new investments in these industries. [53] The increase in manufacturing construction in the U.S. from 2022 to 2023 has been momentous, doubling from March 2022 to March 2023. [54] The bulk of this expansion has been related to electronics, particularly new semiconductor fabrication plants. [55] Intel, TSMC, Samsung, and GlobalFoundries are all building new fabrication facilities in the U.S. In 2022, Bechtel won a contract with Intel to develop Phase 1 of a new semiconductor fabrication facility in Ohio. [56] This is the first of four potential phases.

The expansion is largely attributable to the generous provisions of the CHIPS Act. [57] The act allows subsidies for incumbent foundries without demanding limits on investments in China. Upon fearing subsidies would be conditional on limiting investments in China, Intel’s leadership threatened to cancel the plant. [58] Bechtel will be one of the beneficiaries of this manufacturing construction boom.

Following years of declining revenue, Bechtel might have a chance to regain its prime position. In 2021, Bechtel received $4.8 billion in new contracts—both government and private—the twentieth-largest haul among U.S. construction contractors. But in 2022, it surprisingly received the most in new contracts with $21 billion. This was the largest haul since 2013 when the company received an exceptional windfall from new LNG infrastructure in the U.S. and Australia. [59] Bechtel’s rivals, Fluor and Kiewit, also saw their new contract orders increase markedly. This seems to be a case of U.S. construction contractors benefiting from government-subsidized industrial construction.

Bechtel has on the one hand faced a significant reduction in its revenue in the last decade, both due to a loss of international contracts and of key U.S. government contracts. On the other hand, it has positioned itself for opportunities closer to home, which seem to be paying off. The company can pivot to take advantage of highly-subsidized new streams of business, whether that be natural gas extraction, managing the nuclear security base, or building factories for semiconductors and electric vehicles. Its move to Washington is an indication of who it expects its most important customer to be.

Companies like Bechtel will always be very useful to governments, since they amount to a pool of engineering and management expertise that is unlikely to be found in a government institution, but that can be quickly plugged into a politically, militarily, or economically important material project, on whose success the very legitimacy or security of governments can depend. But this also means their fortunes will closely track the interests and priorities of governments, which are not always conducive to running a predictably profitable enterprise. A family-held company is unusually suited for this line of work, since the long-term orientation means the company can accept the cost of maintaining the pool of expertise even in down-years, while the close social ties at the top mean that governments, especially foreign governments, can expect political loyalty and personal buy-in.

Andrea Murphy, “America’s Largest Private Companies,” Forbes, December 1, 2022, https://www.forbes.com/lists/largest-private-companies/?sh=375e2d40bac4

“ENR 2023 Top 400 Contractors 1-100,” Engineering News Record, 2023, https://www.enr.com/toplists/2023-Top-400-Contractors-1-preview

“Bechtel family,” Forbes, 2023, https://www.forbes.com/profile/bechtel/?sh=61ba0e86f0da

“NASA Awards Contract for Second Mobile Launcher at Kennedy Space Center,” National Aeronautics and Space Administration, June 25, 2019, https://www.nasa.gov/press-release/nasa-awards-contract-for-second-mobile-launcher-at-kennedy-space-center

See here: https://www.marketscreener.com/quote/stock/FLUOR-CORPORATION-41148781/

Interview with Brian Balkus, a correspondent for Palladium Magazine, June 16, 2023,

“Bechtel applauds project partners for completing Vogtle Unit 3 fuel load,” Bechtel, October 17, 2022, https://www.prnewswire.com/news-releases/bechtel-applauds-project-partners-for-completing-vogtle-unit-3-fuel-load-301651343.html

Sally Denton, The Profiteers, Simon & Schuster, 2016, p. 265.

“Fluor Awarded Contracts for Naval Nuclear Laboratory,” Fluor Corporation, July 16, 2018, https://newsroom.fluor.com/news-releases/news-details/2018/Fluor-Awarded-Contracts-for-Naval-Nuclear-Laboratory/default.aspx

David Kramer, “What went wrong with the Los Alamos contract?,” Physics Today, 2016, https://pubs.aip.org/physicstoday/article/69/3/22/415443/What-went-wrong-with-the-Los-Alamos-contract

“LNG Capacity Growth a Proven Model for Energy Transition, Says Bechtel CEO,” Dow Jones Factiva, march 7, 2023, https://viewer.factiva.com/view/?CAT=A&napc=2&MI=NL%3A13391300~NT%3AH&page_driver=newsletter_email&EP=NL&AN=NANA000020230307ej370002t&nldtl=kCeM5RTmxGIWte3NS7cnJlXwbBkUR65SVhAQo63XgEuNqVdKqgjpy1awZIte5vQNdGkaCrdC4Q%2Fvq35jkalLYU5e%2FjahmL6f%2BZZG2DVJaJOsA7coKue3mNmwhp1Lm0yUfI5rEaJyRd8%3D%7C2&ref=watershedanalytics.com&mod=newsletter_email&f=fr2&p=sa&sa_from=IF

“Sabine Pass LNG,” Bechtel, 2023, https://www.bechtel.com/projects/sabine-pass-lng/

“LNG Capacity Growth a Proven Model for Energy Transition, Says Bechtel CEO,” U.S. Energy Information Administration, September 6, 2022, https://www.eia.gov/todayinenergy/detail.php?id=53719

“US to See Dramatic Growth in LNG Export Capacity,” Bloomberg NEF, January 24, 2023, https://about.bnef.com/blog/us-to-see-dramatic-growth-in-lng-export-capacity/

See here: https://www.bechtel.com/projects/

See following: https://www.bechtel.com/projects/jfk-airtrain-jfk-2000/; https://www.bechtel.com/newsroom/releases/2020/06/bechtel-completes-silicon-valley-rail-construction/; https://www.bechtel.com/projects/dulles-metrorail-extension/

See here: https://www.bechtel.com/projects/sydney-metro/; https://www.bechtel.com/projects/riyadh-metro/

“ENR 2021 Top 400 Contractors 1-100,” Engineering News Record, 2023, https://www.enr.com/toplists/2021-Top-400-Contractors-1

“Riley Bechtel steps down as CEO,” Family Business, February 10, 2014, https://www.familybusinessmagazine.com/riley-bechtel-steps-down-ceo

Robert D. Hershey Jr., “Stephen Bechtel Jr., 95, Dies; Led Family’s Giant Engineering Firm,” The New York Times, March 15, 2021, https://www.nytimes.com/2021/03/15/us/stephen-bechtel-jr-dead.html

Shawn Tully, “Meet the Private Company That Has Changed the Face of the World,” Fortune, May 17, 2016, https://fortune.com/longform/bechtel-construction/

Ibid.

Ibid.

Carolyn Proctor, “Bechtel brings it — meet the new private company goliath in town,” Washington Business Journal, September 21, 2018, https://www.bizjournals.com/washington/news/2018/09/21/bechtel-brings-it-meet-the-new-goliath-in-town.html

Shawn Tully, “Meet the Private Company That Has Changed the Face of the World,” Fortune, May 17, 2016, https://fortune.com/longform/bechtel-construction/

Ibid.

Shawn Tully, “One of the Largest Private Companies in the U.S. Just Named a 35-Year-old CEO,” Fortune, June 1, 2016, https://fortune.com/2016/06/01/brendan-bechtel-ceo/

Ibid.

Aaron Gregg, “Bechtel to move headquarters to Reston after more than a century in San Francisco, bringing 150 jobs,” The Washington Post, June 7, 2018, https://www.washingtonpost.com/business/economy/bechtel-to-move-headquarters-to-reston-after-more-than-a-century-in-san-francisco-bringing-150-jobs/2018/06/07/f562e108-6a69-11e8-bea7-c8eb28bc52b1_story.html

See here: https://www.bechtel.com/about-us/offices/

Helena Andrews-Dyer, “A political truce is called at the 104th annual Alfalfa Club dinner,” The Washington Post, January 29, 2017, https://www.washingtonpost.com/news/reliable-source/wp/2017/01/29/a-political-truce-is-called-at-the-104th-annual-alfalfa-club-dinner/

Carolyn Proctor, “Bechtel brings it — meet the new private company goliath in town,” Washington Business Journal, September 21, 2018, https://www.bizjournals.com/washington/news/2018/09/21/bechtel-brings-it-meet-the-new-goliath-in-town.html

“Katherine Bechtel,” LinkedIn, 2023, https://www.linkedin.com/in/kbechtel/

“Darren Bechtel,” LinkedIn, 2023, https://www.linkedin.com/in/darrenbechtel/; Brian Potter, “Interview with Alice Leung, VP at Brick and Mortar Ventures,” Construction Physics, May 3, 2022, link.

“PAC Profile: Bechtel Group,” Open Secrets, 2023, https://www.opensecrets.org/political-action-committees-pacs/bechtel-group/C00103697/summary/2020

Norman Gray, “The Tapline: a legacy of triumph,” Saudi Aramco, May 27, 2021, https://europe.aramco.com/en/magazine/elements/2021/the-tapline-a-legacy-of-triumph

Abdulateef Al-Mulhim, “Jubail: Fishing village to an industrial city,” Arab News, March 10, 2014, https://www.arabnews.com/news/537596

“Behind the Headlines Bechtel Has a Little List and Israel is Included,” Jewish Telegraphic Agency, September 5, 1986, https://www.jta.org/archive/behind-the-headlines-bechtel-has-a-little-list-and-israel-is-included

Justin Elliot, “Report: Ex-Bushie gave P.R. advice to Gadhafi,” Salon, August 31, 2011, https://www.salon.com/2011/08/31/david_welch_bechtel_libya/

Brendan Bechtel, “Without EXIM Bank, US companies fight with a hand tied behind their backs,” The Hill, May 8, 2018, https://thehill.com/opinion/finance/386730-us-companies-fighting-with-a-hand-tied-behind-their-backs-without-exim-bank/

Jim Lardner, “Mapping corruption,” The American Prospect, April 9, 2020, https://prospect.org/mapping-corruption-interactive

Jerry Knight, “Listing the Rich, Richer, Richest 400 in the U.S.,” The Washington Post, August 28, 1982, https://www.washingtonpost.com/archive/business/1982/08/28/listing-the-rich-richer-richest-400-in-the-us/e85b3960-77cd-4509-95ad-53bb259901e2/

“The Forbes 400,” Forbes, 2023, https://www.forbes.com/forbes-400/

Dezan Shira, “China Belt And Road Projects Value Now Exceeds US$4 Trillion,” Silk Road Briefing, September 16, 2021, https://www.silkroadbriefing.com/news/2020/11/25/china-belt-and-road-projects-value-now-exceeds-us4-trillion/

Estimates of Bechtel’s revenues from Engineering News-Record are correlated with but do not exactly match Bechtel’s self-published revenue. As a private company, getting exact assessments of Bechtel’s revenue is difficult.

“Architecture, Engineering, and Construction (AEC) Services,” International Trade Administration, 2023, https://www.trade.gov/report/architecture-engineering-and-construction-aec-services

“ENR’s 2022 Top 250 International Contractors,” Engineering News Record, 2023, https://www.enr.com/toplists/2022-Top-250-International-Contractors-Preview

James Kynge, “China hit by surge in Belt and Road bad loans,” Financial Times, April 16, 2023, https://www.ft.com/content/da01c562-ad29-4c34-ae5e-a0aafddd377c

See here: https://www.neom.com/en-us/newsroom/neom-selects-bechtel

Utkum Ikiz, Bechtel Appointed As The PM Consultant For TROJENA At NEOM,” Parametric Architecture, December 11, 2022, https://parametric-architecture.com/bechtel-appointed-as-the-pm-consultant-for-trojena-at-neom/

“Bechtel teams up with Toshiba for Polish new build,” World Nuclear News, June 8, 2022, https://www.world-nuclear-news.org/Articles/Bechtel-teams-up-with-Toshiba-for-Polish-new-build

Brian Balkus, “The Mineral Conflict Is Here,” Palladium, August 8, 2022, https://www.palladiummag.com/2022/08/08/the-mineral-conflict-is-here/

See here: https://www.whitehouse.gov/invest/

“Monthly construction spending, April, 2023,” U.S. Census, June 1, 2023, https://www.census.gov/construction/c30/pdf/release.pdf

“U.S. manufacturing construction spending,” Joseph Politano Twitter account, June 6, 2023,

https://twitter.com/JosephPolitano/status/1666151186603417600

James Leggate, “Bechtel Wins Phase 1 Contract for $20B Intel Chip Plant Project,” Engineering News Record, November 29, 2022, https://www.enr.com/articles/55464-bechtel-wins-phase-1-contract-for-20b-intel-chip-plant-project

Julius Krein, “Where the chips fell,” American Affairs, August 30, 2022, https://americanaffairsjournal.org/2022/08/where-the-chips-fell/

Ibid.

“UPDATE 1-Bechtel backlog surges with LNG and mining deals,” Reuters, April 11, 2012, https://www.reuters.com/article/bechtel-idUSL3E8FBBEG20120411

Recommend Bismarck Brief to the readers of hilm

Intelligence-grade analysis of key industries, organizations, and live players.

Recommend Bismarck Brief

Intelligence-grade analysis of key industries, organizations, and live players.

By Samo Burja · Hundreds of paid subscribers

Why are you recommending Bismarck Brief? (optional)

Recommendations are shown to readers after they subscribe to your publication. Learn more